Financial Times/Kate Duguid/6-21-2023

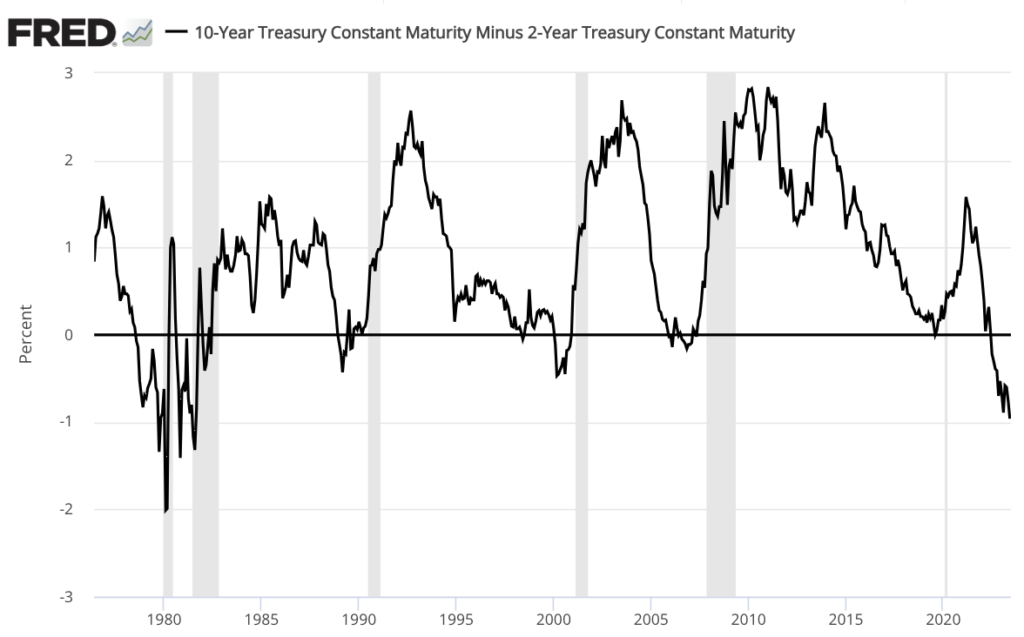

“This situation, known as an inverted yield curve — most commonly measured as the difference between two- and 10-year Treasury yields — has preceded every recession in the past five decades.”

USAGOLD note: This is another of the warning signs individual investors are ignoring and perhaps the most telling.

Source: St. Louis Federal Reserve [FRED] • • • Click to enlarge

Source: St. Louis Federal Reserve [FRED] • • • Click to enlarge