A Steady Controlled Demolition of U.S. Credit Markets: Video

June 30, 2023

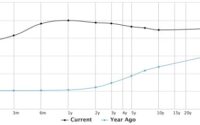

US credit markets face looming problems as deliberate rate hike schedule leads to bankruptcies. Fiscal stimulus and credit card spending delay financial meltdown, but tightening banking and lending standards exacerbate the situation. Student loan forbearance nears its limit, and commercial real estate demand declines. Federal Reserve aims to rewrite monetary policy history by raising rates and ending easing measures. Global implications and significant fiscal relief not expected until Q2 2025. Bleak outlook persists.

[ad_2]

Source link

Tags:Alpha, banks, best, beta, billionaire, Bitcoin, Blockchain, buy, central, Collin Kettell, Decline, energy, Expert, fall, fortune, Freedom, Freefall, gold, high, increase, independence, invest, low, market crash, millionaire, Mining, Monthly Report, ounce, outlook, Palisade Radio, potash, Pound, precious metals investment, Price, private placement, QE, QE4, QE5, rise, sell, silver, Stock, Trump, Update, Uranium, value, Warrant, worst

Related Posts

It’s Full Market Meltdown Mania and the Fire Truck Is on Fire

There Is More Inflation Complexity Ahead by Mohamed A. El-Erian