UK passes bill to recognize crypto as “regulated financial activity”, boosts adoption in Europe

- The United Kingdom passed the Financial Services and Markets Bill after receiving approval from King Charles.

- Akin to MiCA, the new act will bring cryptocurrencies and stablecoins into the scope of regulations.

- Crypto adoption in Europe has snowballed since MiCA’s approval, with the UK joining the league despite not being a part of the bloc.

The United Kingdom became part of the list of nations that have officially brought regulations to cryptocurrencies and digital assets. The move by Great Britain and Northern Ireland has placed it ahead of the United States in terms of acceptance despite having a significantly smaller user base than the US.

UK brings regulations to crypto

The Financial Services and Markets Bill (FSMB) received Royal Assent from King Charles on Thursday. The passing of the bill means that crypto will now be recognized as a regulated financial activity bringing it within the established regulations for the market.

In an official statement following the Royal Assent, the Economic Secretary to the Treasury, Andrew Griffith, stated,

“This landmark piece of legislation gives us control of our financial services rulebook, so it supports UK businesses and consumers and drives growth.

The bill, according to the UK government, also contains new powers available due to Brexit. Reportedly it could unlock around £100 billion for productive investment and help cultivate innovation and grow the economy in the country.

The FSMB will also lay the groundwork for the advancement of the blockchain sector in addition to establishing the following:

- Enhances the scrutiny of the financial services regulators to ensure clear accountability, appropriate democratic input, and transparent oversight.

- Removes unnecessary restrictions on wholesale markets – implementing the key outcomes of the Wholesale Markets Review.

- Protects free access to cash in law and introduces crucial protections for victims of Authorised Push Payment scams.

- Enables the regulation of crypto assets to support their safe adoption in the UK.

- Establishes ‘sandboxes’ that can facilitate the use of new technologies, such as blockchain, in financial markets.

Following the approval, the United Kingdom has joined the European Union in spirit, as the bloc was one of the first major administrations in the world to bring crypto under the scope of regulations. The EU Markets in Crypto Assets (MiCA) bill paved the way for other governments to bring regulations at a large scale, allowing crypto development at a rapid rate.

While the EU law is set to come into effect next year, the influence of the same can already be seen. Earlier this week, German software giant SAP chose stablecoin USDC (USD Coin) to test cross-border payments to solve the challenges faced by businesses when sending money beyond their borders.

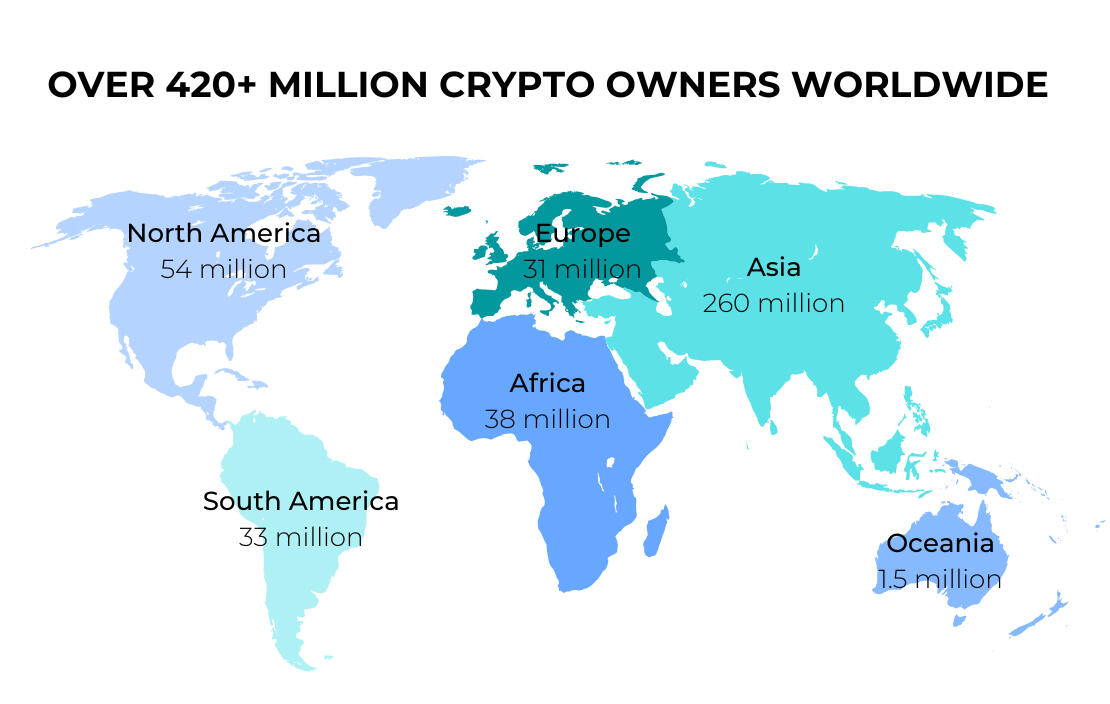

This puts the UK ahead of the United States, which is still years away from adopting regulations for cryptocurrencies, according to Securities and Exchange Commission (SEC) Chair Gary Gensler. The development is of concern since the US is home to over 54 million users as of 2023, while the UK only has 31 million users.

Crypto user base

Thus the US is susceptible to losing its user and developer base if they find more supportive policies in other countries, as has been the case recently with Coinbase. Also, especially since the SEC is at war with the biggest crypto exchange in the world, Binance, along with payment network Ripple (XRP), the vulnerability persists.

[ad_2]

Source link