Why do people trust central bankers?

I can’t understand that. I would rather say: There should be a movement here and there under the prevailing circumstances, a kind of yellow vest against the bankers. But lo and behold, the anti-globalists protest against the “rulers” during the G7 summits, as if they don’t know who pulls the strings in G7. The bankers were, are and will be spared. Look at the history of the “Occupy Wall Street” movement, how it was mercilessly swept away by the rulers. You could say: like an oppositional movement in Russia, but in the middle of freedom-loving America. What does the dictatorship of the bankers look like at the moment? And what threats does it pose to us?

Mario Draghi. Remember his assurance that he would do everything to preserve the euro and its stability? Whatever the cost? This is what he said and did in fact, but at the expense of taxpayers. A more recent example: Jerome Powell, the head of the FED assured on June 21 of this year, in relation to the problems of cryptocurrencies in the U.S. market, made by rigorous actions of the FED and SEC against the platforms and banks dealing in this digital money, that he would do everything to preserve the dollar as the main reserve currency in the world. How much will this cost the American taxpayers? Hello, Mr. Powell! Have you lost touch with reality? The Saudis are renouncing U.S. guarantees and reconciling with Iran; China is trading with the yuan with its partners; The BRICS countries are banding together, looking to add new members, including perhaps France – who knows? And you, Mister Powell, together with your colleagues, want to introduce the digital dollar, called “FED-NOW”, sometime in July 2023 at any cost to show every country in the world who rules here? Pride always comes before a fall.

As always, the next crisis is carefully prepared. One day an article appears, for example in “Financial Times”, the other “qualitative” media follow the topic. Then comes the “crisis,” always like a bolt from the blue. What is the “Financial Times” writing now? That the Bundesbank is broke. And that’s true. But then they publish a counter-statement. After all, the “crisis” has to be baptized in the media at the right time. They have to wait until the bankers themselves (the owners of the leading media) will give a sign to the editors; Yes, you may write that now because all the rats have long since fled the sinking ship and the captain never existed.

Why would the Bundesbank need a bailout right now? Because it is, of course, too big to simply let it fall? Yes, of course. But the reason is too boring for the average citizen, so he ignores the facts, but as always only until the headlines sound the alarm or until the next “unexpected” tax increase comes along. It is about bonds, the world of the bankers, which hardly everyone understands and therefore fails as a small investor mostly because he invests against the current, by the way.

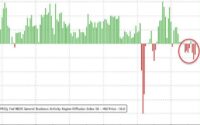

Super Mario, otherwise called “Cost what it may”, bought for years from the member banks of the ECB their government bonds so that they (especially his Italian home central bank) could service their debts. Thus, the over-indebted PISA countries did not become insolvent. But, wait, wasn’t that forbidden by the Maastricht Treaty? Yes, of course, but only if the bank in Frankfurt am Main had bought the debt directly from the states. The states, however, wisely sold their debts to the biggest bigwigs in the financial world, including the infamous funds like Black Rock. Thus, the ECB financed and continues to finance the private US money industry, which has done nothing to any EU citizen. These piles of the securities were hoarded in the bunker in Frankfurt and the great Italian banker had hoped that they would not lose value. But then inflation came, and his successor (remember: he himself did not) had to raise interest rates significantly. Since while prime rates were rising, fixed-income securities were losing value, it turned out that the bunker was full of toilet paper. Independent journalists (not those from the leading media) have calculated that the total loss of the EU monetary guardians could be as high as 500 billion euros. If the Bundesbank takes a stake in the ECB of about 10%, that’s already a small problem. But as a well-known German politician once said: Not all Germans believe in God, but they all believe in the Bundesbank. The euro will last forever. Maybe for 1000 years.

[ad_2]

Source link