Pimco Prepares for ‘Harder Landing’ for Global Economy: FT

(Bloomberg) — Pacific Investment Management Co. Chief Investment Officer Daniel Ivascyn is preparing for a “harder landing” than other investors as central bank chiefs prepare to continue raising interest rates, he said in an interview with the Financial Times.

Most Read from Bloomberg

“The more tightening that people feel motivated to do, the more uncertainty around these lags and the greater risk to more extreme economic outlooks,” Ivascyn told the newspaper.

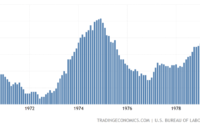

He added that when rates have risen in the past, a lag of five or six quarters for the impact to be felt has been “the norm”. He also argued that the market may still be too confident in the quality of central bank decisions and their ability to engineer positive outcomes, according to the FT.

Though Pimco thinks a “soft landing” is the most likely outcome for the US economy, Ivascyn told the newspaper, the world’s largest active bond fund manager is avoiding areas of the market that would be most vulnerable in a recession.

The firm, owned by Germany’s Allianz SE, is favoring high-quality government and corporate bonds for now. It is waiting for company credit ratings to be downgraded, which Ivascyn said will prompt forced selling among vehicles such as collateralized loan obligations in the coming months and years. That will be the time to snap up bargains, he told the FT.

Ivascyn cautioned that this cycle might be different to previous ones. Central banks may be less willing to provide support for fear of fueling rising prices, he said to the newspaper, while the fact that so much risk has been transferred to private markets would slow down the deterioration of credit valuations, but not prevent it, he added.

To view the source of this information, click here.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

[ad_2]

Source link