A $1.5 Trillion Program For Homebuyers Props Up Banks Instead (Socialist FLUB System At Work Protecting Banks, Not Middle Class) – Confounded Interest – Anthony B. Sanders

The Federal Home Loan Bank system (aka, FLUBs), a relic of FDR and The Great Depression, subsidizes banks, not individuals. Much like its twin sibling, The Federal Reserve system, it is a Socialist institution that rely of manipulation rather than free markets.

The first sign of deep trouble in US banking this year came from a sunbaked office complex in a San Diego suburb. There, a small firm called Silvergate Capital Corp. assured investors it was weathering a run on deposits. Its lifeline: about $4.3 billion from a Federal Home Loan Bank.

Heads turned across the financial industry.

Silvergate didn’t have a network of branches serving consumers, and it barely offered mortgages. It specialized in moving dollars for cryptocurrency ventures.

Soon it became apparent that a roster of troubled regional banks was leaning on FHLBs — a relic of the Great Depression originally aimed at ensuring financial firms have cash to lend to homebuyers. Yet the banks had little to do with everyday mortgage lending.

Silicon Valley Bank, catering to venture capitalists and tech startups, said it held $15 billion from an FHLB at the end of 2022. Signature Bank, with clients including crypto platforms, had $11 billion. And by April, First Republic Bank, offering mortgages to millionaires on unusually sweet terms, ended up with more than $28 billion. All four banks collapsed.

For many, that was a crystallizing moment for the 90-year-old Federal Home Loan Bank system, which has ballooned to more than $1.5 trillion while playing a growing role as a backstop for banks taking all kinds of risks — and a diminishing role in funding new mortgages. That’s raising questions about the purpose of FHLBs and why the private institutions enjoy so much government support.

As Milton Friedman once said, “Nothing is so permanent as a temporary government program.”

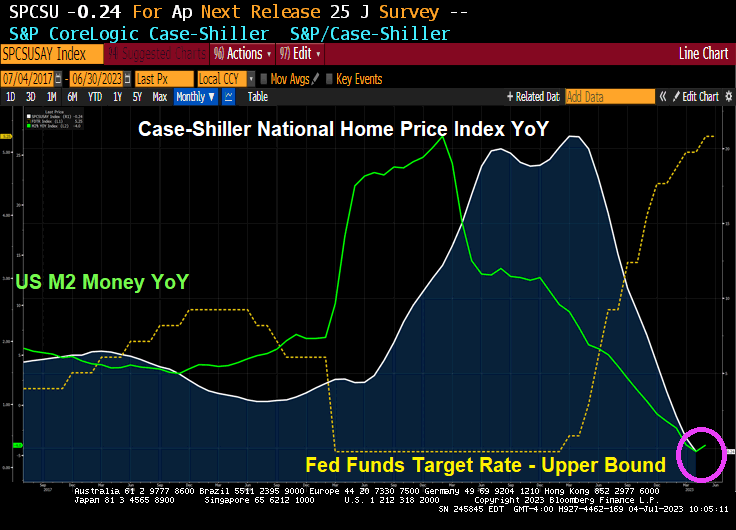

Of course, rate increases are crushing regional banks as well as the middle class. But as M2 Money growth crashes, home price growth is slowing into negative territory.

[ad_2]

Source link