Do High Interest Rates Fix High Inflation?

Published: June 2023

In prior articles and newsletters, I’ve explored the causes of consumer price inflation over time.

In short, the rate of consumer price inflation in an economy comes from a combination of 1) money supply growth and 2) significant changes in productivity and/or resource abundance.

-Periods of fast bank lending or large monetized fiscal deficits (and thus rapid money supply growth) tend to create inflationary environments, while periods of fiscal austerity and/or private sector deleveraging events (and thus slow money supply growth or outright money supply contraction) tend to create disinflationary or outright deflationary environments.

-Periods of technological stagnation, societal dysfunction, the need for resiliency over efficiency, war, and scarce natural resources tend to all contribute to the experience of inflation due to their negative affects on the supply of goods and services. On the other hand, periods of technological improvements, labor specialization, the sacrifice of resiliency for efficiency, geopolitical and civic peace, and abundant natural resources tend to all contribute to the experience of disinflation due to their positive affects on the supply of goods and services.

A useful example of this is to compare the price of oil in gold and in dollars over time.

Here’s a chart for the price of oil in gold since 1913. We can see that it fluctuates pretty wildly between 0.02 ounces of gold for a barrel of oil and 0.14 ounces of gold for a barrel of oil, but generally in a sideways pattern. Periods of great growth or major war generally put oil in high demand relative to scarce supply, and cause high prices. Periods of major recession or certain periods of peacetime abundance generally put oil in low demand relative to abundant supply, and cause low prices:

Here’s the price of oil in dollars since 1913. It has the same supply/demand fluctuations, but also has an exponential trend of price increases, because dollars have an exponential trend of supply increases and therefore persistent debasement:

On average since 1913, only 1.5% more above-ground gold ounces exist per year, but 7% more broad dollars exist per year, and thus the price of oil tends to hold steady in gold terms but tends to appreciate in dollar terms. Technology also makes us more efficient at finding and extracting oil over time, up to a certain point.

Most central banks have a 2% annual price inflation target rather than a 0% inflation target. Over the long arc of time, prices of things like oil and meat and gold and real estate have grown at a significantly faster rate than that, while the averages have been pulled down by certain deflationary categories such as electronics and textiles where massive productivity gains were made. Policymakers are fine with the steady debasement of currency, and even desire it, but don’t want the rate of debasement to get out of control.

That being said, within the context of the existing financial system, what should central banks do when significantly above-target price inflation does happen?

This has been one of the hot macroeconomic discussion topics over the past couple years. Critiques of current monetary policy have become a modern day form of Monday-morning quarterbacking. Finance-oriented people all have an opinion on what Federal Reserve Chairman Jerome Powell should be doing differently than he is at any given time.

The problem, of course, is that central banks can only affect a subset of the causes of inflation. They can influence, albeit very imperfectly, how much private sector credit creation (bank lending) happens. They can impose certain rules on their banking system, although their power to do so relative to the government’s depends on the jurisdiction in question. They can print money to finance their government’s fiscal deficits (and in some contexts, are forced to), or they can try to do the opposite for brief periods of time by avoiding the purchase of bonds or even selling some of their existing bonds. In some contexts, they have the authority to monetize mortgages and/or corporate bonds and equities.

And to complicate matters more, central bank independence is something that can exist in peacetime but quickly goes away during times of war or crisis. Central bank independence in practice means that a president can’t call up the head of the central bank and tell him or her to cut interest rates right before an election, and other obvious manipulation. However, central bank independence does not hold up well during actual crises; a central bank will almost always facilitate monetization of government deficits during war or a sovereign bond crisis, and even if it somehow resists such a thing, it can be compelled to do so by lawmakers.

This article examines under what contexts raising or lowering interest rates can quell or exacerbate money creation and price inflation.

Sources of Money Creation

In the current financial system, the majority of broad money creation happens due to a combination of fiscal deficits and bank lending, and the magnitude of those two sources relative to each other changes over time.

In the 1940s and 2020s inflationary periods, most of the money supply growth was from fiscal deficits (related to the war and the pandemic stimulus respectively). In the 1970s, most of the money supply growth was from bank lending (related to demographics primarily). A lot of analysts get confused or talk past each other about how to fight inflation, when they are unknowingly referring to very different causes/sources of inflation.

This chart shows the 3-year rolling average of U.S. fiscal deficits (blue line), new bank loans (orange line), and broad money supply growth (gray line) as a percentage of GDP since 1913:

This chart shows broad money supply and CPI changes over 5-year rolling periods since 1875:

This chart shows the overall history of U.S. fiscal and monetary policy since 1920:

If you are not familiar with the mechanisms for how both fiscal deficits and bank lending create broad money, I recommend that you read my article on money creation and then return to continue reading this article.

At the current time, Fed Chairman Jerome Powell is treating the 2020s (which is fiscal-driven inflation in a high public debt environment) as though it’s like the 1970s (which was lending-driven inflation in a low public debt environment). He is sharply raising interest rates to try to quell bank lending, even though bank lending wasn’t the cause of inflation in this cycle.

Depending on how certain factors play out, it can result in some unintuitive outcomes.

Interest Rates and Inflation

Raising or lowering interest rates can affect money creation and price inflation, but only in indirect ways. Some people assume that high interest rates are both necessary and sufficient to cure price inflation, but that’s not historically the case. In some contexts, it’s neither necessary nor sufficient. They’re just one tool among a few others in a central bank’s toolbox.

Here are short-term interest rates vs official consumer price inflation since 1934:

Put another way, here’s the scatterplot of the sampling of inflation and short-term rates over that period, with inflation on the left axis and interest rates on the bottom axis:

There’s rather weak correlation. Central bankers usually raise interest rates in response to high price inflation. But we also see periods of no correlation, such as in the 1940s. That’s because interest rates are just one of many variables that impact inflation, and only in specific ways.

At a 2022 investment conference, Stanley Druckenmiller said that “once inflation gets above 5%, it’s never come down unless the Fed Funds rate has gotten above the CPI.”

It’s a rare day that I will disagree with the greatest macroeconomic trader of all time, but he happens to be factually incorrect on this one, likely due to not looking back far enough in the data and therefore using the word “never” a bit too loosely. In the 1940s, inflation came back down to historically normal levels while the Fed was holding interest rates well below the inflation rate.

This was because the 1940s inflation (both in the US and even more-so globally) was caused by monetized fiscal spending on the war. When the war stopped, the fiscal deficit spending stopped, the rapid money creation stopped, and inflation stopped. Some of the money they spent went towards creating more supplies of industrial goods, especially as many factories were repurposed after the war. As the war ended, global supply chains improved and productivity returned. Interest rates were not a key tool to fight inflation in that era.

This was because the 1940s inflation (both in the US and even more-so globally) was caused by monetized fiscal spending on the war. When the war stopped, the fiscal deficit spending stopped, the rapid money creation stopped, and inflation stopped. Some of the money they spent went towards creating more supplies of industrial goods, especially as many factories were repurposed after the war. As the war ended, global supply chains improved and productivity returned. Interest rates were not a key tool to fight inflation in that era.

Interest Rates and Bank Lending

If interest rates are at-or-below the inflation rate, it creates an incentive for people to borrow money and to buy harder assets. Bank lending creates more broad money, and so as more people borrow money and use it to buy other assets, it can increase the money supply and exacerbate inflation into a vicious cycle.

If there is a situation where inflation is 5% per year along with some persistent inflationary catalysts in the future, and I can get a 30-year fixed rate mortgage to buy a decently-priced property at a 3% interest rate, why shouldn’t I? I’m effectively borrowing at a negative inflation-adjusted interest rate to buy a relatively scarce hard asset. And then by issuing the mortgage, the bank is creating more broad money in the system (in the bank account of whoever sold the house), due to the way the fractional-reserve banking system works. Asset prices and money supply subsequently go up as more people to do this.

As a more extreme example, Turkey’s broad money supply and consumer price index both more than doubled over the past year and a half, with upwards of 80% year-over-year inflation at the peak, while their interest rates ranged between 8% and 18%. Consumer level interest rates are higher than that but still; it’s a massive amount of inflation relative to interest rates. There’s a strong market incentive for people and companies to borrow Turkish lira and use it to buy U.S. dollars, gold, stocks, real estate, bitcoin, art, wine, or basically anything that is expected to have a better 3-5 year return than the lira, which is almost everything. And by borrowing lira, they create more lira. Or, even if they don’t or can’t borrow it, they simply refuse to hold much of it, which contributes to a collapse in the lira’s purchasing power and thus higher inflation for imports, including energy.

So, historically, raising interest rates above the inflation rate is a key method to try to slow down bank lending and thus slow down the broad money creation that is caused by excessive bank lending. And it creates stronger incentives for entities to hold the currency, which strengthens it and can lower import costs. This is the type of environment where higher interest rates get their reputation as an inflation-fighting tool, with Volcker in the 1970s being the most well-known example.

This works reasonably well in an environment of low public debt and where high rates of bank lending are the primary cause of money supply growth (like the 1970s). If interest rates are notably above the inflation rate, it does discourage many types of borrowing and encourages holding the money instead. It also pushes down asset prices, which makes them less powerful as collateral for loans.

Conversely, if the economy is growing sluggishly, and central bankers want to boost growth with more bank lending, then cutting interest rates is a tool that is reasonably effective. However, the effect is not linear. And we saw that in developed markets during the 2010s decade. If mortgage rates go down from 15% to 5% as they did in the 1980s and 1990s, and average house prices are a reasonable multiple of average worker incomes, that can indeed encourage a lot of new borrowing and credit creation, and boost price inflation and boost homebuilding and the need for homebuilders. However, if mortgage rates drop from 5% to 3%, and average house prices are already unusually high relative to average incomes, that doesn’t necessarily encourage much more borrowing.

And on the other side of the equation, if interest rates are super low for a long period of time, then banks are not being well compensated for the risks of lending, and may be rather strict by only offering loans to very creditworthy borrowers, which also results in rather low levels of borrowing. So, during the 2010s disinflationary decade, many central banks tried to go lower and lower in terms of interest rates (including below zero) to try to encourage more bank lending, which didn’t really materialize.

Interest Rates and Fiscal Deficits

If inflation is caused by runaway fiscal deficits, high interest rates do not really do much to stop that. A central bank and the commercial banking system in general is basically forced to finance its government’s runaway fiscal deficits anyway, so if they are printing money to help the government put more money into circulation than it removes, then changes in interest rates are going to be a distant second in terms of any impact they may have. It’s like giving someone Tylenol when they have a gunshot wound; what really needs to be done is to stop the bleeding.

At first, raising interest rates in the face of high deficit-driven inflation can slow inflation down, which makes it seem like it’s working. This is because the Fed can potentially reduce the rate of bank lending, and thus slow the economy down a bit, even as those fiscal deficits keep pouring in. In other words, they’re not affecting the primary cause of inflation, but they’re subduing enough other things that they’re able to push back against the primary cause, indirectly.

Over time, however, raising interest rates and keeping them high in an environment where runaway government deficits and high government debts are causing inflation runs the risk of exacerbating inflation. High interest rates on large amounts of government debt (>100% of GDP) will result in even bigger runaway deficits, because now they are dealing with ballooning interest payments on the debt, and this ironically pushes more money into the economy. A deficit for the government is a surplus for the private sector. Unlike a household or corporation that can default on its debt through complete inability to pay, a sovereign government that is indebted in its own currency can just keep forcing its central bank and commercial banking system to print the difference instead of nominally defaulting, and thus just keep pushing more and more money into the financial system.

For this reason, if the Fed had raised rates sharply in the 1940s war, it likely wouldn’t have reduced inflation, and could easily have exacerbated it. This is because the Fed and the commercial banking system were stuck monetizing the fiscal deficits anyway, the interest rates would likely not have changed how much war spending was done, and the deficits would have been bigger due to more interest being paid on the debts, which would have created even more money and pushed it out into the economy.

Why This is Complicated

Analysts often debate with each other about the relationship between interest rates and inflation. The conclusions are often too simplistic because they often only look at either the bank lending channel or the fiscal deficit channel of money creation, rather than both simultaneously. And to make it worse, it’s often politicized; hard money or easy money economic approaches are a very politically sensitive economics topic, and so people tend to talk past each other rather than with each other.

A number of analysts keep calling for the Fed to get more and more hawkish to quell inflation. Their view has been, if 3% rates didn’t do it, then go to 4%. If 4% didn’t do it, then go to 5%. If 5% doesn’t do it, then go to 6%, and cause a recession if need be. If a firm enough grip has been placed on money in their view, then surely it’ll iron inflation out of the system.

In fact, the Taylor rule says that the Fed should have gotten up to nearly 12% interest rates (and now back down to “only” 8%) in this cycle. This type of model is based pretty much entirely on the premise that lending-driven money supply growth is the primary cause of inflation:

And indeed, higher interest rates may work in the short term, for indirect reasons. If money gets tight enough over a cyclical period, then it could indeed cause a recession and a temporary drop in inflation. The private sector gets squeezed with higher interest expenses and tighter credit standards, and asset prices drop or stagnate. This is a theme I’ve been tracking since 2022.

However, what many of the hawks are missing is that raising rates increases the fiscal deficit, and the deficit has been the primary driver of inflation in this cycle rather than excessive lending. It’s more like the 1940s than the 1970s in that regard.

So, does that mean the solution is to hold rates low? Is dovishness the answer?

Not necessarily, no. That’s the strategy that Turkey has been trying to do, and it hasn’t worked very well. When inflation began to worsen in 2022, they cut interest rates to under 15% and inflation exploded to over 80% for a period of time:

Money supply and the consumer price index have been like a rocket ship for Turkey:

The problem with Turkey’s situation is that cutting interest rates may indeed reduce the portion of inflation caused by fiscal deficits, but it exacerbates speculative attacks on the currency and inflation caused by bank lending, and makes it so that nobody wants to hold lira, including especially foreign entities. Who wouldn’t borrow Turkish lira at low rates, and buy almost anything else with that lira? The lack of monetary tightening encourages rational actors to do so. And who would hold lira at such negative real rates?

On the other hand, if inflation is mainly caused by government deficit spending and a central bank relies too heavily on raising interest rates to quell it (mistakenly thinking that what works to quell lending-driven inflation can also quell the fiscal-driven inflation) then that can be a policy mistake that feeds inflation instead of tempering it.

Argentina currently has an inflation rate of over 100%, and unlike Turkey they’ve been aggressively raising interest rates to keep up with it. And yet inflation remains completely uncontained, and actually even worse than in Turkey.

Argentina’s money supply and consumer price index have been like a rocket ship as well:

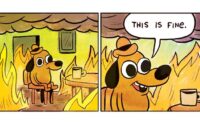

It’s almost as if… interest rate policy isn’t the only variable to consider here.

For the United States, as previously described there have been periods where one form of inflation dominates over the other. In the 1940s it was fiscal-driven inflation that dominated in the United States. In the 1970s it was lending-driven inflation that dominated in the United States. In the 2020s, it’s fiscal-driven inflation dominating again. A tool that works in one environment may backfire in the other environment. In some rare contexts for developed markets, and more commonly in developing markets, both can occur together, and that’s a particularly toxic mix to manage, as described below.

The Hardest Inflation Combination

Aggregate price inflation can be quelled by having low money supply growth relative to the growth in the supply of goods and services.

Of course, that’s much easier said than done for certain economic situations. But that simple lens, at the end of the day, helps us assess what measures can be done to quell inflation within the context of the financial system as it is currently structured, and whether certain measures that are being taken are likely to be successful or unsuccessful on a structural basis to fix inflation.

If inflation is caused by a war, or by a demographics bulge and a high rate of bank lending, it’s pretty fixable. War-driven inflation can stop (at least in rate-of-change terms, with prices permanently higher at a new steady-state) once the war ends and the government returns to a rather austere financial baseline. Lending-driven inflation can stop (also just in rate-of-change terms, with prices permanently higher) either due to the demographics bulge ending naturally or by tightening monetary policy and slowing down credit creation by banks.

-In the 1910s and 1940s, the U.S. had high deficit-driven inflation, but had a clear way to bring it down after the war, due to a lack of locked-in entitlement spending and a low ratio of dependents to workers. Sharply raising rates against this backdrop would have likely not helped with inflation and instead could have made it worse. The focus should have been, and was, on fiscal normalization.

-In the 1970s, the U.S. had low sovereign debt-to-GDP (only 30%), and thus had a clear path towards monetary tightening to rein in the rate of bank lending and consumer demand without blowing up the fiscal budget. Higher rates encouraged foreign entities to hold more dollars, which helped strengthen the dollar and lower import costs (and also, crush the economies of certain foreign developing countries that had a lot of dollar-denominated debt, which reduced their consumption of oil and other commodities and thereby left more for the United States). A dovish policy of not raising rates could have spiraled into uncontrollable lending-driven inflation and an avoidance of the rest of the world to hold dollars, and so raising rates to positive inflation-adjusted levels made sense.

The hardest inflation combination for a central bank to deal with is 1) a high sovereign debt-to-GDP ratio, 2) large and structural fiscal deficits tied to aged demographics and imbalanced entitlement programs and high military spending with no clear resolution in sight, and then 3) significant supply constraints such as tight oil markets or labor shortages. Due to high public debt levels, this combination is a very different environment than the 1970s, and a closer environment to the 1940s, although at least the 1940s had a more temporary spending reason.

Chart Source: CBO

If they bring out the 1970s playbook against that combination of high debts and deficits as they have been, and greatly increase interest rates over a multi-year period, then they can reduce money creation from bank lending in the intermediate term but ironically exacerbate inflation due to further widening those fiscal deficits and deficit-induced money supply growth in the longer term.

And so far, that’s what’s playing out. Asset prices stagnated in 2022, which led to weak capital gains taxes in 2023, and so tax revenue suffered. Meanwhile, higher interest expense increased government spending, and thus the deficit began re-widening as interest rates went up in late 2022 and throughout 2023 so far:

However, if they bring out the 1940s playbook and keep interest rates low despite high inflation, it reduces the fiscal-driven inflation a bit, but encourages speculative attacks on the currency by borrowing it and using it to buy harder assets with it, and thus making more currency in the process. Or, it merely convinces people to sell dollars and buy hard assets, thus weakening the currency considerably and causing more import price inflation and energy price inflation that way. When a country has a twin deficit (fiscal deficit and trade deficit simultaneously), it is vulnerable to some big swings in its currency value if it’s not monetarily tight enough.

In other words, on one side is a rock and on the other side is a hard place. As a Star Trek analogy, it’s a Kobayashi Maru, meaning a no-win scenario.

The Kobayashi Maru is a training exercise in the Star Trek franchise designed to test the character of Starfleet Academy cadets in a no-win scenario. The Kobayashi Maru test was first depicted in the 1982 film Star Trek II: The Wrath of Khan, and it has since been referred to and depicted in numerous other Star Trek media.

The notional goal of the exercise is to rescue the civilian spaceship Kobayashi Maru, which is damaged and stranded in dangerous territory. The cadet being evaluated must decide whether to attempt to rescue the Kobayashi Maru—endangering their ship and crew—or leave the Kobayashi Maru to certain destruction. If the cadet chooses to attempt a rescue, an insurmountable enemy force attacks their vessel. By reprogramming the test itself, James T. Kirk became the only cadet to defeat the Kobayashi Maru.

The phrase “Kobayashi Maru” has entered the popular lexicon as a reference to a no-win scenario. The term is also sometimes used to invoke Kirk’s decision to “change the conditions of the test.”

–Wikipedia

Other analysts have used the Kobayashi Maru analogy to describe policymakers choosing between inflation and recession (and indeed that is a similar situation, and one I’ve been analyzing), but at high enough debt and deficit levels, it can instead become a choice between fiscal-driven inflation and lending-driven inflation. And it becomes a matter of timelines.

For this reason, those types of environments often result in capital controls and various restrictions on lending eventually, which is the government’s version of reprogramming the test. Specifically in that context, lawmakers generally want to reduce interest rates to quell the fiscal-driven inflation, while also avoiding the speculative attack on the currency that such negative inflation-adjusted interest rates would encourage. They want to reduce the various ways to borrow money to buy private assets, while mandating institutions to buy government debt at interest rates that are below the prevailing inflation rate, and closing the various exit doors that people turn to in order to avoid holding the devaluing currency.

This can take many different forms.

Throughout the 1940s, the United States and other countries had strict capital controls. Owning gold was punishable by up to ten years in prison for Americans, and it was purposely hard to transfer money globally. The United Kingdom also had restrictions on the ownership of various financial securities during wartime.

Similarly, Turkey over the past year has been restricting lending to firms that have a lot of foreign currency, to offset the natural incentive that occurs when interest rates are so far below the inflation rate. They don’t want entities to be able to borrow lira and buy financial assets with it. Indeed, making it hard for businesses and individuals to access dollars or other foreign currencies is a common tactic used by developing country governments experiencing high inflation in order to try to protect their own currencies. Some countries such as Argentina and Nigeria have cut off access points to cryptocurrency exchanges well, to try to slow down outflows from the currency there.

But the problem with capital controls (aside from ethical issues) is that they result in a top-down command-and-control economy, and capital keeps wanting to escape if possible.

IMF Working Paper 2015/07 called “The Liquidation of Government Debt” described this in detail. Here was the abstract:

High public debt often produces the drama of default and restructuring. But debt is also reduced through financial repression, a tax on bondholders and savers via negative or belowmarket real interest rates. After WWII, capital controls and regulatory restrictions created a captive audience for government debt, limiting tax-base erosion. Financial repression is most successful in liquidating debt when accompanied by inflation. For the advanced economies, real interest rates were negative ½ of the time during 1945–1980. Average annual interest expense savings for a 12—country sample range from about 1 to 5 percent of GDP for the full 1945–1980 period. We suggest that, once again, financial repression may be part of the toolkit deployed to cope with the most recent surge in public debt in advanced economies.

The Fed’s new BTFP facility is a mild form of this. It provides liquidity to banks so that they don’t need to sell Treasuries or mortgage-backed securities. However, that liquidity is expensively-priced, which discourages them to use it beyond their needs. Bank funding costs are going higher, and their incentive to lend is weak. As a result, private sector credit is tightening (disinflationary) while public sector money creation continues to be facilitated with any liquidity that it may need (inflationary).

In such an environment, politics are likely to get quite heated. In a period of prolonged high interest rates, high inflation, and high government interest expense, some politicians will argue (and have argued in past analogues) that the government shouldn’t pay such high rates to its lenders, that the government is being unfairly squeezed by its lenders, and so forth. They can also argue that the high interest rates are exacerbating deficit-driven inflation.

So, the level of interest rates can become a very hot political topic, with some politicians advocating for lower interest rates and capital controls and increases in taxes, and others arguing for higher interest rates and major cuts to government spending (but of course not on the parts of government they like, just on the portion that their opponents like, which doesn’t get sufficient votes). As the fiscal deficits remain large and unresolved between these different viewpoints, the situation risks spiraling into a vicious cycle.

The combination of structurally high public debts, high fiscal deficits, and tight resources supplies is why I expect the later portions of the 2020s decade to be volatile and generally bouncing and back and forth between inflation and stagnation, and without good inflation-adjusted returns for the major U.S. stock indices.

When people say they want low inflation, what they really mean is that they want disinflationary growth. They want inflation fixed by more supply, not due to suppressed demand. If we get inflation under control by having a recession, and then stimulate our way out of that recession and have another round of above-target inflation because of it, then that’s not really fixing the problem. That would just be bouncing between inflation and stagnation, without much disinflationary growth, which is the actual target.

To address the underlying cause of inflation would be outside of the Fed’s purview, since it is more of a fiscal conundrum. The government would likely have to restructure the public debt and the existing mix of taxation and spending, encourage more industrial and energy production to come online, and then leave it to the Fed to harden the currency after that point. That combination might give a decent foundation for a period of longer-term disinflationary growth, but is extremely difficult to do and is basically a non-starter politically.

Summary Points

-High interest rates help to slow down bank lending and to incentivize various entities to hold the currency. Thus, high interest rates help reduce money supply growth from borrowing, and help reduce speculative attacks on the currency. This mainly works in an environment of lower public debt and deficits, and where high rates of bank lending are the main contributor to money supply growth.

-However, high interest rates also exacerbate deficit-driven inflation, specifically during eras with unusually large sovereign debts and deficits (e.g. >100% debt-to-GDP and >7% structural deficits-to-GDP). Each increase in interest rates puts some disinflationary pressure on the private sector, but also results in even larger public sector deficits pouring money into the economy. If those public sector deficits are big enough, then high interest rates can actually be inflationary.

Many developed countries including the United States currently have high debt-to-GDP ratios (unlike the 1970s) and large deficits, and thus actually need low interest rates to not exacerbate fiscal-driven money creation over a multi-year period. However, low interest rates in an inflationary resource-constrained situation could encourage excess bank lending including to buy harder assets which would also lead to an acceleration of money creation, or could lead to a spike in import prices and energy prices.

So, this combination generally leads to government attempts to restrain bank lending on things that are not considered good for national interest while also trying to keep interest rate expenses and liquidity for the government at workable levels, and results in the politicization of interest rates.

As of this writing, the interest rate increases over the past year haven’t fully affected things yet, for either the private sector or the public sector. It comes with a long and variable lag.

-For the private sector, many homeowners and corporations have longer-term fixed debt, and only some portion of it matures each quarter and gets refinanced at higher rates. As more private debt matures and gets refinanced at higher rates, this will continue to serve as a disinflationary and recessionary force on the economy, especially for sectors that are more sensitive to interest rates.

-For the public sector, about half of the federal debt is longer-term, and will continue to mature and be refinanced at higher rates too. This will continue to serve as an inflationary and stimulatory force on the economy. At $32 trillion in debt, sustained 4-6% interest rates eventually result in $1.3 to $1.9 trillion in annual interest expense as more and more of the debt matures and gets refinanced towards that level. All of that adds to the deficit and pours into the economy.

Therefore, somewhat stagflationary conditions persist, with two powerful forces pushing against each other.

Right now the cyclical disinflationary side is slowly winning, with a tightening in 2022/2023 after the 2020/2021 period of rapid fiscal money creation, but I don’t think we’ve seen the end of high inflation this decade.

Specifically, the next time we have a period of economic acceleration, it’ll likely come with a side order of inflation again.

[ad_2]

Source link