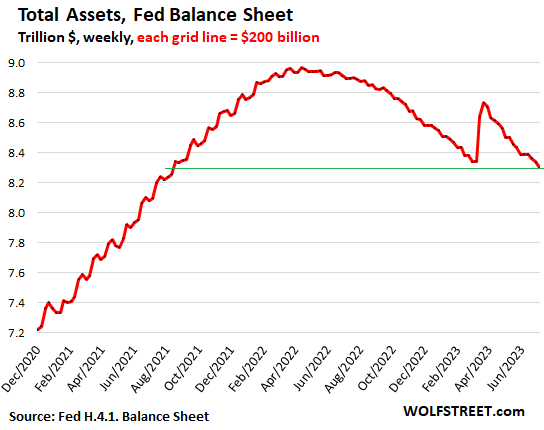

Fed’s Balance Sheet Drops $667 Billion fr. Peak to $8.3 Trillion, Below Aug 2021, as QT Continues, Bank Panic Support Unwinds

The Fed has now shed 20.5% of the Treasury securities it had bought during pandemic QE.

By Wolf Richter for WOLF STREET.

The Fed’s total assets dropped by $87 billion in June, and by $667 billion since the historic peak in April 2022, according to the Fed’s weekly balance sheet today.

In the 15 weeks since the height of the bank panic in March, the Fed has shed $435 billion in assets, the fastest-ever 15-week drop, as Quantitative Tightening (QT) continued on track and bank liquidity support measures continued to unwind.

At $8.298 trillion, the balance sheet is now at the lowest level since August 2021. This chart shows the details of the banking crisis, and how it is being unwound:

From crisis to crisis to raging inflation. Note QT #1 in 2018-2019, which removed $688 billion from the balance sheet. By the end of this month, 12 months into QT #2, the Fed will have unwound more of its assets than in the entire period of QT #1, despite the bank-panic bailout that at the peak had added $391 billion to the balance sheet.

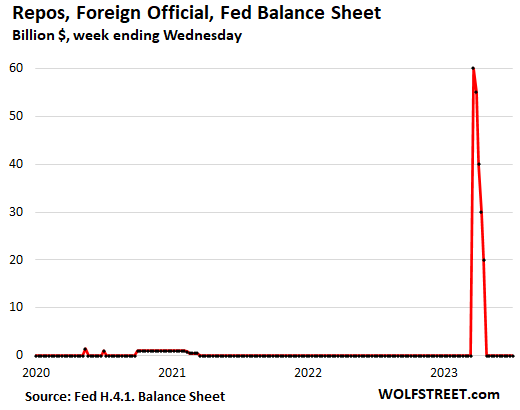

The banking crisis measures.

Repos with “foreign official” counterparties: $0. It was paid off in April. The Swiss National Bank likely leaned on this program to fund the dollar-liquidity support for the take-under of Credit Suisse by UBS.

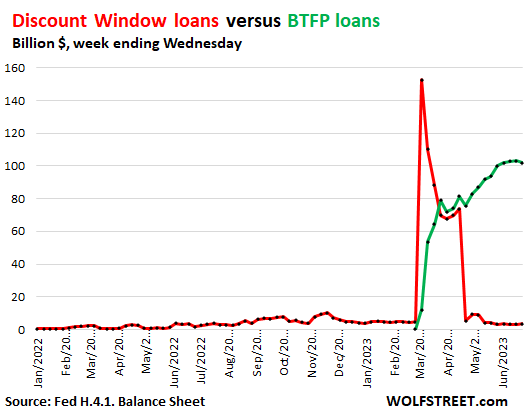

Bank liquidity programs.

Discount Window: $3 billion, down from $153 billion in March. Since the last rate hike, the Fed charges banks 5.25% to borrow at the Discount Window ( “Primary Credit”). In addition, banks have to post collateral at “fair market value.” This is expensive money for banks that should normally be able to borrow for less from depositors without having to post collateral. So they pay it off as soon as they can.

Bank Term Funding Program (BTFP): $102 billion, declined by $1 billion in the week, first decline since May. Banks can borrow for up to one year, at a fixed rate, pegged to the one-year overnight index swap rate plus 10 basis points. Banks have to post collateral, but valued “at par.” Still expensive money, but less expensive than at the Discount Window. It seems banks paid off the Discount Window loans with proceeds from BTFP loans.

Both facilities combined: $105 billion, down from $165 billion in mid-March. The chart shows loans at the Discount Window in red, and the loans at the BTFP in green:

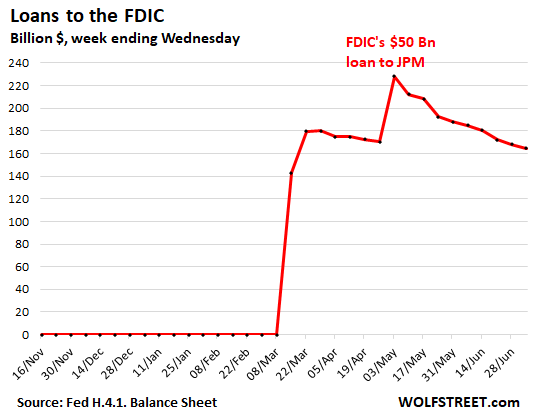

Loans to FDIC: $188 billion, down by $4 billion in the week, and by $23 billion in June. That spike in the week through May 3 was caused when JP Morgan acquired the assets of First Republic from the FDIC for $182 billion, and borrowed $50 billion from the FDIC to help fund the purchase. The FDIC then borrowed from the Fed (we walked through the details here).

The FDIC is now methodically selling the loans and securities it took over from the collapsed Silicon Valley Bank and Signature Bank. As the FDIC returns those funds to the Fed, the loan balance declines.

QT continues.

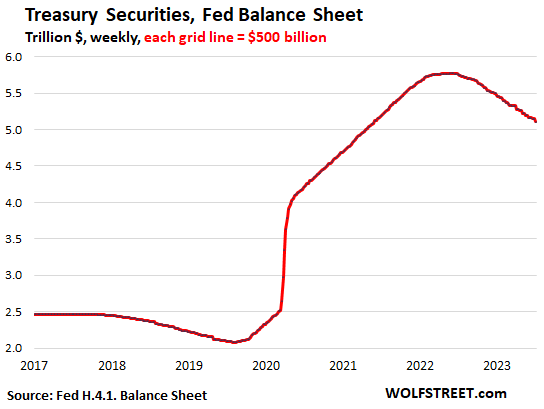

Treasury notes and bonds: $5.11 trillion. Down $58 billion in June, down $665 billion from the peak in June 2022.

The Fed has now shed 20.5% of the Treasury securities it bought under the pandemic QE ($3.25 trillion).

Treasury notes and bonds “roll off” the balance sheet mid-month or at the end of the month when they mature and the Fed gets paid face value for them. The roll-off is capped at $60 billion per month, and about that much usually rolls off, minus the inflation protection the Fed earns on TIPS (Treasury Inflation Protected Securities) which is added to the principal of the TIPS.

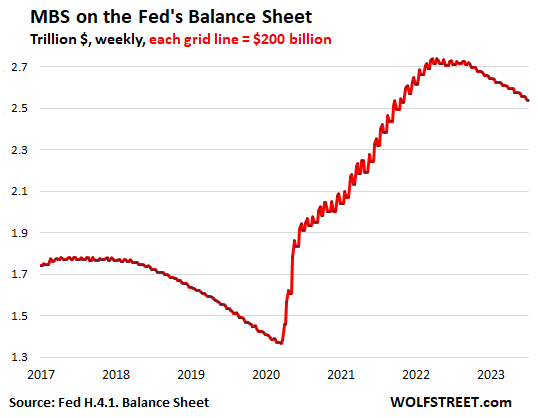

MBS: $2.54 trillion, down by $20 billion in June, down by $202 billion from peak. The Fed only holds government-backed “Agency MBS,” where taxpayers carry the credit risk, not the Fed.

Mortgage-backed securities come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when regular mortgage payments are made.

The reduction in MBS has been well below the cap of $35 billion per month because passthrough principal payments to the Fed have been slow, as fewer mortgages are getting paid off because home sales have dropped and refis have plunged:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link