Stocks could crash 25% with Fed rate hikes set to trigger a recession before the end of 2023, strategist says

-

Stocks could crater 25% from their current level if the Fed carries on raising rates, according to FS Investments’ Troy Gayeski.

-

The US central bank’s monetary tightening could also lead to a fourth-quarter recession, he said.

-

The economy “will soon be one of the biggest threats to equity prices,” Gayeski added.

US stocks could crash 25% from their current levels with the Federal Reserve’s aggressive interest-rate hikes set to plunge the economy into a recession before year-end, according to FS Investments’ chief market strategist.

Equities enjoyed an impressive rally in the first half – with the benchmark S&P 500 rising 16% – but an economic slump is likely to wipe out all of those gains, Troy Gayeski said.

“From our perspective, there’s probably only 3% to 5% more upside left in this rally as it runs out of air or support, and there’s potentially as much as 20% to even 25% downside from here as… the Fed continues to hike,” he told Yahoo Finance on Tuesday.

“Coming into this year, the economy was not a problem – it will soon be one of the biggest threats to equity prices and valuations over the next three to six months,” Gayeski added, giving odds of between 70% and 80% that there’s a recession before the end of 2023.

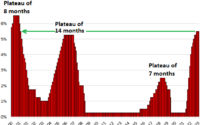

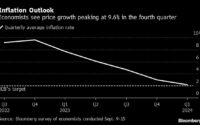

The Fed raised interest rates from near-zero to over 5% between March 2022 and May 2023 to tame soaring prices – and chair Jerome Powell has signaled it’ll likely tighten twice more this year in a bid to bring inflation down to its 2% target level.

Spending levels tend to fall as borrowing costs rise, dragging on the economy – US GDP growth slumped to just 1.1% in the first quarter.

Gayeski said that any contraction in the US jobs market – which has so far proved resilient in the face of the Fed’s aggressive rate hikes – will signal a full-blown recession and likely be a catalyst for a stock-market crash.

“As soon as the labor market starts to crack, the initial Fed reaction is going to be to high-five one another,” he told Yahoo.

“Then inflation truly will go back to 2% – but inevitably after that we’ll have a wild recession, which last we checked is not terribly good for earnings or revenue,” Gayeski added.

Read more: Stocks’ bull run from the first half won’t last – high interest rates and slumping growth will kill the rally, UBS says

Read the original article on Business Insider

[ad_2]

Source link