Where Are They? Where Are They Headed? – MishTalk

Let’s check in with Mortgage News Daily and Bankrate to see what they say about national mortgage Rates.

Rates Remain Over 7 Percent

Matthew Graham, writing for Mortgage News Daily says, Rates Remain Over 7% Despite Modest Improvement

The most important thing to know about mortgage rates so far this week is that they lived through last week. Living through last week means rates reacted to surprisingly strong economic data by jumping well into the 7% range for conventional 30yr fixed loans.

We’ve been here before–just a few months ago, but not for very long. Also, we haven’t been much higher than this during in more than 20 years. That said, many experts thought we might not be back here quite so soon–if at all during the same cycle.

The x factor is the steady supply of data that shows stubborn inflation and persistent economic growth. Rates will remain high until these things change. We’ll get a major update on the state of inflation this Wednesday morning with the release of June’s Consumer Price Index (CPI), but even then, it will take several months of cohesive messaging in the data to definitively turn the tide for rates.

According to MND, mortgage rates jumped back above 7.0 percent on June 29, and have been there ever since. The “modest improvement” refers to a decline from 7.22 percent on July 6.

Bankrate Tuesday July 11

For today, Tuesday, July 11, 2023, the current average 30-year fixed mortgage interest rate is 7.37%, up 20 basis points over the last seven days. If you’re looking to refinance, today’s national average interest rate for a 30-year fixed refinance is 7.44%, increasing 15 basis points from a week ago.

I am not sure how Bankrate computes national average. MND takes points into consideration to standardize rates.

Reflections on Housing

Jobs Data

Data had been on the hot side, especially ADP’s job forecast of 497,000 jobs. But that did not pan out with the BLS jobs report. For discussion, please see The BLS Jobs Report Falls Way Short of Stellar ADP Expectation

Consumer Credit

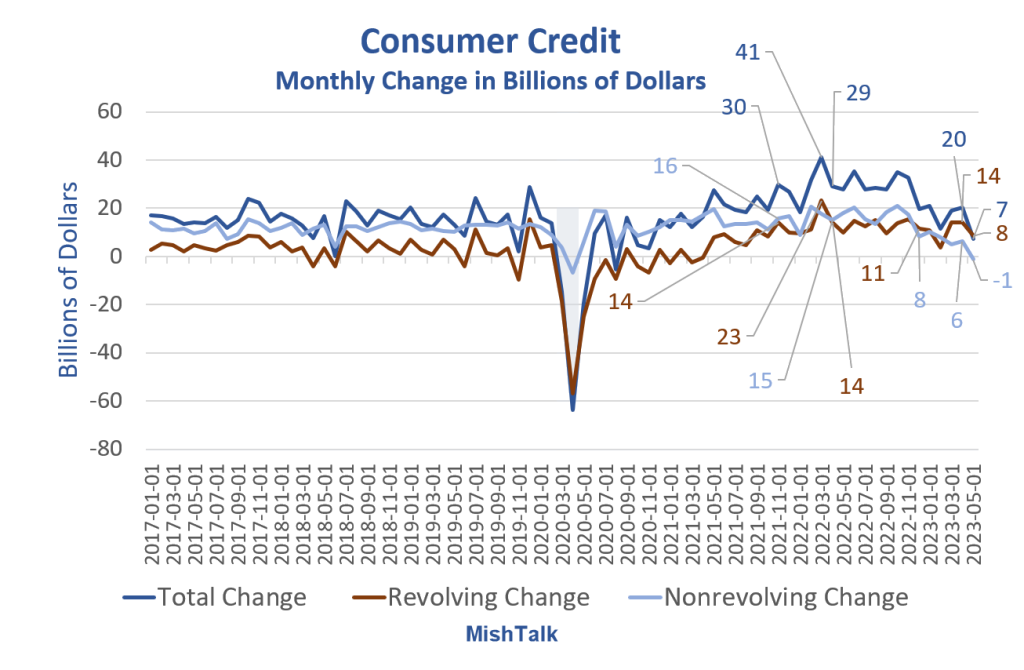

Yesterday, I noted Consumer Credit Is Much Weaker Than Expected, Non-Revolving Turns Negative

The Bloomberg Econoday consensus was for credit to rise by $20.0 billion. Instead, the rise was $7.3 billion.

In addition, the Fed revised May credit from $23.0 billion to $20.3 billion. And nonrevolving credit posted its first negative reading since April of 2020. The net change is the lowest since November 2020.

The Fed will be pleased with this report. Mortgage rates yawned at the news.

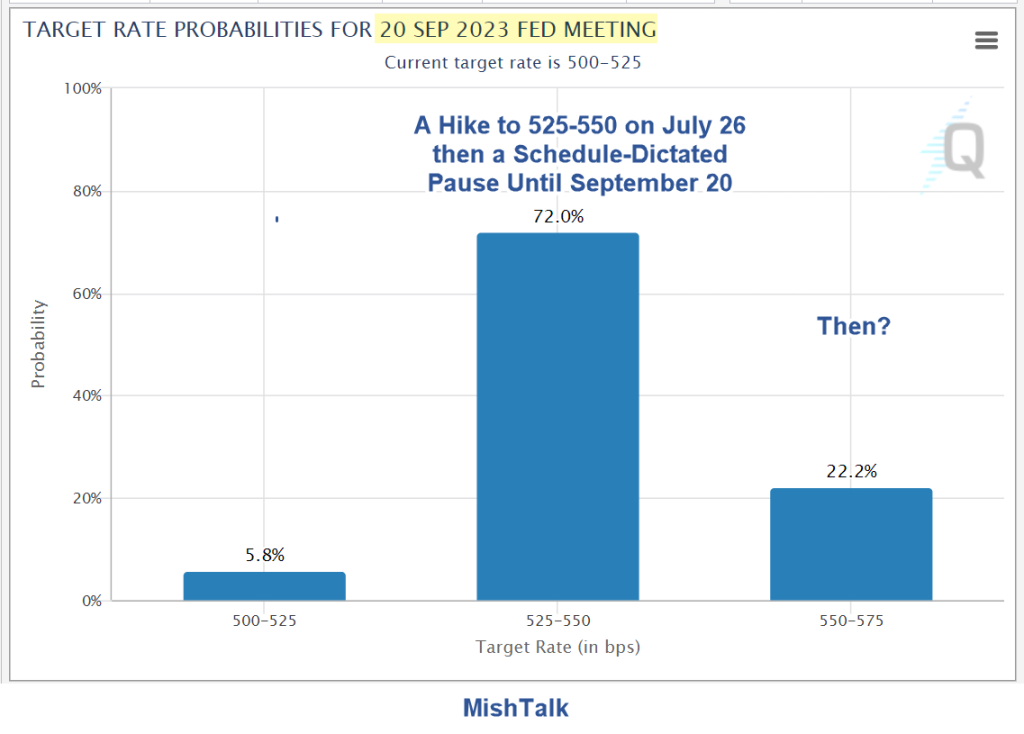

Tomorrow, the BLS releases the CPI report and on July 26, the FOMC meets. CME Fedwatch says there is a 92.4 percent chance of a quarter point hike.

Two Month Pause Until September

The Following meeting is not until September 20. The market thinks there is a 22.2 percent chance of a hike, and a 5.8 percent chance of a cut.

A lot can happen in two months and the Fed will appreciate this forced pause dictated by the meeting schedule.

[ad_2]

Source link