The numbers: The leading economic index dropped 0.7% in June, falling for the 15th month in a row, a recession signal if there ever was one. But the U.S. economy is still growing and shows few signs of a pending slump.

The leading index is a gauge of 10 indicators designed to show whether the economy is getting better or worse. Seven of the 10 indicators fell in June.

Economists polled by the Wall Street Journal had forecast a 0.6% drop.

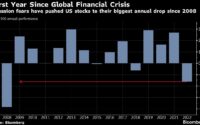

Key details: The last time the leading index dropped for so many months in a row was in 2007-08, when the U.S. fell into the Great Recession.

In June, seven of the 10 indicators tracked by the nonprofit Conference Board declined.

A measure of current economic conditions, meanwhile, was flat in June.

The so-called lagging index — a look in the rearview mirror — was also unchanged last month.

Big picture: Lots of economists are sticking to their guns and predicting a recession within the next year because of rising interest rates. The Federal Reserve has sharply increased borrowing costs to slow the economy and quash inflation.

The economy is still growing faster than expected, however, and shows little sign of a rapid slowdown. What’s more, the Fed might be done raising interest rates in July.

Looking ahead: “June’s data suggests economic activity will continue to decelerate in the months ahead,” said Justyna Zabinska-La Monica, senior manager of business cycle indicators at the Conference Board.

“We forecast that the U.S. economy is likely to be in recession” from the third quarter of 2023 to the first quarter of 2024, she said. “The recession likely will be due to continued tightness in monetary policy and lower government spending.”

Market reaction: The Dow Jones Industrial Average

DJIA,

rose but the S&P 500

SPX,

fell in Thursday trading.