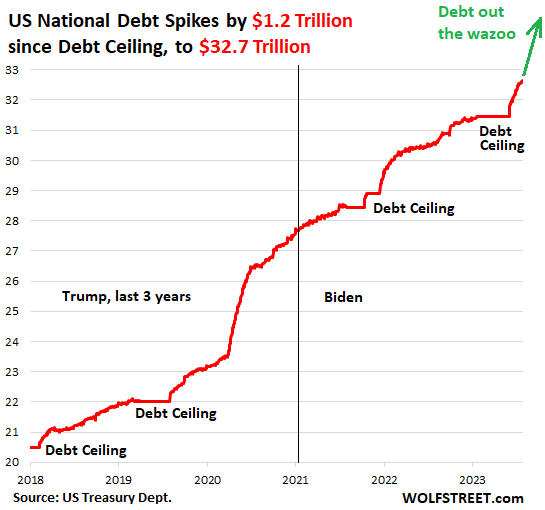

US Government Debt Spikes by $1.2 trillion since Debt Ceiling, to $32.7 Trillion. Treasury to Add $1.5 Trillion in Debt by Year-End

Stunning numbers out today. Investors will buy the securities, plus those the Fed steps away from. But… Crystal ball sees rising longer-term yields.

By Wolf Richter for WOLF STREET.

To set the scene for what’s to come in a moment: The total US national debt spiked by $1.19 trillion since the debt ceiling was lifted, to $32.66 trillion.

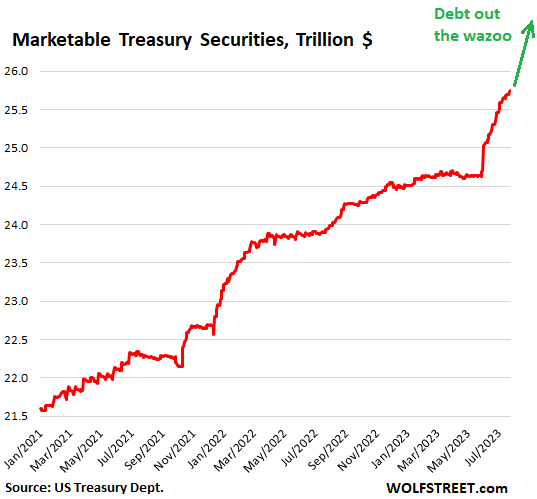

And to set the scene further: This $32.66 trillion of debt is composed of two groups of Treasury securities:

- $6.9 trillion of nonmarketable (not traded in the market) Treasury securities that have been bought by US government pension funds, the Social Security Trust Fund, etc.;

- $25.7 trillion in marketable securities (Treasury securities held and traded by the global public, from regular folks to central banks, including the Fed).

Marketable securities outstanding have spiked by $1.05 trillion since the debt ceiling was lifted on June 2, a huge amount of issuance in two months.

And in a moment, we’ll get into how much more will be issued for the remainder of the year: Another $1.5 trillion (as indicated by the green line and technical term for this phenomenon), according to the jacked-up projections released today by the Treasury Department:

Today’s debt-issuance shocker for the 2nd half.

The Treasury Department today jacked up its borrowing plans to deal with the lower-than-previously-expected revenues and the higher-than-previously-expected outlays, as the deficit keeps careening out of all control.

For the current quarter: $1.01 trillion in additional debt. This July through September quarter has only two months left, Treasury jacked up its borrowing plans by $274 billion, to total borrowing in the quarter of $1.01 trillion, up from the $733 billion it had imagined in May, according to its announcement today.

In other words, the government will issue over $1 trillion in marketable securities this quarter that the market has to buy this quarter, in addition to refinancing maturing securities.

Last time the government issued securities at this pace and faster was in 2020, but back then, the Fed was buying Treasuries hand over fist, including $3 trillion in March through May 2020. Now the Fed is shedding Treasuries at a pace of about $60 billion a month.

Markets not only have to digest the new issuance but also pick up the $60 billion a month that the Fed is walking away from.

The Treasury Department cited three main reasons for this $274 billion increase to this monster $1.01 trillion in new issuance this quarter:

- It raised by $50 billion the balance it wants to have in its checking account, the Treasury General Account (TGA), by the end of September, to $650 billion, from $600 billion as planned in May.

- It started out the quarter with $148 billion less in the TGA than projected in May. So it was behind before the quarter even started.

- It now projects “lower receipts and higher outlays” than imagined in May, requiring an additional $83 billion new debt to cover this additional deficit.

For the next quarter: $852 billion in new borrowing. In the October through December quarter, Treasury expects to borrow an additional $852 billion, to end with a cash balance in its TGA of $750 billion.

The way things are going, with these big upward revisions of borrowing estimates, along with the less than projected receipts and more than expected outlays, we can expect an upward revision of this $852 billion by the next update.

Total new borrowing in the second half: $1.85 trillion. In July – the first month of the second half – the government already borrowed nearly $300 billion. So for the five months from now through the end of December, the government projects to issue $1.56 trillion in new debt. Some of it to refill the TGA to $750 billion (from $550 billion now), and the rest of it cover the budget deficit.

Bon appétit, investors!

This is a huge amount of supply of Treasury securities coming to the market, on top of the $60 billion a month in maturing securities that the Fed is walking away from, and as they’re refinanced, the market has to pick them up too.

Yield solves all demand problems. That’s what yield is for, and it’s a good thing, we know that. You can sell even the riskiest junk bonds if the yield is high enough. So there will be buyers, but the yields will have to be high enough to attract them.

So far, the government has only increased its issuance of Treasury bills (securities of one year or less) and Cash Management Bills – a veritable flood of CMBs.

CMBs are the most flexible securities for the government. They are sold at auctions on short notice and outside the normal auction schedule. Their balance is not included in the above charted $32.66 trillion in national debt. CMBs can have peculiar terms, from one day on up to several months. For example, on July 27, Treasury announced that it will offer $50 billion in 42-day CMBs at an auction on August 1.

Even though CMBs are not included in the balance of the US national debt, they will still have to be absorbed by investors and are part of what investors have to buy.

The longer-term securities are coming. On Wednesday, Treasury is expected to announce a substantial increase in the issuance of longer-term securities – Treasury notes of 2 to 10 years and bonds of 20 and 30 years – most likely through increases of the sizes of its regular auctions.

This increased supply of longer-term securities will have to attract enough buyers with a yield that is high enough. Currently, Treasury bills are paying somewhere near 5.5%. But the 10-year yield is only around 4%. So this will be interesting.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link