U.S. Credit Rating Lowered from AAA to AA+

In this week’s Nuggets, we bring you key updates on the U.S. national debt, government spending, potential threats to the dollar, and more.

U.S Default Rating Downgraded – AAA to AA+1 — Fitch, a major credit rating agency, announced late Tuesday that it has downgraded the U.S. long-term foreign currency issuer default rating from AAA to AA+. The reasons? Expected financial decline, political disagreements over the debt limit, and a growing unmanageable debt burden.

U.S. Debt Expected to Grow $5.2 Billion Daily Over Next Decade — The U.S. government’s debt is projected to increase by $5.2 billion daily for the next decade, according to Bank of America strategist Michael Hartnett. He bases this on Congressional Budget Office (CBO) projections, which also predict that public debt will reach 118.9% of GDP by 2033, a major rise from 98.2% in 2023.

Government Spending Skyrockets – $1.4 Trillion in 2023 So Far — The Congressional Budget Office reports that the U.S. government’s budget deficit for June was $225 billion – a 156% increase from last year. So far in 2023, the deficit has reached $1.4 trillion – a 171% rise from the same period in fiscal 2022.

Debt Service Payments Are the Fastest Growing Part of the Deficit — Interest payments over the last nine months reached $652 billion and are projected to grow by 39% from fiscal 2022. In 2022, the US spent over $465 billion in interest payments. This year, it will spend almost a trillion dollars.

Could Gold-Backed Currency Challenge the Dollar? — The BRICS nations are poised to unveil a gold-backed digital currency that could challenge the dollar’s dominance. An official announcement about this new CBDC, which has been in development for some time, is expected at the August 22-24 summit in Johannesburg, South Africa.

Understanding Fitch’s Downgrade of the U.S. Credit Rating

Fitch is a major credit rating agency that evaluates the financial health of countries and companies. They give ratings that help investors decide how risky it is to lend money to these entities. A high rating means Fitch believes the entity is very likely to pay back its debt, while a low rating means there’s a higher risk they won’t pay back.

One of these key ratings is the “U.S. long-term foreign currency issuer default rating.” It’s a score that Fitch gives to the U.S. government. It shows how likely the U.S. is to pay back its long-term debt. Recently, Fitch downgraded the U.S. rating from AAA to AA+. This means Fitch thinks there’s a slightly higher risk that the U.S. might not pay back its debt – and that could be a big deal.

This downgrade could have several negative effects on the economy. It could make it more expensive for the U.S. government to borrow money, because lenders might demand higher interest rates to compensate for the increased risk. This could lead to higher taxes or cuts in government spending. It could also make investors nervous, which could lead to lower stock prices.

Fitch cited several reasons for the downgrade. They believe there’s been a decline in the U.S. government’s management of its finances over the last 20 years. They pointed to political disagreements over the debt limit, which have often been resolved at the last minute, and the lack of a long-term plan for managing the government’s finances.

They also mentioned economic shocks, tax cuts, new spending initiatives, and rising costs for social security and Medicare due to an aging population as factors that have led to increasing debt.

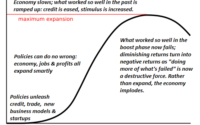

Banks are Tightening Their Belts

A new study from UBS, one of the world’s largest banks, says that other banks are starting to lend less money. This includes money lent to people and businesses, but not including home loans and credit cards.

There are two main reasons for this.

- First, the cost of borrowing money (interest rates) has gone up a lot recently. This makes it more expensive for people and businesses to borrow money, so they’re less likely to do so.

- Second, banks have become more careful about who they lend money to. This is because a bank called Silicon Valley Bank failed, which has made other banks nervous.

The Federal Reserve has warned that this could lead to a “credit crunch”. This means it could become even harder for people and businesses to borrow money, which could slow down the economy. Other experts from Goldman Sachs, Moody’s, and JP Morgan have echoed these concerns, predicting a decrease in lending and a potential impact on economic growth.

Despite these worries, right now people are still spending money, which is good for the economy. But with the economy possibly heading towards a downturn, it’s uncertain how long this will continue.

209 Years of Debt Added in Just 8 Weeks

Here’s a shocking fact: it took the U.S. 209 years to accumulate its first $1.8 trillion in debt…

But we just added $1.8 trillion in debt in a mere 8 weeks after a historic debt ceiling deal. We’re now spending in weeks what once took us centuries.

This puts the U.S. in a tricky position. The sheer size of the debt, and the way it is exponentially increasing, makes repayment seem virtually unachievable. Once investors start doubting the U.S.’s ability to repay its debt, they might stop lending money to the U.S. or demand higher interest rates. Either scenario could trigger a financial crisis.

The rapid growth of the U.S. national debt is a complex and pressing issue. Our very own Mike Maloney says that unfortunately, when it comes to the U.S. National debt, we’re past the point of no return. Yet, some still believe there’s time to rectify the situation.

One thing is for sure – as the debt continues to surge at this unprecedented rate, it’s crucial for policymakers to act now if they want to find a sustainable solution.

But will they?

History suggests that relying on the government or banks may not be the best strategy for your portfolio. Wall Street, and the world at large, believe that U.S. debt was one of the safest investments to own. But as Fitch just warned, maybe it isn’t…

With U.S. debt no longer seen as safe as it once was, consider turning to history’s most enduring asset — gold. As the only asset that isn’t simultaneously someone else’s liability, gold offers a store of value and portfolio insurance when you need it most.

Build Your Gold Portfolio Today

Stay tuned for the next edition of GoldSilver Nuggets!

Best,

Brandon S.

GoldSilver

[ad_2]

Source link