US and EU Corporations Slam the Brakes on Demand for Business Loans – MishTalk

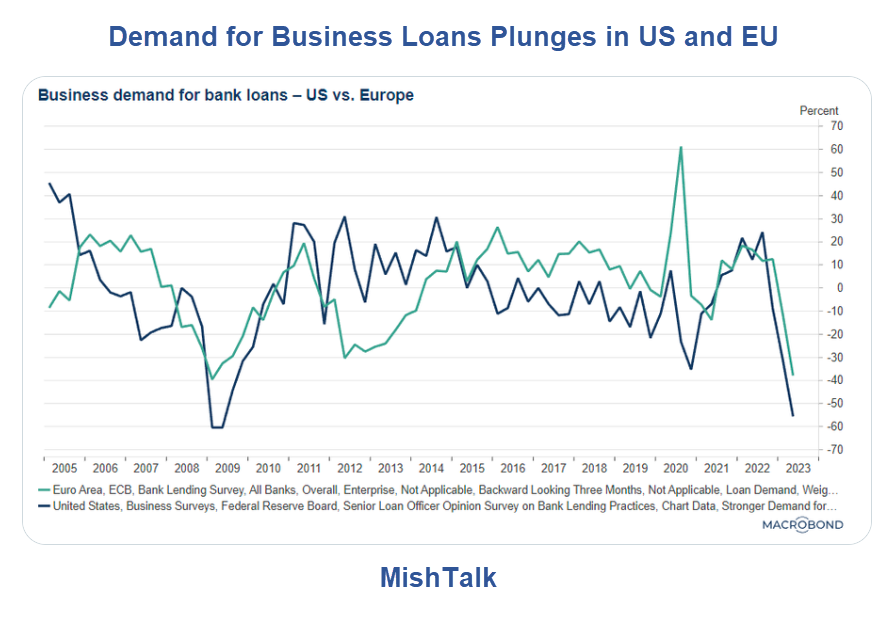

Both the US and Europe have seen massive drops in demand for bank loans. Meanwhile, the Fed just said they no longer expect a recession.

Here’s a Tweet that caught my eye today.

Why are Companies Slamming the Brakes?

Senior Loan Officer Opinion Survey on Bank Lending Practices

Please consider the Fed’s latest Senior Loan Officer Opinion Survey on Bank Lending Practices.

- Survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the second quarter.

- Banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

- For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans, especially for RRE loans other than government-sponsored enterprise (GSE)-eligible and government loans.

- Demand weakened for all RRE loan categories.

- Banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs).

- Standards tightened for all consumer loan categories; demand weakened for auto and other consumer loans, while it remained basically unchanged for credit card loans.

Supply and Demand for Commercial and Industrial Loans

Measures of Supply and Demand for Commercial Real Estate Loans

Attitude Change

Q: Why are Companies Slamming the Brakes?

A: Recession risk and profit risk

It’s not just companies who are slamming the brakes. Tighter lending standards across the board shows banks are doing the same.

Large and small banks alike are getting clobbered on rising yields. This led to the collapse of Silicon Valley Bank (SVB).

Banks raise lending standards, the economy slows a bit, corporations get fearful of falling profits so they do not want to expand.

The cycle feeds on itself until something breaks. And it’s breaking now.

The Inflation Reduction Act dampened the cycle impact with huge subsidies, but that band-aid is about to fall off.

Soft Landing?

A crashing demand for loans does not add up to the now widely believed soft landing thesis.

For further discussion, please see China Exports and Imports Collapse, Harbinger of the Global Economy?

[ad_2]

Source link