Subpar, Tailing 30Y Auction Prices At Highest Yield In 12 Years

With much trepidation ahead of refunding week following some dire forecasts about a deluge Treasury supply in the coming quarter, moments ago the Treasury sold the last coupon auction of the week when it placed $23BN in 30Y paper in willing hands and while the sky did not fall, the auction was clearly the ugliest of the lot.

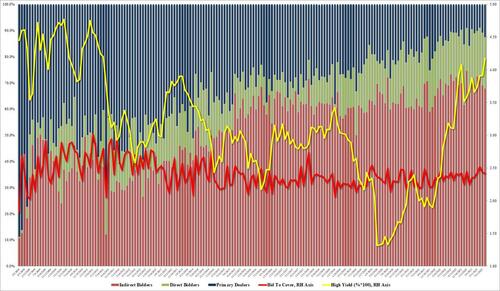

Stopping at a high yield of 4.189%, the 30Y auction priced at the highest yield since July 2011, and was well above last month’s 3.910%; it also tailed the When Issued 4.175% by 1.4bps, the highest tail since February.

The bid to cover was 2.42, the lowest since April and below the 6-auction average of 2.39.

The internals were also subpar, with Indirects awarded just 67.8%, the lowest since February. And with Directs awarded 19.6%, let Dealers holding 12.5%, the most since February.

Overall, a subpar, ugly auction, if hardly catastrophic and certainly not only to send any shockwaves int he market where the 10Y has barely budged.

Loading…

[ad_2]

Source link