Bond Market Carnage Sends Mortgage Rates Soaring towards 23-Year Highs – MishTalk

US Treasury yields rose last week despite a relatively tame CPI report. Mortgage rates rose as well. What’s going on?

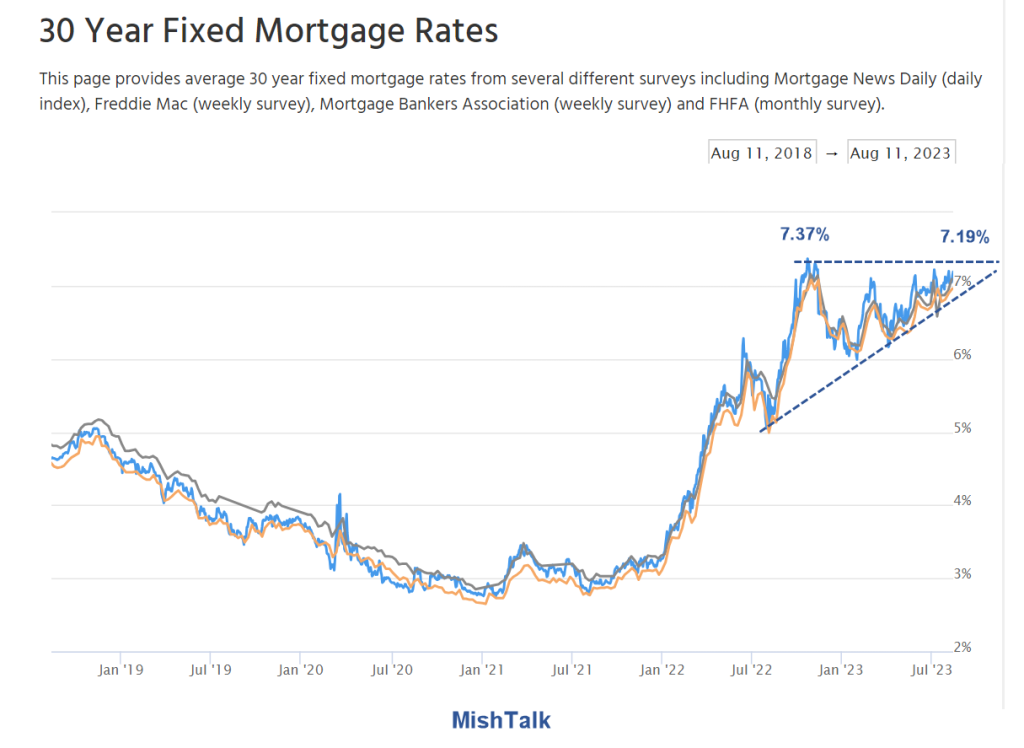

30-Year Mortgage Chart Notes

- On Friday, August 11, 2023, mortgage rates jumped to 7.19 percent and approach the October 20, 2022 high of 7.37 percent as noted by Mortgage News Daily.

- The 7.37 percent rate was the highest since October of 2000, nearly 23 years ago.

Ominous Chart Technically

Technically speaking, the chart is ominous. Rising triangle formations tend to break higher.

That’s certainly not a guarantee, or even close. But it fits in with US treasury action in response to CPI data.

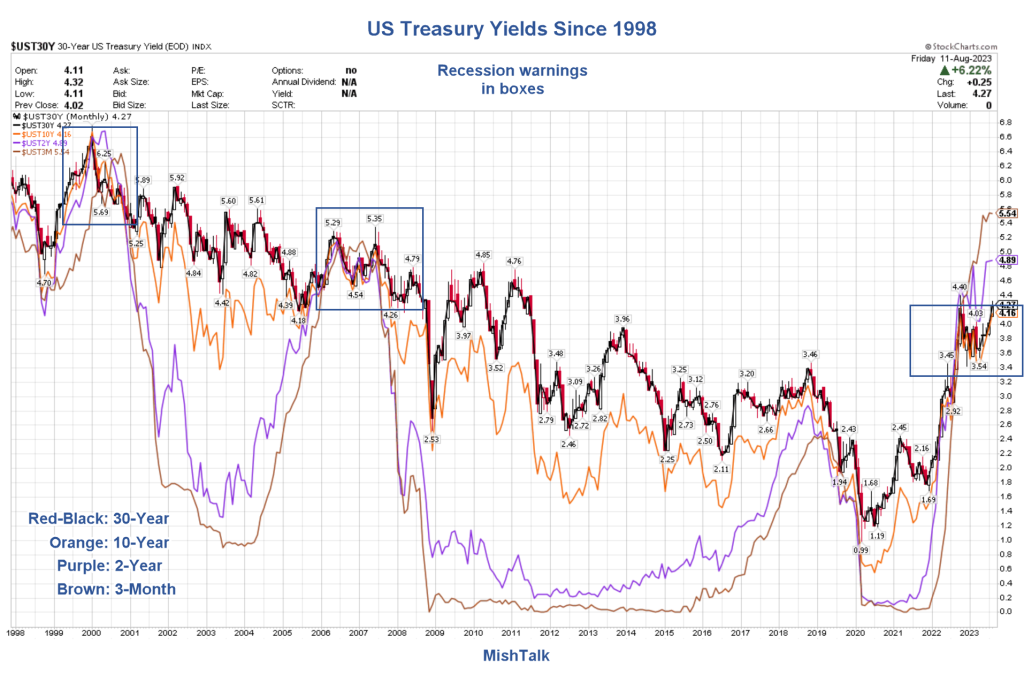

US Treasury Yields Since 1998

Since 1998 there have been three major inversions where short-term yields soared above long-term yields across the board.

Currently we are in one of the steepest inversion in history with the 3-month yield at 5.54 percent and the 10-year yield at 4.16 percent.

But it’s the recent action that is more telling especially vs the CPI.

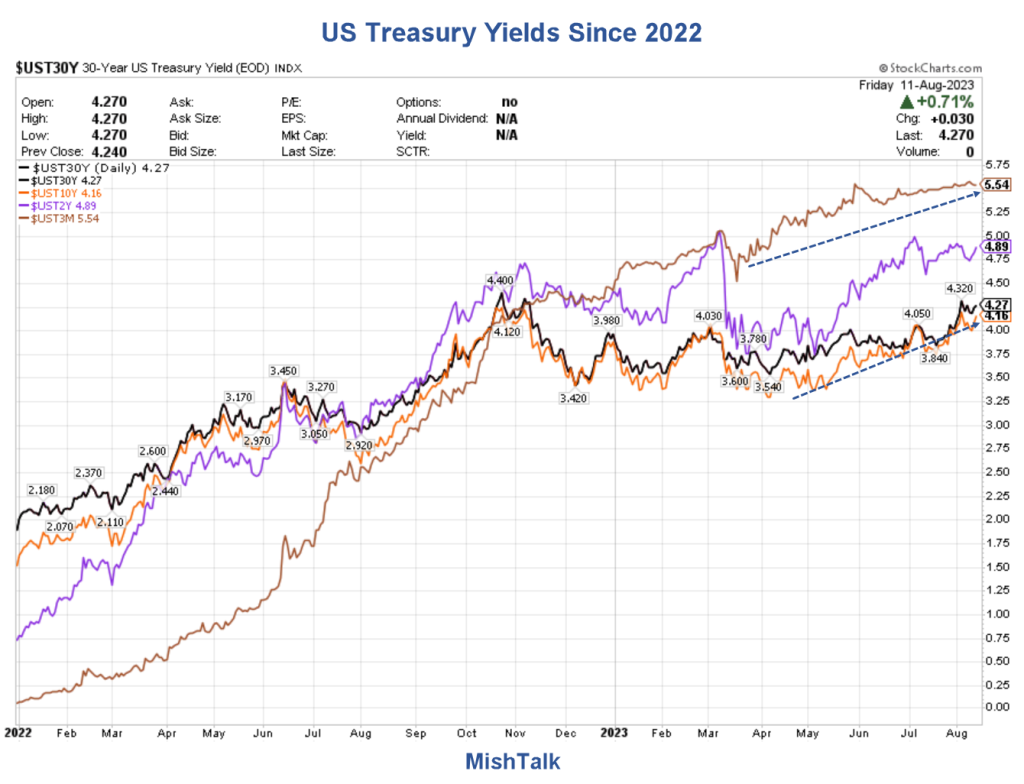

US Treasury Yields Since 2022

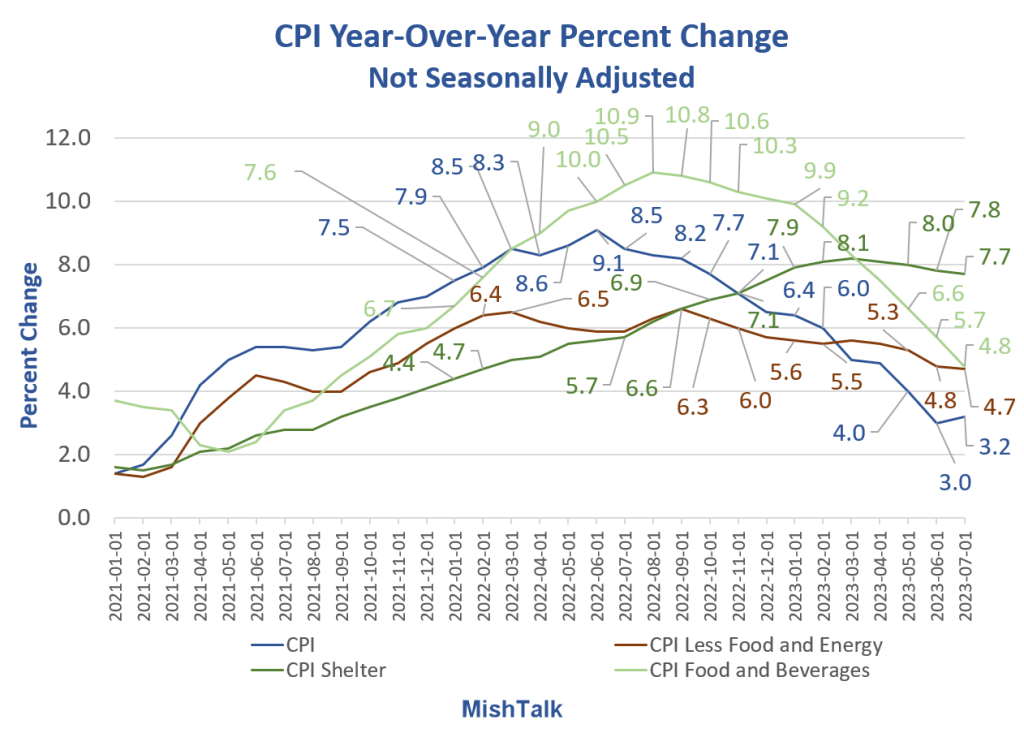

CPI Year-Over-Year

Year-over-year the CPI peaked at 9.1 percent in June of 2022. Since then, it has plunged to 3.2 percent.

For the move, the 10-year treasury yield slid to 3.54 percent in April of 2023. Mortgage rates also declined, leading the way, in fact.

30 year Fixed Mortgage Rates Detail

What’s the Message?

- Another uptick in inflation is on the way.

- The Fed is not done hiking.

- The goldilocks view by the Fed any widely touted in mainstream media isn’t going to happen.

Take your pick from those choices and add any other views you like.

Meanwhile, the already crippled housing market is sure to take another hit transaction-wise.

CPI Rises 0.2 Percent, Shelter Again Accounts for Most of the Increase

On August 10, I noted CPI Rises 0.2 Percent, Shelter Again Accounts for Most of the Increase

For the 18th straight month, the price of shelter has risen at least 0.4 percent. For a year, analysts have predicted not just a slowing pace of increases, but falling prices. They have been wrong.

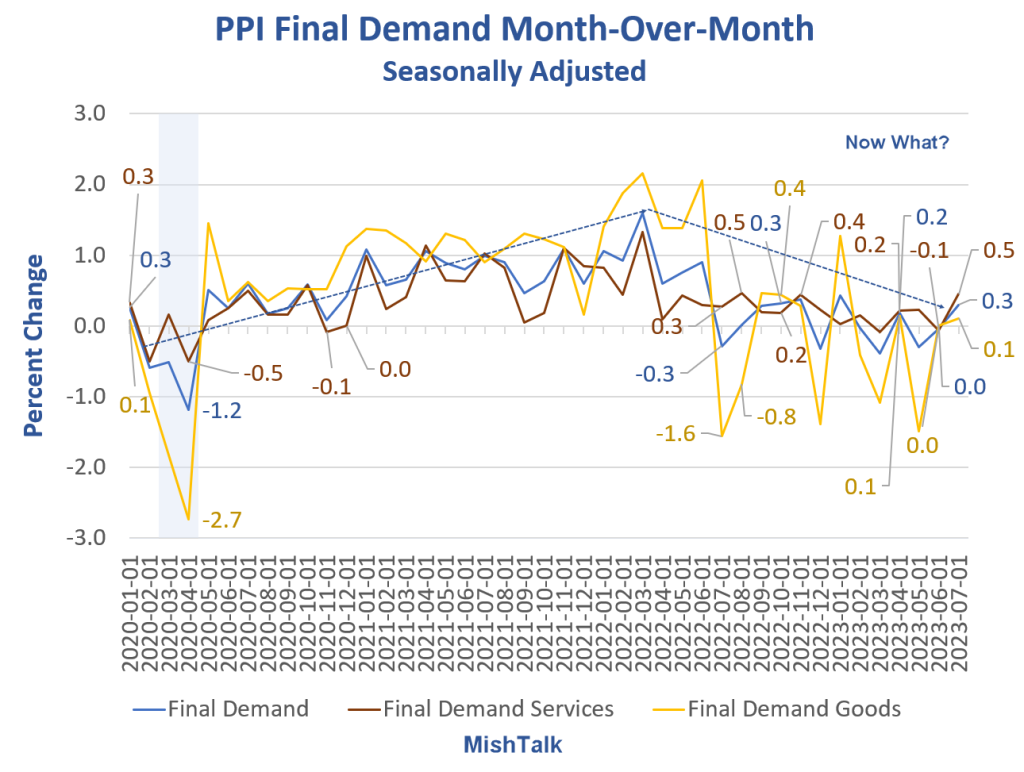

Producer Price Index Rises 0.3 Percent Led by a 0.5% jump in Services

On Friday, I noted Producer Price Index Rises 0.3 Percent Led by a 0.5% jump in Services

I think it was the PPI that spooked the bond market. The index for crude petroleum rose 8.4 percent in July.

That will spill over into gasoline prices. Unless the price of shelter stabilizes, the August CPI report is going to come in on the hot side.

Does Fed Policy Help?

It’s debatable if rate hikes will do much for shelter, at least the way the BLS and Fed view things, because home prices are not directly in the CPI.

Higher rates will slow the pace of new construction, and its finished construction that will add to supply and possibly pressure rent prices.

The price of a new leases are falling because of the added supply, but existing leases are stubborn. Meanwhile, landlords have every reason and incentive to keep hiking rents and have done so, despite reported claims to the contrary for months on end.

The supply of existing homes is extremely tight because people do not want to trade a a 3.0 percent mortgage for a 7.0 percent mortgage. And potentially millions of people want to buy a new home but cannot because they cannot afford these high interest payments.

The Fed created this housing mess by not factoring in home prices into its inflation model.

Like homeowners who want to move but can’t, the Fed is also trapped into a problem of its own making. The Fed wants to reduce demand, and has done so, but simultaneously, the Fed is reducing supply of new houses. The latter acts to firm rent prices.

[ad_2]

Source link