Not So Fast With The CPI Celebrations: Rents Are Surging Again And Back To Record Highs

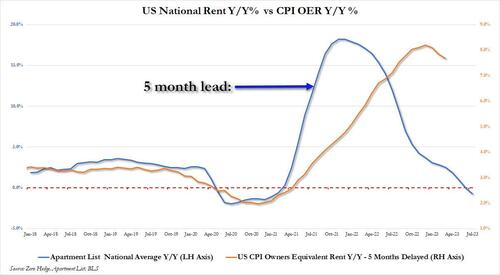

Last week’s CPI report was surprisingly dovish because, as we have discussed extensively in the past two years, rent inflation – which is the biggest variable in the CPI’s biggest category (shelter) – has turned, and is now decelerating sharply. Recall that it was two years ago when we first warned that contrary to CPI report’s subdued and badly lagging prints, rental inflation when observed using real-time indicators such as Apartment List, Zillow or Real Page – was soaring out of control…

a 5.5% print for OER? pic.twitter.com/r5xriFJfZl

— zerohedge (@zerohedge) August 29, 2021

… and would feed through into the inflation report in 9-12 months… which it did right on schedule, at which point the market freaked out earlier this year just as expected, even though as we showed half a year ago using real-time metrics, rent inflation had actually topped out in late 2022.

Rent inflation: OER vs actual asking rents pic.twitter.com/ngN0Fxtk1G

— zerohedge (@zerohedge) February 27, 2023

The good news is that as the CPI report continues to lag the actual economic data with its traditional 12-month lag, rents have continued to slide, and in fact the latest Apartment List data showed that the “rental market hit a big milestone this month, as national rent growth is finally negative year-over-year.”

This means that on average across the nation, apartments today are renting for less than they did one year ago. This marks a major deceleration from recent years, when annual rent growth neared 18% nationally and soared to over 40% in a handful of popular cities.

So far so good, and indeed many economists – even those who had never heard of real-time rent indices until a few months ago – declared victory and went so far as to pronounce inflation as “basically GONE” when one excludes lagging shelter/rent data.

Inflation is basically GONE when you exclude the lagged shelter (i.e. rent) data in CPI. Remember: Rent is the biggest variable in the CPI’s biggest category (shelter), and there’s a known 12-month lag between asking rents and CPI rents.

I’m surprised how little buzz there is… pic.twitter.com/XhxS49ZQtD

— Jay Parsons (@jayparsons) August 10, 2023

Unfortunately, there is one big snag with this analysis: it looks at the annual rate of change, not the actual current read of the index. What we mean by this is that while the annual rate of change – a favorite indicator of economists – indeed turned negative in July, the actual amount of dollars spent on rent has resumed rising again after bottoming in January and is now higher for six consecutive months…

… and at this rate, the pace of annual change will turn positive again in just 2-3 short months.

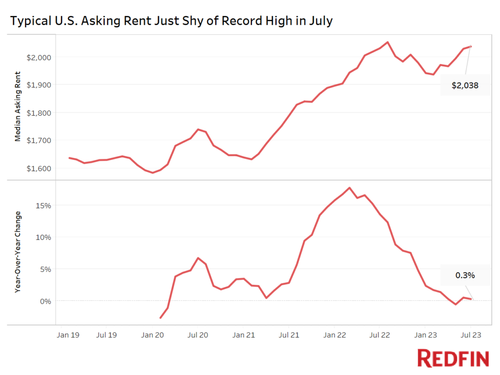

Or sooner than that, because while Apartment List’s rent index may itself be lagging the price data by a few months due to compilation and calculation delays, that of real estate brokerage RedFin appears to be even more accurate and “real-time”, and has found that after rising since the start of the year, the median US asking rent in July was $2,038, just $16 below the record high set in August 2022.

In other words, not only is the YoY rental print about to turn positive again, it will do so just as rents print a new all time high!

To be sure, there are some caveats: as RedFin notes, while rents are just shy of their all-time high, rent growth remains sluggish. The median asking rent was up just 0.3% from a year earlier in July, compared with a 13.6% annual gain in July 2022. Still, that’s with Fed Funds at 5.5%, 3x higher from the 1.75% last July. And yes, this surge in rates was supposed to crash the rental housing market… something it has clearly failed to do.

As RedFin notes, “Rent gains cooled over the past year due to an increase in supply, economic uncertainty and slowing household formation, but big bargains are still often hard to come by given rents are near record highs.”

“While rents are flattening out, it’s too early to say whether rent growth has bottomed,” said Redfin Deputy Chief Economist Taylor Marr. “A strong job market, cooling inflation and increasing consumer spending—which have decreased the likelihood of a recession—point to resilient renter demand. But there are still a lot of newly built apartments that have yet to hit the market, meaning rents may still have room to fall as landlords grapple with rising vacancies.”

Making the Fed’s life especially difficult, Marr explains that the median asking rent is near its record high “because the housing market tends to be “downside sticky,” meaning prices don’t typically fall substantially even when business is slow.” Instead of lowering rents, many landlords offer perks like a free month’s rent or discounted parking, which tend to be less detrimental to profits.

The good news for landlords is that the Fed is pretty much done hiking rates if the economist consensus is accurate; in fact, according to a Sunday note from Goldman, the Fed may start cutting as soon as Q2 2024, which means a renewed burst higher in rents… and everything else.

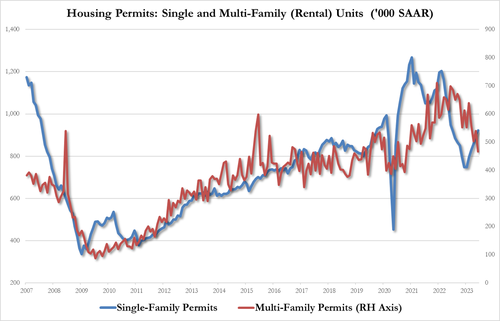

There is another challenge for those seeing a roof above their heads: over the past year, the number of options renters had to choose from had steadily climbed as completed residential projects in buildings with five or more units rose 26.3% year over year to 476,000 on a seasonally adjusted basis in June— the most recent month for which data is available — meaning landlords have more vacancies to fill and less leeway to raise prices.

But the homebuilding boom itself is now easing as the number of permitted residential projects in buildings with five or more units fell 33.4% year over year to 465,000 in June, the biggest drop since 2016. Permits, or approvals given by local jurisdictions to start construction projects, are a leading indicator of what’s happening in the housing market. Completions are a lagging indicator.

In other words, not only are surging commodities about to blow away hopes for moderation in headline CPI, but economists are once again dead wrong, and instead of looking at the moderation in YoY rents – which they correctly see as indicative of a slowdown in the CPI basket-heavy OER index – what they should be looking at is the real-time actual rental index, which has been rising for 6 months now and is about to take out all time highs at a time when the Fed is supposedly pausing its rate hikes and if anything, is already planning its next easing cycle.

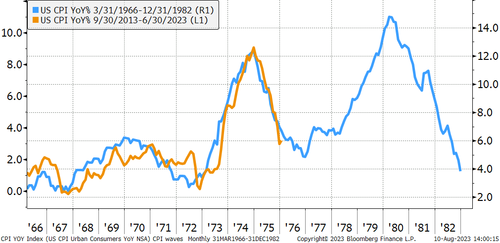

What happens next? The following chart from Schwab’s Jeffrey Kleintop tells you all you need to know.

Loading…

[ad_2]

Source link