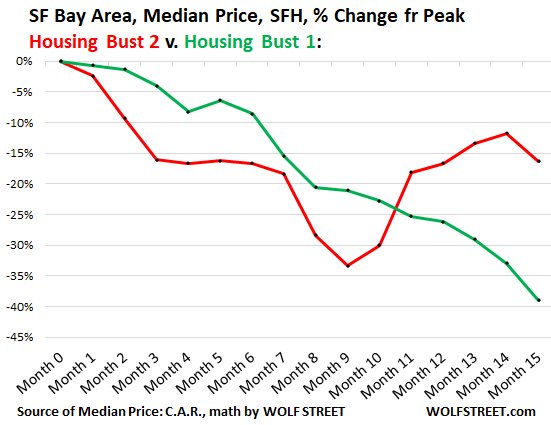

San Francisco House Prices Plunged Faster (-29%) in 16 Months of Housing Bust 2 than in the First 16 Months of Housing Bust 1

But the Bay Area cannot keep up with the spectacular collapse of prices during Housing Bust 1. That had been a doozie.

By Wolf Richter for WOLF STREET.

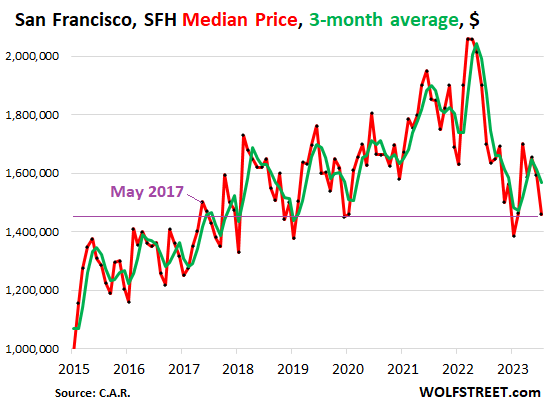

In San Francisco, the median price of single-family houses dropped by 8.5% in July from June, and by 14.1% from a year ago, to $1,460,000 million, according to the California Association of Realtors today.

In the 16 months since the peak in March 2022, the median price has plunged by 29%, or by $600,000 (red line).

The three-month moving average (3mma), which irons out some of the monthly ups-and-downs of median prices, fell by 2.6% in July from June and was down by 23.1%, or by $474,500, from its peak in May 2022 (green line).

Housing market downturns are slow-moving. Prices don’t plunge overnight, as you’ve come to expect from cryptos. Housing market downturns take years to play out. Housing Bust 1 started in different markets at different times. In San Francisco, the median price peaked in May 2007. Nearly five years later, in February 2012, it bottomed out, having dropped 31% from the peak.

Housing Bust 2 started after the peak in May 2022. May was month zero, and we’re now in month 16 of this downturn.

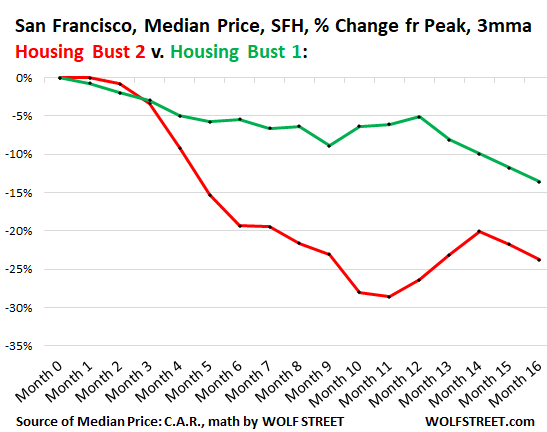

So we started comparing the Housing Bust 2 in San Francisco against Housing Bust 1, in terms of the percentage drop from the peak.

In 2007, the median price peaked in May; in 2022, it peaked in March. So we’re off by two months, which adds some seasonality to the mix. But we’re using the 3mma for both periods, which irons out some of the seasonality.

So we find:

- HB 2: In month 16, the median price 3mma was down 23.8% from peak

- HB 1: In month 16, the median price 3mma was down 13.6% from peak.

- Both experienced a sucker rally of three months that started in month 10 for HB 1 and in month 12 for HB 2, providing lots of false hopes.

- The rally was steeper in HB 2, after prices had dropped a lot faster.

- After three months, both rallies died and prices headed south, extinguishing the false hopes.

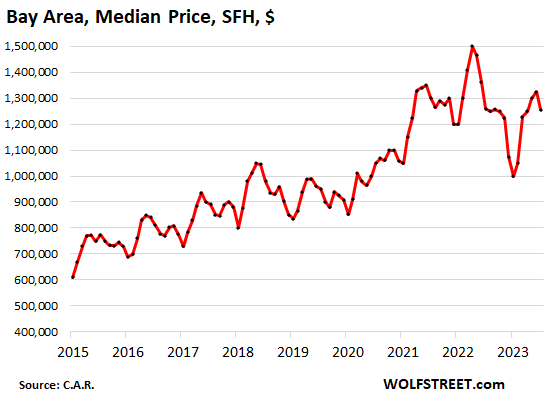

In the San Francisco Bay Area, the median price of single-family houses dropped by 5.2% in July from June, by 0.8% from a year ago, to $1,255,000, as the different counties moved to different drummers.

In the 15 months since the peak in April 2022, the median price has plunged by 16.3%, or by $245,000.

Given the large size of the nine-county Bay Area, with a population of around 7.6 million people and about ten times as many transactions as in San Francisco alone, the median price is less volatile. So the 3mma was not needed, and all comparisons here are between the unsmoothed original median prices.

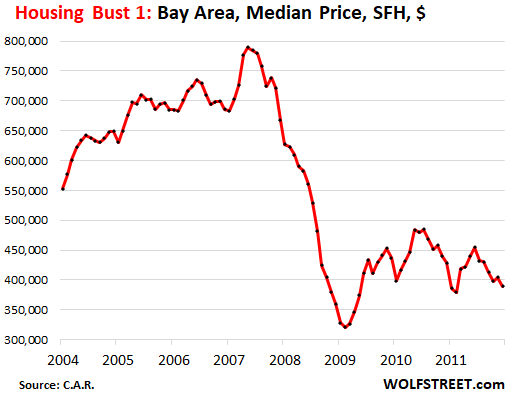

The Bay Area’s Housing Bust 1 was atypical in how fast it moved. April 2007 was the peak. By February 2009, in less than two years, it had plunged by 59%. It then rose and re-dropped a few times, and by January 2012, it was still down by 54% from May 2007. Then it took off again.

In the Bay Area’s Housing Bust 1, the median price plunged over the first 15 months by 40%. Prices just kept plunging without any kind of rally. That was very fast for housing downturns.

Housing Bust 2 started out plunging even faster, but then had this magnificent rally, perhaps driven by the magnificent Nasdaq rally, that has now also ended, and prices turned south again:

Look, the Bay Area, and particularly the most expensive counties, are a part of the US where “Housing Crisis” means homes are too expensive, even starter shacks are too expensive, for people to be able to afford to live here.

So there is constant political juggling over creating taxpayer-subsidized “affordable housing” and other subsidies. The problem simply is that homes are too expensive, and creating subsidies – whether subsidized housing or down-payment assistance, or whatever – isn’t going to help, and may make the pricing situation worse.

What is needed is for the market to sort out this “Housing Crisis.” The market needs to be allowed and encouraged to sort it out. That’s really the only way to solve the Housing Crisis.

The Fed’s interest rate repression and QE, which drove up all asset prices, did an amazing job in the SF Bay Area to create this Housing Crisis. Higher interest rates (we just discussed them, good lordy) and QT (the Fed has shed $759 billion in securities) should be allowed to undo that damage, with the market letting home prices find their balance to where people don’t have to leave – and they did leave in large numbers! – in order to dodge the ridiculous housing costs. The local economy would function a lot better if home prices are allowed to find an economically sustainable level.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link