Conference Board Confidence Plunged In August, Inflation Exp Ticks Up

After reaching two year highs in July, The Conference Board consumer confidence survey was expected to show a very modest decline in August. Instead it plunged from the best in two years to the weakest since May (July was revised down from 117 to 114 and then August printed 106.1, dramatically below the 116.0 exp).

The Present Situation plunged to its lowest since Dec 2022 and expectations tumbled…

Source: Bloomberg

“Consumer confidence fell in August 2023, erasing back-to-back increases in June and July,” said Dana Peterson, Chief Economist at The Conference Board.

“August’s disappointing headline number reflected dips in both the current conditions and expectations indexes.

Write-in responses showed that consumers were once again preoccupied with rising prices in general, and for groceries and gasoline in particular.

The pullback in consumer confidence was evident across all age groups—and most notable among consumers with household incomes of $100,000 or more, as well as those earning less than $50,000. Confidence held relatively steady for consumers with incomes between $50,000 and $99,999.”

“Expectations for the next six months tumbled back near the recession threshold of 80, reflecting less confidence about future business conditions, job availability, and incomes.

“Consumers may be hearing more bad news about corporate earnings, while job openings are narrowing, and interest rates continue to rise—making big-ticket items more expensive.

Notably, expectations for interest rates jumped in August after falling two months ago. Also, the outlook for stock prices fell and average 12-month inflation expectations ticked up.

The measure of expected family financial situation, six months hence (not included in the Expectations Index) softened further.”

Meanwhile, inflation expectations ticked up from Oct 2020 lows…

Source: Bloomberg

The Conference Board’s measure of labor market tightness worsened slightly last month (less jobs plentiful vs hard-to-get)…

Source: Bloomberg

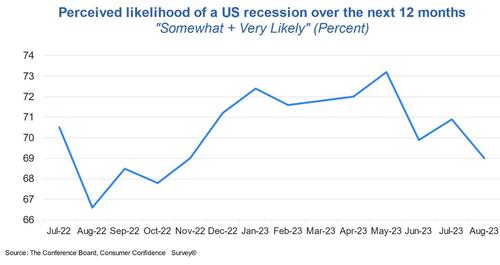

The proportion of consumers saying recession is ‘somewhat’ or ‘very likely’ ticked down again in August but remain elevated at 69.0%.

So a weaker stock market and stickier prices finally broke the optimism cycle? Or is this reflective of Americans hitting the credit wall together?

Loading…

[ad_2]

Source link