America’s debt problem is only getting bigger- Richard Mills – Ahead of the Herd

2023.08.30

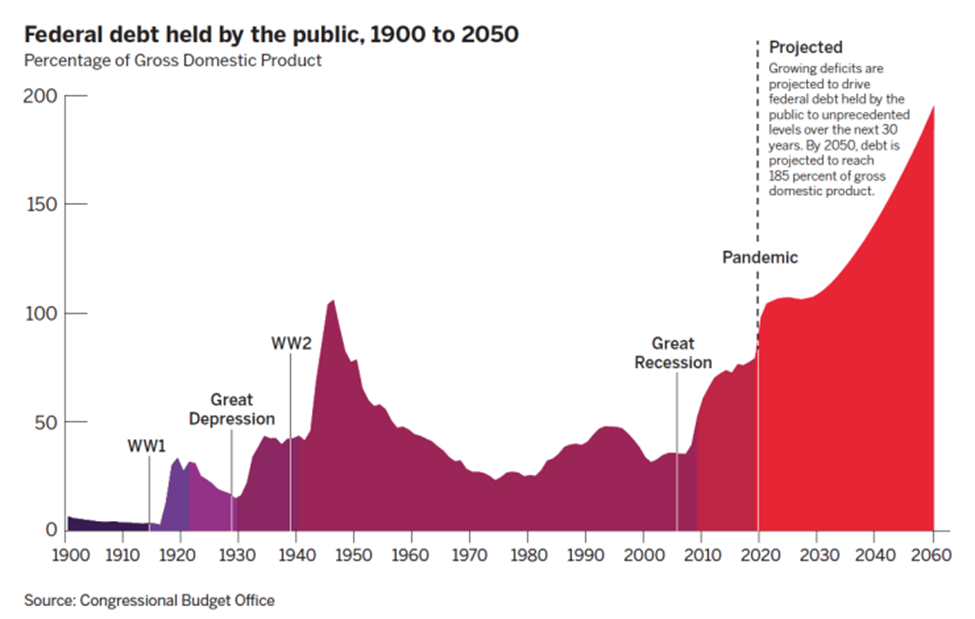

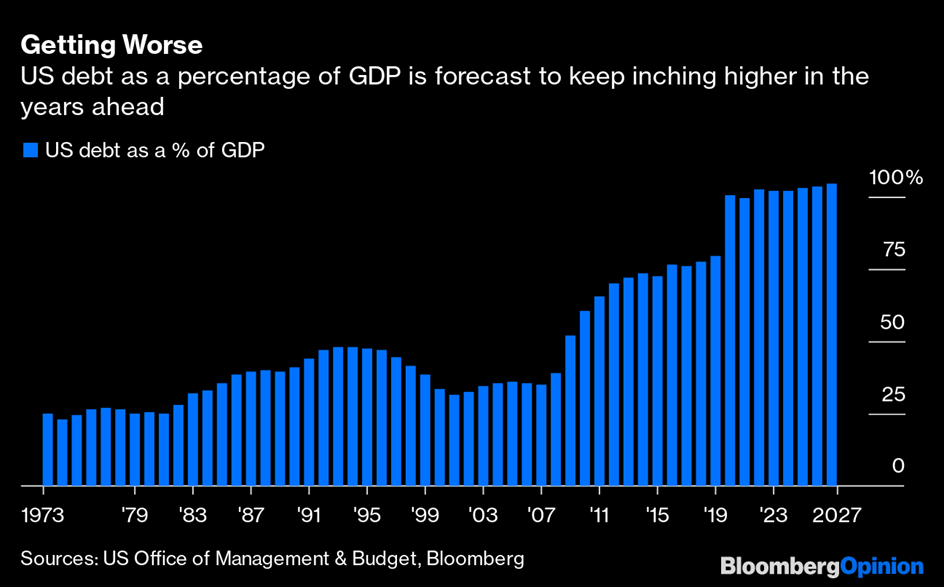

The US officially has a debt problem, in the present and in the future. As we speak, America’s gross national debt stands just below $33 trillion, or 122% of its GDP! The bigger problem, though, is the pace at which it’s doing so, leading to ballooning interest payments.

According to CBO’s projections, interest payments would total around $71 trillion over the next 30 years and would take up 35 percent of all federal revenues by 2053.

In June, the Congressional Budget Office (CBO) projected that annual net interest costs would total $663 billion in 2023 and almost double over the upcoming decade, soaring from $745 billion in 2024 to $1.4 trillion in 2033 and summing to $10.6 trillion over that period.

But if inflation is higher than CBO’s projections and if the Fed raises interest rates by larger amounts than the agency projected, such costs may rise even faster than anticipated.

According to CBO’s projections, interest payments would total around $71 trillion over the next 30 years and would take up 35 percent of all federal revenues by 2053. Interest costs would also become the largest “program” over the next few decades, it predicted.

Fast-Rising US Debt

Over the past decade, US national debt has nearly doubled, including a three-year period between 2020-2023 during which federal spending amounted to a jaw-dropping $28 trillion.

Then in June, a bipartisan agreement to suspend the debt ceiling was reached, which essentially gave the US government a free rein on its spending. Weeks after that, its debt, to no one’s surprise, crossed the newly extended $31.4 trillion ceiling and reached the $32 trillion mark for the first time.

This $32 trillion figure, in the views of analysts, arrived much sooner — nine years to be exact — than they had projected prior to the Covid pandemic, according to a piece by Alan Rappeport of the NY Times.

But now, the US national debt is on track to top $50 trillion by the end of the decade, even after some of the newly passed spending cuts in the debt ceiling deal have been taken into account. Even this projection seems conservative still, given its debt has already risen by over $1 trillion in the two months since that agreement.

The Congressional Budget Office (CBO) projects that the US government will run trillion-dollar deficits over the next 10 years, resulting in a cumulative deficit of $20.3 trillion between 2024 and 2033.

“We were fortunate to avoid a default under the debt ceiling, but the broader problem is that we keep ignoring the growing debt itself. As we race past $32 trillion with no end in sight, it’s well past time to address the fundamental drivers of our debt, which are mandatory spending growth and the lack of sufficient revenues to fund it,” said Michael Peterson of the Peter G. Peterson Foundation, a nonpartisan organization that advocates for deficit reduction.

In his commentary published on the foundation’s website, Peterson expressed concerns about projections that show the US adding $127 trillion in debt over the next 30 years. “By 2053, nearly 40% of all federal revenues will be spent on interest alone — an unthinkable burden for us to place on future generations,” he added.

Of course, the alarm bells surrounding the US debt situation are almost ubiquitous across market commentaries. Lawrence McDonald, founder and editor of The Bear Traps Report, wrote in a recent blog that fiscal spending, especially since the pandemic, has created a “mind-blowing hole” in the nation’s finances.

“The US government has already spent $5.3 TRILLION this year. We are on track for the 4th consecutive year with $6 trillion or more in government spending. Since 2020, the US government has spent a jaw-dropping $25 TRILLION. To put this in perspective, the market cap of the S&P 500 is $37 trillion. Spending since 2020 is equivalent to 68% of the entire S&P 500 market cap,” he wrote.

Similar concerns are shared by billionaire investor Ray Dalio, who warned in June that the US is at the start of a “classic late, big cycle debt crisis” characterized by the nation facing a shortage of buyers for its bills and bonds, as well as veteran economist Nouriel Roubini, who is predicting a severe recession ahead on the potential debt defaults.

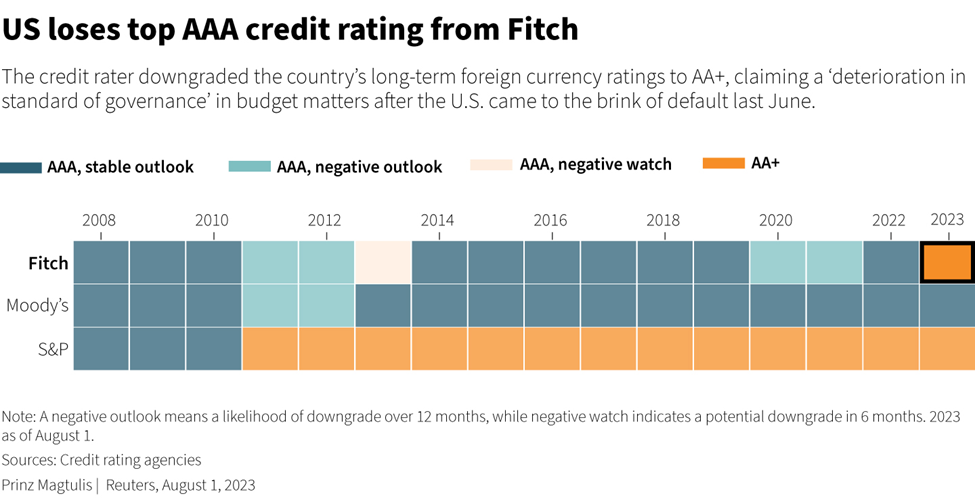

Credit Rating Downgrade

One implication of America’s fast-rising national debt is how it would impact its financial condition in the eyes of investors. Earlier this month, we got an answer from Fitch, which downgraded its US credit rating from the top level of AAA to a lower level at AA+.

The ratings agency, one of the three biggest in the world, cited its decision to the “steady deterioration” in US governance over the last 20 years. Fitch, like many others, also said it expects the US to slip into a mild recession later this year.

With the downgrade, Fitch now becomes the second major rating agency to strip the US of its triple-A rating after Standard & Poor’s, which did that back in 2011, also after a debt ceiling deal.

Fitch had first flagged the possibility of a downgrade in May, then maintained that position in June after the debt ceiling crisis was resolved.

“The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to peers,” Fitch said in its statement.

US Treasury Secretary Janet Yellen, however, called the downgrade “arbitrary”, stating that it was based on outdated data between 2018 and 2020. Former US Treasury Secretary Larry Summers, via his Twitter account, also called Fitch’s decision “bizarre and inept”, particularly as the US economy “looks stronger than expected.” The White House, too, disagreed with the decision.

Alec Phillips, the chief US political economist at Wall Street bank Goldman Sachs, told BBC that: “The downgrade mainly reflects governance and medium-term fiscal challenges, but does not reflect new fiscal information.”

Regardless, the downgrade has placed a stain on America’s reputation and accentuated its fiscal problems. “This basically tells you the US government’s spending is a problem,” said Steven Ricchiuto, US chief economist at Mizuho Securities USA, in a Reuters interview.

This is an important development, because investors use credit ratings to assess the risk profile of a government when it raises financing in debt capital markets. The lower a borrower’s rating, the higher its financing costs. A downgrade therefore would make US bonds less attractive (or more risky) to investors.

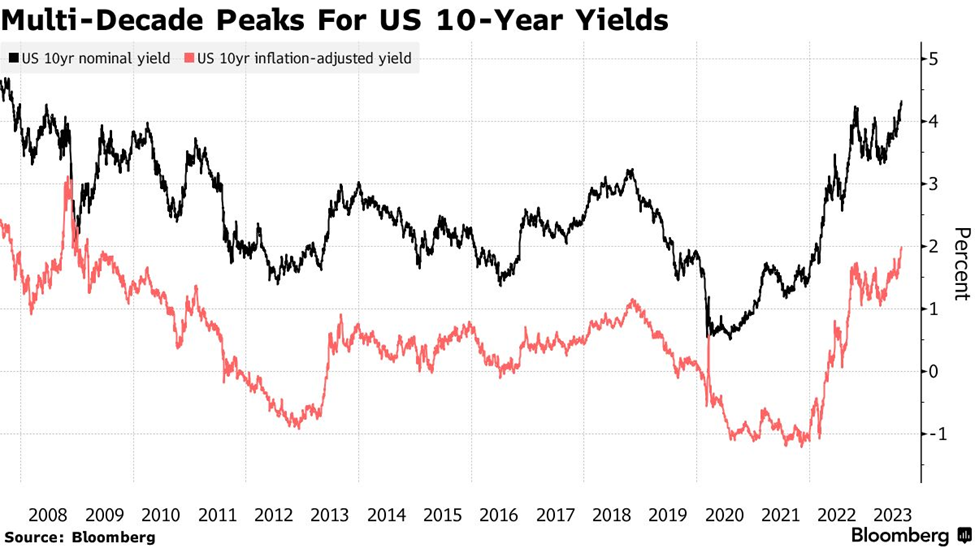

Understandably, right after the credit downgrade, 10-year Treasury yields jumped 11 basis points to nearly 4.2%, as investors sought higher compensation for the risk of holding long-term US government debt. Two-year yields are also rising, now at the highest since March.

What’s Next For Interest Rates

Rising Treasury yields are also a reflection of the higher borrowing cost of borrowing (i.e. interest rates) throughout the US economy. Sure, as the US government continues this pace of spending, it’s likely that higher rates will be needed.

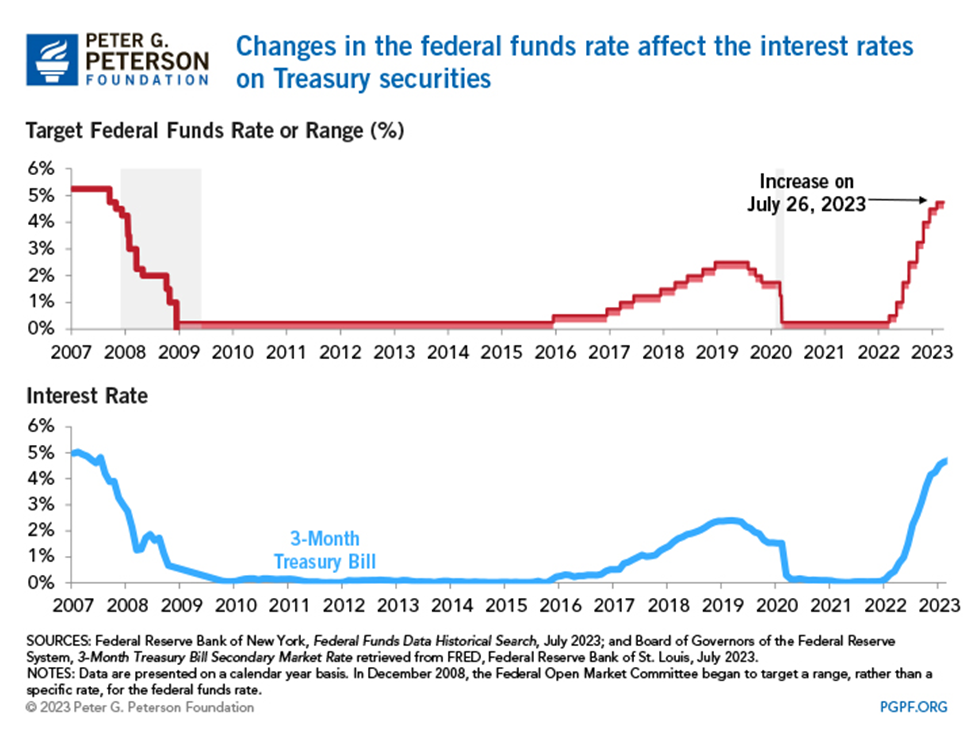

But the US Federal Reserve has also played its part by engineering interest rate hikes to achieve its main goal of controlling inflation, which had been running near 40-year highs.

Even before the credit downgrade, 10-year yields have been on the rise since a series of 11 interest rate hikes by the US central bank, starting in March of 2022.

With the inflation rate now slowly coming down at about 3%, what the Fed does for the rest of its monetary tightening cycle is of great interest. Since its last hike, chairman Jerome Powell on many occasions has sung a “hawkish” tone.

Perhaps this week’s Jackson Hole Economic Symposium in Wyoming brought a bit more clarity (or not) on the Fed’s intentions, as Powell, like he did in the same conference last year, left the door open for a further rate increase, citing that “inflation is still above where policymakers feel comfortable.”

“Although inflation has moved down from its peak — a welcome development — it remains too high,” Powell said in his speech on Friday, August 25. “We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

The key takeaway here is that the Fed chair remains cautious of declaring a victory in the fight against inflation, even when significant strides have been made in the past year. For now, it seems as though the Fed would prefer to keep rates higher for longer.

According to CNBC, markets of late have been pricing in little chance of another hike at the September meeting of the Federal Open Market Committee, but are pointing to about a 50/50 chance of a final increase at the November session. CME’s prediction algorithm has the odds of another quarter-point rate hike at the Fed’s next meeting at 13.5%, down from 17.5% prior to Powell’s remarks.

Currently, the Fed’s key interest rate is within a range of 5.25%-5.5%, the highest level in more than 22 years.

Powell, on his end, is not committing to any Fed actions. “Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment,” he said. “Doing too much could also do unnecessary harm to the economy.”

For those anticipating a pivot by the Fed, they would need to wait a little longer, at least when economic growth slows down, just enough to tilt the balance away from inflation swelling again.

“The basic thought that they’re close to done, they think they probably have a little bit more to do … that is the story they’ve been telling for a little while. And that was the heart of what he said today,” Bill English, a former Fed official and now a Yale finance professor, told CNBC.

“I don’t think this is about sending a signal. I think this is really where they think they are,” he added. “The economy has slowed some but not enough yet to make them confident inflation is going to come down.”

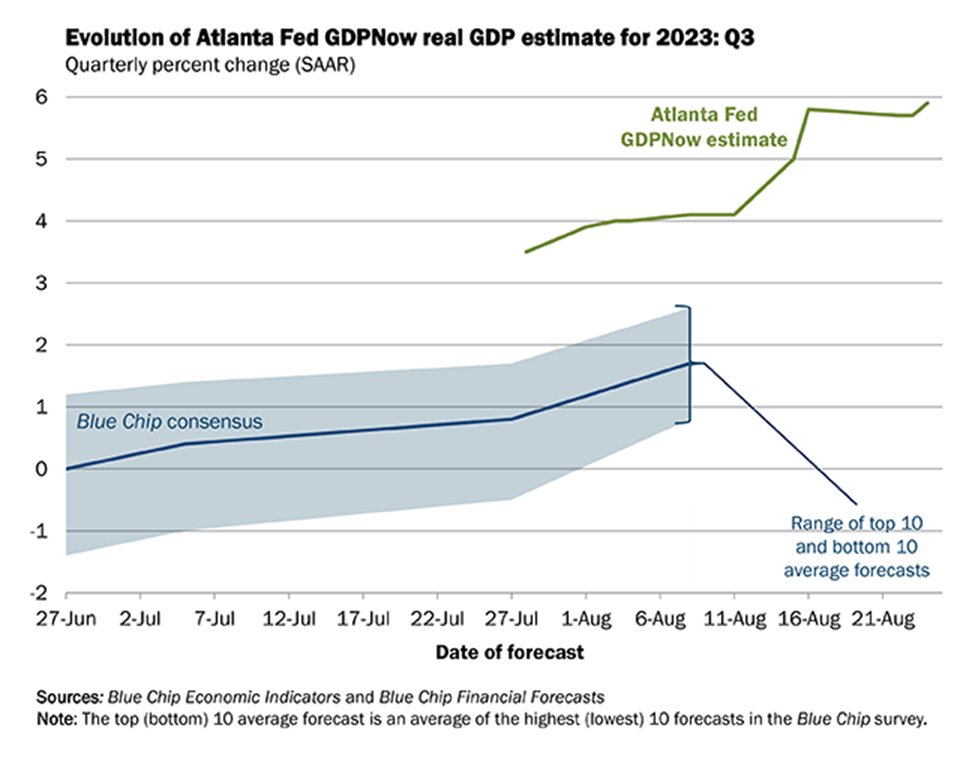

US gross domestic product has been increasing steadily since the rate hikes began, and there are indications that the economy is actually starting to heat up. Employment, for example, remains strong as ever, with the jobless rate hovering around lows last seen in the late 1960s.

According to the Atlanta Fed, the third quarter of 2023 is tracking at a 5.9% growth pace, which would present as a shock to many (see below). Even if the figure is a bit exaggerated, the Atlanta Fed’s forecast is almost always directionally correct.

So the Fed’s worries aren’t unfounded; inflation could well become a long-lasting problem if the right actions aren’t taken, or taken at the wrong time. As Powell noted in his speech, the previous tightening moves “likely haven’t made their way through the system yet,” providing further caution for future policy.

Can High Rates Be Sustained

In the short term, Wall Street is still convinced that the Fed will need to keep rates higher than expected given the recent economic performance. But over a longer horizon, there’s a debate to be had on whether high rates can be sustained, especially if the fiscal spending problem gets worse.

One former Fed official argued that in the long run America may require higher rates to balance the need for more borrowing (implied by higher government deficits).

However, it would also make perfect sense for the Fed to hold rates low, because, according to former US presidential candidate Ron Paul, that’s exactly what the government is counting on to keep up its spending, because spending limits aren’t ever going to work.

In an article published on August 21, he wrote: “One reason Yellen and others may be so blasé about the federal debt is that they believe the Federal Reserve will bail the government out by holding interest rates low enough to keep the federal government’s interest payments to manageable levels This is why, even though the Fed has been raising interest rates, the rates remain well below what they would likely be in a free market.”

“However, the Fed knows it cannot go back to keeping rates at or below zero without causing price inflation .. Therefore the Fed will likely continue to raise rates for the next several months.”

In 2024, Paul believes the Fed will likely pause its rate increase in the hope of boosting economic activity to help President Biden’s reelection campaign. But after that, it would have to find a way to keep both rates and inflation low enough to satisfy everybody.

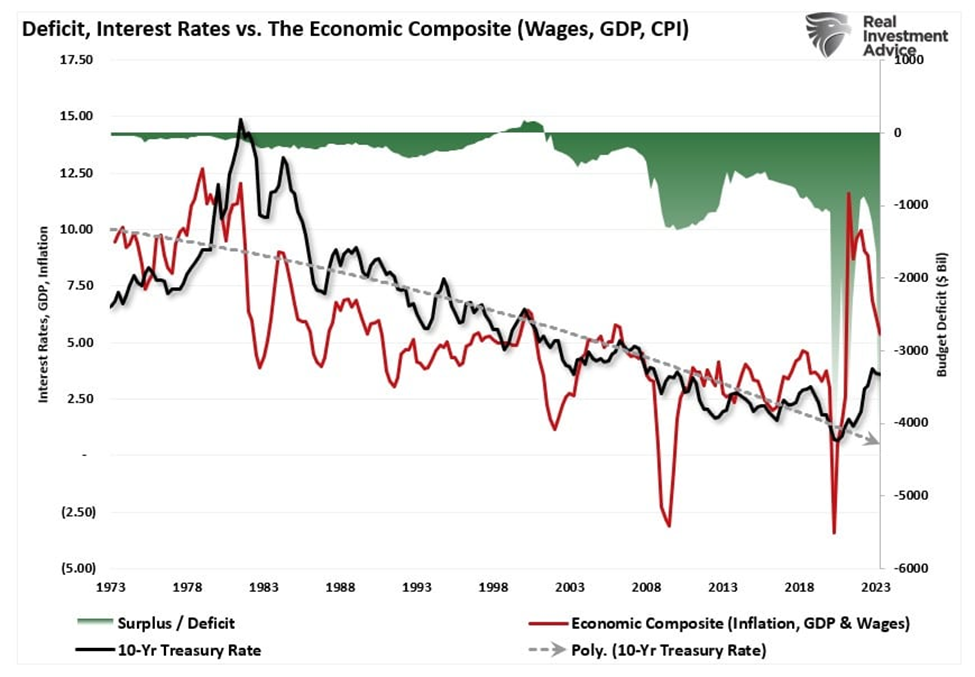

Lance Roberts, chief portfolio strategist/economist for RIA Advisors, also sees Fed lowering rates due to the “inability of the economy to sustain higher rates due to mounting debt issuance and rising deficits.”

According to Roberts, the claim that more debt and more significant deficits will lead to higher interest rates isn’t always correct. In fact, since 1980, such has not been the case (see graph below).

He also brings up the idea that interest rates are relative globally, so higher yields in US debt would attract flows of capital from countries with low to negative yields, which then pushes US rates down.

“Central banks will continue to buy bonds to maintain the current status quo but will become more aggressive buyers during the next recession. The next QE (quantitative easing) program by the Fed to offset the next economic downturn will likely be $4 trillion or more, pushing the 10-year yield toward zero,” he wrote.

Furthermore, it’s actually possible for the Fed to suppress interest rates and to sustain weak economic growth, Roberts says, as non-productive debt (i.e. military spending, welfare programs) does not create economic growth.

He points out that since 1977, the 10-year average GDP growth rate has steadily declined as debt increased. Thus, using the historical growth trend of GDP, the increase in debt will lead to slower economic growth rates in the future.

Conclusion

In any event, the surging US debt is going to have its ripple effects. As some suggest, it could keep interests higher, but that means the government needs to keep borrowing more; it would also drive down the profit margins for corporations, cause decline in the housing and stock markets, leading us down towards the road of recession.

The biggest victims would be the consumers. Laura Veldcamp, a professor of economics at the Columbia University Graduate School of Business, told Forbes that the growing debt burden is going to cost more for the US government to service its debt, and at some point, somebody is going to have to pay higher taxes.

Talks of Fed pulling off a fabled “soft landing” still premature

But if the Fed has to lower rates to accommodate more US government spending, and thus deficits, that would mean excessive economic growth — and it’s already showing signs — and more inflation. That scenario would align more with a “no landing” instead of a “soft landing”; that isn’t exactly what the Fed had aimed for.

One other issue addressed by Powell at this year’s Jackson Hole summit was debate over what is happening with the longer-run, or natural, rate of interest that is neither restrictive nor stimulative, also known as R*. The R* is seen as the theoretical level at which the Fed uses as a reference point for its benchmark rate when it wants to contain inflation.

Discussions around R* is complex. As Powell stated: “We cannot identify with certainty the neutral rate of interest, and thus there is always uncertainty about the precise level of monetary policy restraint.”

According to the Financial Review, “any hint at an upward revision would likely ripple across global markets.” An added complication is that the level of rates that are best for an economy may not be the best for markets, risking disruptions in the financial system.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

[ad_2]

Source link