Gold’s Resilience Gives Out Recessionary Vibes

Authored by Simon White, Bloomberg macro strategist,

Gold is typically one of the best performing assets in recessions. Its recent resilience in the face of rising real rates is another sign – along with deteriorating economic data – that recession risks are rising.

I’m always a bit skeptical of certain markets having a supposed sixth sense about what the future holds. Gold is often believed to have such clairvoyance when it comes to rising inflation or impending market dislocations. While no man, woman or metal has a crystal ball, it would nonetheless be remiss to dismiss out of hand what gold may be saying, especially if it is consistent with other data points.

Gold has had plenty of excuses to weaken in recent weeks as US real yields rose to GFC highs. But instead it has been one of the strongest performing commodities over the last six months (silver even more so), and has also been rising over the last few weeks.

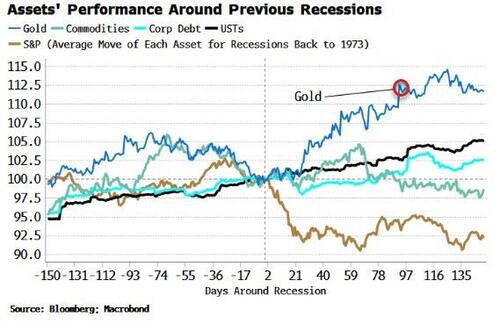

Looking at previous recessions, gold typically performs the best out of the major asset classes (stocks, bonds, corporate debt and commodities).

We can also see from the chart that stocks fare the worst out of the assets shown, rallying before the recession begins, before the penny drops and the market sells off.

There’s a big but, though, as the next recession is likely to be accompanied by elevated inflation.

The chart above fits probably what most people would expect to happen in a recession, i.e. stocks sell off and bonds rally.

However, in an inflationary recession it’s real returns that matter, not nominal ones. In such downturns, money illusion means stocks typically fare ok in nominal terms, but they suffer big losses in real terms. Similarly bonds rally in nominal terms, but in real terms they lose value. Commodities rally in both real and nominal terms.

Even if gold is not signalling a recession, one is still likely on the cards, and as it’s primed to be different from more recent downturns, it makes sense to know how and be ready for it.

Loading…

[ad_2]

Source link