Asia Gold-China premiums surge on strong buying; India discounts widen

By Deep Kaushik Vakil, Rajendra Jadhav

*

China premiums jump to $90-$135/oz this week

*

India discounts highest since second week of May

*

Gold buying in Japan steady despite record domestic rates

Sept 15 (Reuters) –

China’s physical gold premiums soared to a new high this week, amid strong demand to shore up a depreciating yuan and a lack of fresh import quotas, while discounts widened to a four-month high in India.

“This reflects Beijing’s escalating efforts to safeguard the currency,” said Bernard Sin, regional director, Greater China at MKS PAMP, adding premiums could also reach an unprecedented peak of $200.

Chinese dealers sold gold at premiums between $90 and $135 an ounce XAU-CN-PREM over global spot prices, compared to $55 last week.

“It appears that no new import quotas have been released, which ties in the with currency operations,” StoneX analyst Rhona O’Connell said.

The People’s Bank of China boosted liquidity using medium-term policy tools, as a weakening Chinese yuan constrained its efforts to aggressively lower interest rates.

“While the rise had more to do with a supply squeeze caused by the government’s import restrictions, strong physical buying should keep the premium high into the fourth quarter,” analysts at ANZ said.

Meanwhile, dealers in India were offering a discount XAU-IN-PREM of up to $8 an ounce this week over official domestic prices — inclusive of 15% import and 3% sales levies, versus discounts of $5 last week.

Local gold prices were trading around 58,700 rupees per 10 grams on Friday, down nearly 2% in a fortnight.

“In the market, sentiments are weak, with buyers lacking confidence in the price direction. Some believe the price could fall further,” said a Mumbai-based dealer with a private bullion importing bank.

In Hong Kong, bullion was sold at premiums of $1.50-$4.50 XAU-HK-PREM and premiums between $2 and $3 were charged in Singapore. XAU-SG-PREM

With domestic gold rates in Japan still near record highs this week, dealers sold gold at par to $0.5 premiums. XAU-TK-PREM

“Beyond my imagination, the people are buying at this record high price level,” said Kazuko Shimano, manager at Tanaka Precious Metals in Tokyo. (Reporting by Deep Vakil and Brijesh Patel in Bengaluru, and Rajendra Jadhav in Mumbai; Editing by Varun H K)

[ad_2]

Source link

Related Posts

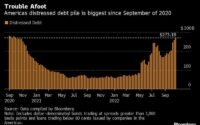

A Shocked Wall Street Reacts To Today’s “Scary” CPI Print

U.S. delays ICBM test-launch in bid to de-escalate Russia nuclear tensions