Services Surveys Confirm Stagflation Scare: Growth Slows, Prices Re-Accelerate

Despite the plunge in ‘hard’ data in September, the Manufacturing PMI rose to six-month highs (but still sub-50). However, more notably, the Services PMI tumbled to 50.1 (barely in expansion), its lowest level since January.

Source: Bloomberg

ISM Services – for once – agreed with PMI Services, sliding to 53.6…

Source: Bloomberg

…with new orders plunging and employment tumbling and prices sticky…

Source: Bloomberg

As the PMI survey noted, In line with another substantial uptick in cost burdens, service providers hiked their selling prices in September.

The pace of charge inflation accelerated to the fastest since July as firms sought to pass through greater costs to customers.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“The final PMI data for September add to indications that the US economy has started to cool again after a resurgence of growth earlier in the summer. Inflationary pressures in the service sector meanwhile remain uncomfortably sticky.

“The biggest change in recent months has been the waning in demand for consumer services, such as travel, tourism and recreation, along with a slump in financial services activity.

“Providers of consumer-oriented services report that a revival of demand in the spring has gradually lost momentum amid the ratcheting up of interest rates and increased cost of living at a time of diminishing savings. In the financial services sector, financial conditions are tightening and uncertainty about the outlook is subduing confidence. Both sectors are now reporting falling activity levels, taking away a major source of support to the wider economy’s expansion.

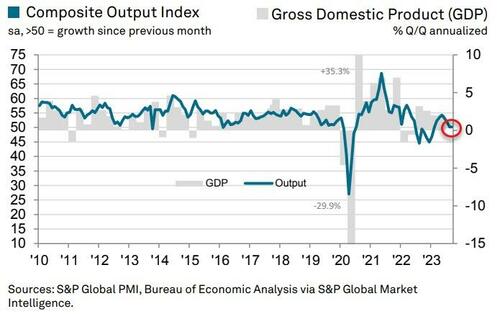

Finally, the economy therefore looks to be moving into the fourth quarter on a weak footing, hinting at slower GDP growth as we head toward the end of the year…

And just to rub some more salt into the wound – prices are rising…

“Average prices charged for goods and services meanwhile continue to rise at a rate well above the pre-pandemic average, with service sector charge inflation remaining especially stubborn, in part due to recent oil price hikes.”

So – growth slowing and prices rising – we love the smell of stagflation in the morning.

Loading…

[ad_2]

Source link