A major Wall Street bank is warning about the risk that inflation expectations could become unanchored in a fashion similar to the 1970s stagflation era.

Weekend attacks on Israel by Hamas illustrate how geopolitical risks can suddenly return — adding to the surprise shocks of the current decade, such as the COVID-19 pandemic and Russia’s invasion of Ukraine, said macro strategist Henry Allen and research analyst Cassidy Ainsworth-Grace of Frankfurt-based Deutsche Bank

DB,

Read: Questions emerge over how Israeli intelligence missed Hamas attack

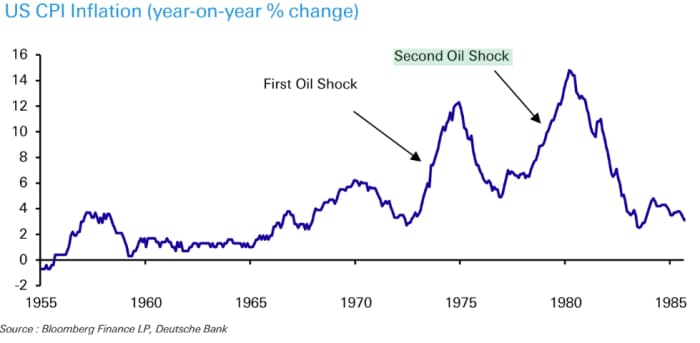

Oil prices settled more than 4% higher on Monday as traders weighed the impact of the war in the Middle East on crude supplies. The spike in energy prices is adding to the growing list of similarities to the 1970s era — which also includes consistently above-target inflation across major economies and repeated optimism about how quickly it would fall; strikes by workers; and even increasing chances that this winter will be dominated by the El Niño weather pattern, similar to what took place in 1971 and which is historically tied to higher commodity prices, according to Deutsche Bank.

Inflation remains above central banks’ targets in every G-7 country — the U.S., Canada, France, Germany, Italy, Japan, and the United Kingdom. How long it will remain high is one of the most important questions facing financial markets, and a destabilization of expectations would make it even harder for policy makers to restore price stability.

“So given inflation is still above its pre-pandemic levels, it is important not to get complacent about its path,” Allen and Ainsworth-Grace wrote in a note released on Monday. “After all, if there is another shock and inflation remains above target into a third or even a fourth year, it is increasingly difficult to imagine that long-term expectations will repeatedly stay lower than actual inflation.”

History indicates that the last mile of inflation is often the hardest. One of the key lessons of the 1970s was that inflation failed to return to previous levels after the first oil shock of 1973 and U.S. recession of 1973-1975, and went even higher following a second oil shock in 1979. Now that inflation has been above target for the last two years, “a fresh inflationary spike could well lead expectations to become unanchored,” according to the Deutsche Bank note.

Source: Bloomberg, Deutsche Bank

For now, the public’s inflation expectations, as measured by a New York Fed survey of consumers in August, remain largely stable, though still above the Federal Reserve’s 2% target.

The current period differs from the 1970s era in a number of ways, the Deutsche Bank team also points out. Long-term inflation expectations remain “impressively” well-anchored, commodity prices have fallen substantially from their peaks over the past 12 to 18 months, and supply-chain disruptions that emerged during the pandemic have “broadly healed.” In addition, the U.S. is less energy intensive than in the past and less susceptible to damage from a 1970s-style energy shock.

Even so, “it is vitally important to avoid complacency,” Allen and Ainsworth-Grace wrote. “Indeed, with the benefit of hindsight, one of the mistakes of the 1970s was that policy was eased up too early, which contributed to a resurgence in inflation.”

Risk-off sentiment prevailed in financial markets during the early part of Monday, before stocks turned higher during the New York afternoon. All three major U.S. stock indexes

DJIA

SPX

COMP

finished higher in a volatile session. Trading in U.S. government-debt futures reflected greater demand and gold rallied as a flight to safety took hold. The cash market for Treasurys was closed for Columbus Day and Indigenous Peoples Day.