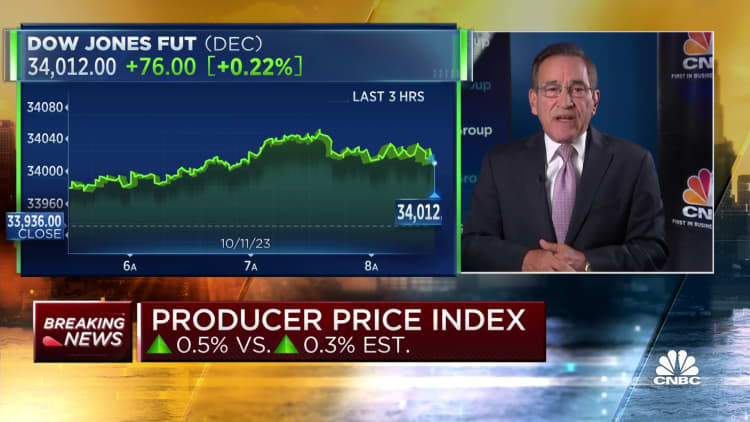

PPI September2023: Wholesale inflation rose 0.5%

A measure of wholesale prices rose more than expected in September, indicating simmering inflation pressures for the U.S. economy.

The producer price index, which measures costs for finished goods that producers pay, increased 0.5% for the month, against the Dow Jones estimate for a 0.3% rise, the Labor Department reported Wednesday. That was less than the 0.7% increase in August.

Excluding food and energy, the core PPI was up 0.3%, versus the forecast for 0.2%. Excluding food, energy and trade services, the index rose 0.2%, in line with the estimate.

Markets showed only a mild reaction to the PPI release, with stock futures off slightly and Treasury yields off their lows though still negative on most longer-duration issues.

Inflation pressures came primarily from final demand goods, which surged 0.9% on the month, while services increased 0.3%.

Much of the goods prices increase came from gasoline, which jumped 5.4%, while food prices posted a 0.9% gain. Energy prices broadly rose 3.3%. Core goods, stripping out food and energy, increased just 0.1%, a reflection of normalized supply chains.

On the services side, prices for final demand services less trade, transportation and warehousing rose 0.3%, while final demand trade services costs increased 0.5%. Also in the services category, the costs for deposit services at commercial banks surged 13.9%.

On a year-over-year basis, the headline PPI increased 2.2%, the largest move since April. The 12-month pace had slowed to as low as 0.2% in June but has been on the rise since.

The report “suggests we haven’t seen the end of sticky inflation — and high interest rates,” said Mike Loewengart, head of model portfolio construction for Morgan Stanley’s Global Investment Office. “Either way, investors will need to remain patient. Lowering inflation significantly from last year’s highs was one challenge, getting it down to the Fed’s 2% target level is another.”

Markets look at the PPI as a leading indicator for inflation, as it gauges a wide variety of costs for pipeline goods that feed to consumer products. On Thursday, the Labor Department will release its more closely watched consumer price index, which is expected to show a slight easing in the pace of inflation.

Both reports feed into policy decisions from the Federal Reserve, which has been raising interest rates aggressively in an effort to stem inflation.

In recent days, central bank officials have indicated that they may not need to enact additional hikes as Treasury yields have risen sharply on their own, tightening financial conditions. That in turn has helped assuage market fears, leading stocks higher this week.

The Fed targets 2% annual inflation but doesn’t expect to get there for several years. Market pricing indicates the central bank is likely done raising rates in this cycle, even though officials have one more increase penciled in before the end of the year.

[ad_2]

Source link