Friday the 13th: Terror on Wall Street

As October’s chill settled in, Friday the 13th loomed ominously…

But on October 13, 1989, it wasn’t just superstitions and ghost stories sending shivers down spines — it was a financial nightmare unfolding on Wall Street.

The Dow Jones took a harrowing dive, marking its second-largest one-day drop in history up to that point. Yet, amidst the turmoil, one asset stood resilient, shining as a beacon of stability.

But before we delve into that, let’s catch up on today’s news…

CPI Report Shows Inflation Rose More than Expected — The Consumer Price Index rose 3.7% for the 12 months ended in September, slightly above the market expectation of 3.6%. While inflation is far lower than a year ago, it is still proving difficult to tame.

Israel Is at War With Hamas — It’s been one week since the surprise Hamas attack that started a war in Israel. Gold often acts as a hedge against geopolitical turmoil. Since the war began, gold is up over 3% and silver is up nearly 5%.

The United States Owes Nearly $100K per Citizen — According to USdebtclock.org, the U.S. national debt is now over $33.5 trillion, which comes out to $99,847 per citizen and $258,000 per taxpayer. Not only that…

The U.S. Has $194 TRILLION in Unfunded Liabilities — Beyond just Social Security and Medicare, the total financial burden in the U.S. is hard to comprehend. Broken down, it equals an astonishing $578,000 liability for every U.S. citizen.

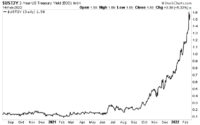

Rising Bond Yields Mean the Debt Crisis Is Getting Real — U.S. Treasury bond yields are reaching heights unseen in years, with the 10-year Treasury bond approaching a 5% yield. Why is this significant? “We took out a mortgage thinking we’d be paying 2%, but now we’re paying 5%,” Marc Goldwein, director of policy at the Committee for a Responsible Federal Budget wrote on X, formerly Twitter.

World Gold Council Releases Q4 Gold Commentary — With bond yields continuing to move higher alongside a still buoyant US economy, the World Gold Council reports that gold is likely to face continued turbulence over the next few weeks.

Friday the 13th – Terror on Wall Street

It was the late eighties and Friday the 13th was fast approaching – however, instead of the typical spooky tales of ghosts and goblins, October 13, 1989, brought a different kind of terror to Wall Street.

Seemingly out of nowhere, the Dow Jones Industrial Average (DJIA) dropped a chilling 6.91% – which was the second-largest one-day percentage drop (at the time) in market history. This day became known by some as “Black Friday” around the stock market.

So, what spooked the market?

The crash was triggered by the collapse of a $6.75 billion leveraged buyout deal for UAL Corporation, the parent company of United Airlines. When this deal unraveled, it sent shockwaves through the financial world, leading to a massive collapse of the junk bond market.

In the simplest terms, junk bonds are high-risk, high-reward bonds. Throughout the 1980s, the market for these bonds exploded, growing from $10 billion in 1979 to a whopping $189 billion by 1989, an increase of 34% annually.

Initially, junk bonds were tied to companies that once had solid reputations but had hit hard times, causing their credit ratings to drop. But by the 1980s, these bonds weren’t just for struggling companies. They became popular tools for big financial moves like leveraged buyouts and mergers.

This trend snowballed, and soon, many businesses were using junk bonds for various financial needs. But as with any trend that grows too big too fast, it became a bubble. And on that fateful Friday, the bubble burst.

What Happened to Gold in the Aftermath?

While October has had its share of disastrous stock market days, in actuality, negative financial events aren’t limited to that month. It turns out, October is no more of a magnet for market collapses and the onset of crises that any other time of the year.

But it’s a good reminder that during these times of crisis, it’s good to have your nest egg hedged with gold, just in case something happens.

Generally speaking, gold and equity have an inverse relationship. This means, that when the gold price goes up, prices in the stock market will fall and vice versa.

Historically it has been observed that when the stock market is most pessimistic, gold performs very well.

This makes sense when you think about it. Stocks benefit from economic growth and stability while gold benefits from economic distress and crisis. If the stock market falls, fear is usually high, which means investors are more likely to seek out the safe haven of gold. If stocks are moving higher month after month, the perceived need for gold from mainstream investors is low.

Even if gold initially declines during a stock market collapse, one should not assume it’s down for the count. In fact, history says it might be a great buying opportunity.

If you’re considering adding to your precious metals position, InstaVault makes it as easy as 1… 2… 3!

ADD GOLD TO YOUR PORTFOLIO TODAY

We’ll be back next week with another Shocktober installment of GoldSilver Nuggets.

Until next time!

Best,

Brandon S.

GoldSilver

[ad_2]

Source link