Powell Discusses What the Fed Could Have Done to Prevent Inflation Rise – MishTalk

Fed Chair Jerome Powell’s speech on October 19 to the Economic Club of New York is more than a bit amusing. Let’s tune in.

On October 19, Fed Chair Powell gave a Speech to the Economic Club of New York.

Somehow, they failed to invite me to ask questions. I am sure this oversight will be corrected next time and I have some doozies.

Anyway, the session was interesting despite me not being there to ask questions.

Forex Live reports Q&A from Fed Powell: Economy is very resilient and growing strongly

Comment Clips

- No precision in understanding monetary policy lags.

- Markets have been front running Fed policy changes.

- Household savings are higher, spending has been higher.

- We should be seeing effects of monetary policy arriving

- Fed has slowed on rates to give policy time to work.

- There is a lot of uncertainty on lags

- It is very hard to know how economy can grow with higher rates

- By any reckoning, neutral rates ebbed over recent decades, unsure where it is now

- Models useful but have to look at what the economy is telling us

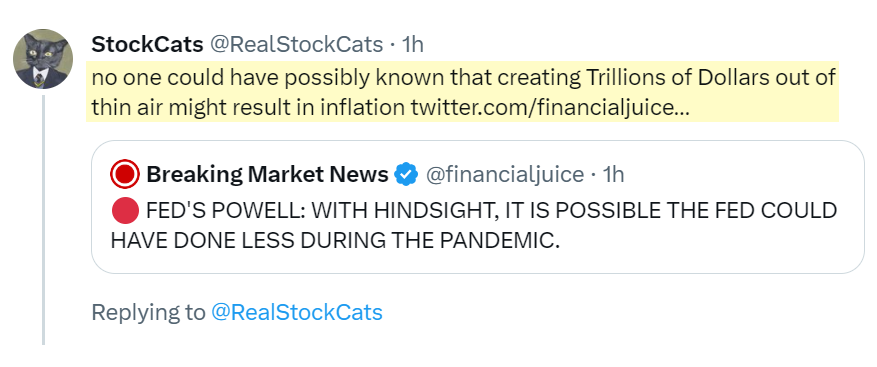

- With hindsight possible Fed could have done less during pandemic

- Bond yield rise doesn’t seem to be about expectations of Fed doing more on rates

- Is unclear if bond yield rise will be persistent, markets are volatile.

- We will let market yield rise play out, Fed will watch it.

That’s an abbreviated set of clips from Forex Live notes.

In Hindsight, It’s Possible

Well, no it wasn’t because the Fed never learns from mistakes.

And note that hindsight isn’t 20-20 because Powell said didn’t say “should have“.

Fed Uncertainty Principle in Action

Powell’s speech and subsequent Q&A is a beautiful example of my all-time favorite post, Fed Uncertainty Principle, written April 3, 2008, before the collapse of Lehman and Bear Stearns.

Does the Fed Follows the Market?

Most think the Fed follows market expectations.

However, this creates what would appear at first glance to be a major paradox: If the Fed is simply following market expectations, can the Fed be to blame for the consequences? More pointedly, why isn’t the market to blame if the Fed is simply following market expectations?

This is a very interesting theoretical question. While it’s true the Fed typically only does what is expected, those expectations become distorted over time by observations of Fed actions.

The Observer Affects The Observed

The Fed, in conjunction with all the players watching the Fed, distorts the economic picture. I liken this to Heisenberg’s Uncertainty Principle where observation of a subatomic particle changes the ability to measure it accurately.

The Fed, by its very existence, alters the economic horizon. Compounding the problem are all the eyes on the Fed attempting to game the system. [See Powell’s admission above about the market front-running the Fed]

What happened in 2002-2004 was an observer/participant feedback loop that continued even after the recession had ended. The Fed held rates rates too low too long. This spawned the biggest housing bubble in history. The Greenspan Fed compounded the problem by endorsing derivatives and ARMs at the worst possible moment.

The Fed has so distorted the economic picture by its very existence that it is fatally flawed logic to suggest the Fed is simply following the market therefore the market is to blame. There would not be a Fed in a free market, and by implication there would be no observer/participant feedback loop.

Fed Uncertainty Basic Principle: The fed, by its very existence, has completely distorted the market via self-reinforcing observer/participant feedback loops. Thus, it is fatally flawed logic to suggest the Fed is simply following the market, therefore the market is to blame for the Fed’s actions. There would not be a Fed in a free market, and by implication, there would not be observer/participant feedback loops either.

Corollary Number One: The Fed has no idea where interest rates should be. Only a free market does. The Fed will be disingenuous about what it knows (nothing of use) and doesn’t know (much more than it wants to admit), particularly in times of economic stress.

Corollary Number Two: The government/quasi-government body most responsible for creating this mess (the Fed), will attempt a big power grab, purportedly to fix whatever problems it creates. The bigger the mess it creates, the more power it will attempt to grab. Over time this leads to dangerously concentrated power into the hands of those who have already proven they do not know what they are doing.

Corollary Number Three: Don’t expect the Fed to learn from past mistakes. Instead, expect the Fed to repeat them with bigger and bigger doses of exactly what created the initial problem.

Corollary Number Four: The Fed simply does not care whether its actions are illegal or not. The Fed is operating under the principle that it’s easier to get forgiveness than permission. And forgiveness is just another means to the desired power grab it is seeking.

Irony Abounds

All of that was written prior to the collapse of Lehman.

Former Fed Chair Ben Bernanke call the collapse of Lehman his biggest failure. Ironically, it was the only thing he ever did right.

Capitalism must have failures to succeed.

Instead we have gone through three massive bubbles caused by Fed distortions with the market front running the Fed all the way creating bubbles and busts of increasing amplitude over time.

How the Fed Destroyed the Housing Market and Created Inflation in Pictures

We have the strangest housing bubble in history with rising prices and crashing transactions.

By my calculations based on wages vs prices, home prices are roughly 46 percent too high. If you prefer, home prices would need to fall roughly 31 percent.

For discussion, please see How the Fed Destroyed the Housing Market and Created Inflation in Pictures

Now Powell says the Fed “could have” done something when it’s damn clear the Fed has no idea what it’s doing at all.

What a hoot!

[ad_2]

Source link