Biden’s Highway To Hell! Subprime Auto Loan Delinquencies Erupt, Highest Rate On Record (Higher Than Great Recession And Covid Recession!) – Confounded Interest – Anthony B. Sanders

Biden’s Highway to Hell!

Bidenomics has been a massive windfall for the top 1% of households in terms of wealth due to the emphasis on green energy transformation. But for the 99%, Bidenomics has been a disaster (unless you consider low-paying job creation a victory).

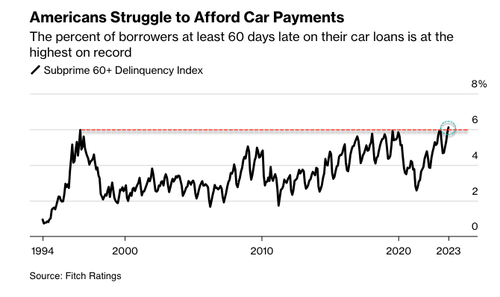

The auto sector, considered a leading economic indicator, pinpoints the arrival of the crushing auto loan crisis and even the possibility of the onset of the next recession. In late January, we Fitch revealed tat consumers are falling behind on auto payments – the most since the peak of the Great Financial Crisis. Fast forward nine months later, to September, that rate just hit the highest level in nearly three decades.

And with interest rates rising the fastest in history,

And Discover projected charge off rate for 2023 would more than double from its current 1.82% to as much as 3.90%!

In what could be the early innings of the auto loan crisis, something we called a “perfect storm” earlier this year, Bloomberg cites new Fitch data:

The percent of subprime auto borrowers at least 60 days past due on their loans rose to 6.11% in September, the highest in data going back to 1994, according to Fitch Ratings.

“The subprime borrower is getting squeezed,” said Margaret Rowe, senior director with Fitch.

Rowe said, “They can often be a first line of where we start to see the negative effects of macroeconomic headwinds.”

What has been widely known is the consumer has been funding car purchases with even more debt to afford record-high prices, with many monthly payments exceeding $1,000. Factor in the Federal Reserve’s most aggressive interest rate hiking cycle in a generation, elevated inflation, and the restarting of the federal student loan payments, tens of millions of consumers are under immense pressure this fall.

An endless stream of retailers, such as Walmart, Nordstrom, Macy’s, and Kohl’s – all of whom have recently warned about a consumer slowdown. Banks have also raised concerns, such as Morgan Stanley’s Mike Wilson, who believes the consumer is ‘falling off a cliff.’ And the latest high-frequency data from Barclays shows card spending has taken another leg down.

As delinquencies rise, Cox Automotive forecasts that 1.5 million vehicles will be seized this year, up from 1.2 million in 2022. That’s still below pre-pandemic levels, but the numbers could soar if a recession materializes in 2024.

Bloomberg cited Bankrate data that shows consumers with excellent credit can lock in an average interest rate of around 5.07% for a new car and 7.09% for a used vehicle. Those with bad credit should expect a new car rate of 14.18% and 21.38% for a used car.

The perfect storm we described earlier this year is unfolding.

At least residential mortgage delinquency rates remain low. With elevated home prices, the incentive to default on a loan is limited.

So The Perfect Storm hasn’t hit residential real estate … yet. But with households needing $114,000 in annual income to afford a typical home …

But at least home prices aren’t rising as fast as olive oil and orange juice!! Wow, that excesssive stimulypto by The Fed and Federal government is really screwing things up in the economy.

Biden is like George Clooney in “The Perfect Storm” sending the US out into stormy, violent seas while obessing about Ukraine and protecting Iran/Hamas.

[ad_2]

Source link