Bond Yields Have More To Go As Retail Wises Up To Inflation

Authored by Simon White, Bloomberg macro strategist,

US yields likely need to climb further as retail investors become increasingly attuned to hedging inflation. Bond rallies are likely to be transient as the primary trend for Treasuries remains down.

After decades of real and nominal levels being almost indistinguishable, it’s not a great surprise that both professional and retail investors will take time to adapt to the new normal. Countries used to unruly inflation, like Argentina, are well accustomed to their currency’s actual value (not the official value), and how rampant price growth can decimate the real value of financial assets.

In the wake of the initial burst of US inflation in 2021, there was a spurt of interest among both retail and professional investors for real assets and their proxies, such as commodities, as well as energy and industrial stocks. That has since waned somewhat, but inflation is unlikely to return to a low-and-stable regime anytime soon.

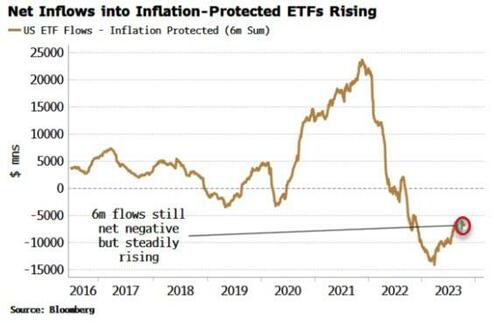

Households may be picking up on this, and are investing accordingly. Flows into the largest commodity ETFs have been rising this year. And flows into ETFs of inflation-protected securities, which peaked in 2021 then fell sharply, have also been steadily picking up.

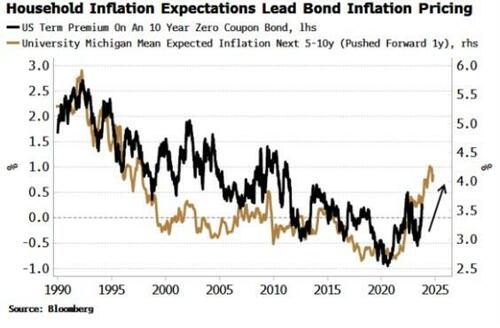

Long-term inflation expectations of households (as measured by the University of Michigan’s survey) are markedly higher than what is expected by the Federal Reserve, or priced in by the market based off breakeven rates and CPI fixing swaps.

Typically, household inflation expectations lead bond term premium – which is mainly driven by the market’s expectation of inflation and inflation volatility – by around a year. Term premium has been following household inflation expectations higher this year.

But in this cycle, the sensitivity between inflation expectations and term premium is likely to be higher as the household sector becomes the de facto buyer of last resort of Treasuries.

They are the only sector absorbing USTs as the Fed, US financials and the rest of the world reduce their exposure.

As the marginal buyer, they’re likely to demand a higher yield than the market is currently offering to compensate for the greater inflation risks they foresee, and are beginning to hedge.

Loading…

[ad_2]

Source link