GLOBAL MARKETS-Stocks struggle as Treasury yields linger near 5% after strong U.S. growth data

(Updates to U.S. market open)

*

U.S. shares decline, European and Asian stocks all fall

*

Dollar climbs above 150 yen, dollar index at two-week top

*

Oil slips, gold near five-month high

*

ECB hold rates as expected, euro unaffected, last down 0.27%

By Lawrence Delevingne and Alun John

Oct 26 (Reuters) – U.S. Treasury yields were back near 5% on Thursday, reinforced by above-expectation U.S. GDP data, dragging shares around the world to multi-month lows in the middle of a busy corporate earnings week.

The U.S. economy grew at its fastest pace in nearly two years in the third quarter, Thursday data showed, as higher wages in a tight labor market helped to power consumer spending, again defying dire warnings of a recession that have lingered since 2022.

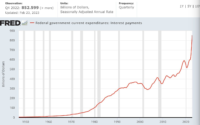

The unexpected strength of the U.S. economy has been a factor in the selloff in the U.S. Treasury market, and the benchmark 10-year yield last stood at 4.917%, down slightly on the day, having earlier reached 4.989%, just below 5.021%, the highest since 2007 hit earlier in the week.

A rebound in U.S. home sales and an auction of five-year notes that showed weak demand were the latest trigger for concern in the bond market, which saw the U.S. 10-year Treasury yield rise 11 basis points on Wednesday.

Quincy Krosby, chief global strategist at LPL Financial in Charlotte, said that U.S. economic growth prompts market concerns that the Fed may need to increase interest rates again before the end of the year to quell inflation.

“The Fed’s job isn’t done and it does not appear that higher interest rates are doing the job for them,” Krosby said in an email.

Friday’s personal consumption expenditure (PCE) price index, which is the Fed’s preferred inflation gauge, is also in focus.

The Dow Jones Industrial Average fell 0.23% to 32,959, the S&P 500 lost 0.59% to 4,161 and the Nasdaq Composite dropped 0.97% to 12,696.

A drag was Meta Platforms, which fell 6% even after its third-quarter results beat expectations, with the Facebook parent forecasting 2024 spending above estimates and suggesting the conflict in Israel and Gaza could dampen fourth-quarter sales.

That decline came after Alphabet’s shares logged their worst session since March 2020, dropping 9.5% as investors were disappointed with growth stalling in its cloud division. Amazon.com reports its results after the closing bell Thursday.

In Europe, the European Central Bank broke the longest streak of interest rate hikes in its 25-year history on Thursday, leaving its main rate at a record high of 4.0%, and saying the latest data continued to point to inflation slowly coming down to its 2% target.

There was limited market reaction to the decision, and the euro was down 0.27% on the day.

Europe’s broad STOXX index was down 0.4%, just off seven-month lows hit earlier in the week.

MSCI’s broadest index of Asia-Pacific shares outside Japan hit an 11-month low, down about 1.2%.

Kiran Ganesh, global head of investment communications at UBS Wealth Management, said there were three main things pushing stocks lower.

“High yields are reflecting concerns that rates will have to stay high for longer, and that won’t be good for the economy longer term; high yields are also competing for equity market investment; and the start of the earnings season has been a mixed bag, but generally on the negative side.”

European banks were the big earnings story on Wednesday, with Standard Chartered at one point falling more than 17% after the group announced its third quarter profit unexpectedly plunged by a third due to a nearly $1 billion combined hit from its exposure to China’s real estate and banking sectors. Shares in BNP Paribas fell 3% after results.

In currency markets, the dollar index hit a two-week high of 106.8, driven by the higher yields, and the yen weakened past 150 per dollar, a level that has put traders on guard for intervention to support the Japanese currency.

Oil prices slipped after a rise in U.S. crude stockpiles and due to the stronger dollar, though the war in the Middle East loomed large in traders’ minds. U.S. crude fell 1.93% to $83.74 per barrel and Brent was at $88.63, down 1.66% on the day.

Spot gold was flat, at around $1,978 an ounce.

(Reporting by Lawrence Delevingne in Boston, Xie Yu in Hong Kong and Alun John in London; Editing by Toby Chopra, Hugh Lawson, Shinjini Ganguli and Susan Fenton)

[ad_2]

Source link