More Americans face ‘persistent debt’ as interest rates and fees rise: New study

American cardholders paid a record $130 billion in interest and fees in 2022, according to a new government report.

The study released Tuesday by the Consumer Financial Protection Bureau (CFPB) was part of the government watchdog’s biennial report to Congress. The breakdown: Credit card companies charged consumers more than $105 billion in interest and some $25 billion in fees last year. Overall, it was the “highest amount” recorded in the CFPB’s data history.

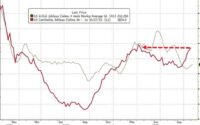

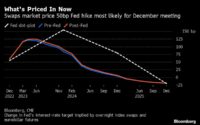

The CFPB report comes at a time when outstanding credit card debt has surpassed a record $1 trillion — and pressure from the Federal Reserve’s fight on inflation has continued to push interest rates higher.

For many Americans, the combination of rising debt and interest rates has been hard to manage.

Read more: Credit card interest and fees soar to $130 billion — but you don’t have to pay them

“Credit card debt is more expensive than years past,” Rohit Chopra, CFPB director, said in a statement. “It’s clear that Americans need more ways to switch cards to ones with lower rates.”

The bottom line

As interest rates and fees increased in 2022, more Americans had a harder time paying down their credit card debts.

According to the report, the average cardholder carried $5,288 in total credit card debt at the end of 2022, up 24% from 2021 lows and marking a return to late 2019 levels. Cardholders with prime credit scores between 660 and 719 shouldered the highest debt, with average balances reaching $9,135 at the end of 2022.

Among major credit card issuers, 82% of total debt was revolving — meaning that consumers were carrying a balance into the next month in 2022. Only 18% of consumers surveyed said they were able to pay off their full balances by their due date, the CFPB noted.

In 2020, by contrast, only 51.3% of consumers carried a balance into the next month, and 48% of respondents said were able to pay balances in full by the due date.

Read more: Credit card fees explained: 8 types you should know

“Pandemic relief programs in 2020 and 2021 enabled some card holders to pay down credit card balances, but the number of people facing persistent debt could climb if interest rates remain elevated,” the CFPB said in a statement.

And interest rates rose quite a bit during 2022, due to the Fed’s moves to curb inflation.

The average APR on private cards — used for select vendors, similar to retail cards — was 27.7% by the end of 2022, an increase of more than 2 percentage points from the year prior, according to the CFPB. Meanwhile, interest rates on general-purpose cards — used across wide networks such as Visa and Mastercard — jumped from 18.8% in mid-2020 to 22.7% in 2022.

Between March and December 2022, the prime rate most commercial banks use to set cardholders’ APRs had risen by 4 percentage points.

“All in all, the data show more cardholders are being charged late fees, falling behind on payments, and facing higher costs on growing debt,” CFPB researchers noted.

More borrowers face ‘persistent debt’

A greater share of Americans slipped into more than 180 days’ delinquency as they faced higher fees and interest, the CFPB found, and those with the lowest credit scores at times weren’t able to pay anything at all.

Nearly 10% of credit card users found themselves in “persistent debt,” the CFPB said in the release, meaning they were charged more in interest and fees each year than what they paid toward their principal.

One of the hurdles consumers faced were higher minimum payments.

The minimum payment for revolving accounts increased to $102 for general purposes cards, up from $95 the year prior. Meanwhile, folks with private-label cards faced a minimum payment of $69, up from $66 in 2021.

Those most vulnerable to falling behind on payments and facing higher minimum payments were borrowers with deep subprime credit scores (below 580), or those with prime scores (between 660 and 719), the CFPB found.

For instance, for private-label cards, the average minimum payment due for consumers with a credit score under 580 was $43 higher than those who had a credit score of 660. Folks in the deep prime scoring category also paid $54 more than consumers with credit scores above 720.

CFPB researchers noted it was “a pattern that could become increasingly difficult for some consumers to escape.”

Reducing junk fees

To reduce consumers’ financial burden, the CFPB has also been taking aim to reduce junk fees and promote a fairer marketplace.

Earlier this year, the government watchdog proposed a rule to reign in excessive credit card late fees, which they say companies “exploited” as they hiked fees with inflation. The measure is part of the CFPB’s campaign to eliminate or reduce junk fees.

Companies currently charge up to $41 for each missed payment. Under the proposed rule, late fees would be lowered to $8 and the automatic annual inflation adjustment would be eliminated. The proposed rule would also ban late fees above 25% of the consumer’s required payment.

The CFPB also proposed another rule this month to allow consumers to change banks with more ease, in hopes to encourage a competitive marketplace and help folks transfer their transaction data without hurdles.

“Over a decade ago, Congress banned excessive credit card late fees, but companies have exploited a regulatory loophole that has allowed them to escape scrutiny for charging an otherwise illegal junk fee,” Chopra said in a statement. “[The] proposed rule seeks to save families billions of dollars and ensure the credit card market is fair and competitive.”

Gabriella is a personal finance and housing reporter at Yahoo Finance. Follow her on Twitter @__gabriellacruz.

Click here for real estate and housing market news, reports, and analysis to inform your investing decisions.

[ad_2]

Source link