The Money Has Stopped Flowing in Commercial Real Estate

October 31, 2023

Commercial real-estate lending is shrinking to historically low levels, threatening a rise in defaults on expiring debt and a sharp decline in new construction of warehouses, apartments and other property types.

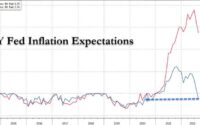

Banks, insurance companies and other commercial property lenders have been cutting back since the first half of 2022 when the Federal Reserve began increasing interest rates and recession concerns intensified. But creditors have been even more reluctant to make new loans as Treasury bond yields have soared since early August.

Copyright ©2023 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

[ad_2]

Source link