Gold steady as investors strap in for Fed’s policy decision

(Reuters) – Gold was flat on Wednesday ahead of the Federal Reserve’s policy decision, while all eyes will be on Chair Jerome Powell’s speech later for guidance on rate path.

Spot gold was little changed at $1,983.32 per ounce by 1214 GMT. U.S. gold futures ticked lower by 0.1% to $1,992.40.

Bullion prices have pulled back after surpassing the key $2,000 level last week, supported by strong safe-haven inflows due to growing unrest in the Middle East, helping it register its biggest monthly rise since March in October.

This is just a long-overdue consolidation following a very strong rally seen in the past three weeks, and prices could drop to at least $1,952, said Ole Hansen, Saxo Bank’s head of commodity strategy.

Investors’ focus now shifts to the end of the Fed’s two-day monetary policy meeting at 1800 GMT, and Powell’s speech at 1830 GMT.

“Although no change in the interest rates is expected, the focus will be on the Fed’s assessment of the U.S. economy and clues to the monetary policy going forward,” said Praveen Singh, associate vice president at BNP Paribas’ Sharekhan.

Meanwhile, Asia’s manufacturers faced worsening pressure in October, with factory activity in China slipping back into decline, clouding recovery prospects for the region’s major exporters already squeezed by weaker global demand and higher prices.

Spot silver dropped 1.1% to $22.65 per ounce.

Platinum slipped 1.8% to $916.58, while palladium fell 0.3% to $1,111.81.

“Right now, platinum and silver look relatively cheap compared with gold. Perhaps we could see some additional outperformance in these two metals in the short term,” said Saxo Bank’s Hansen.

Reporting by Harshit Verma and Anjan Anil in Bengaluru; Editing by Varun H K and Mrigank Dhaniwala

[ad_2]

Source link

Related Posts

Miracles, Housing, and the False Shortage Signals of Money That is Priced Too Cheap – Mish Talk

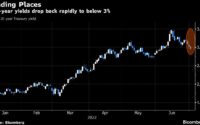

Ten-Year Treasury Yield Hovers Below 3% as Recession Fears Mount