A Hawkish Interest Rate Hold by the Fed or Something Else? – MishTalk

The Fed is not thinking about interest rate cuts. But what about hikes?

Wolf Richter at Wolf Street has a different interpretation of the Fed’s Press Conference than I do. The difference isn’t radical, but I would not call today’s meeting or press conference particularly hawkish.

Wolf Street: Another Hawkish Hold

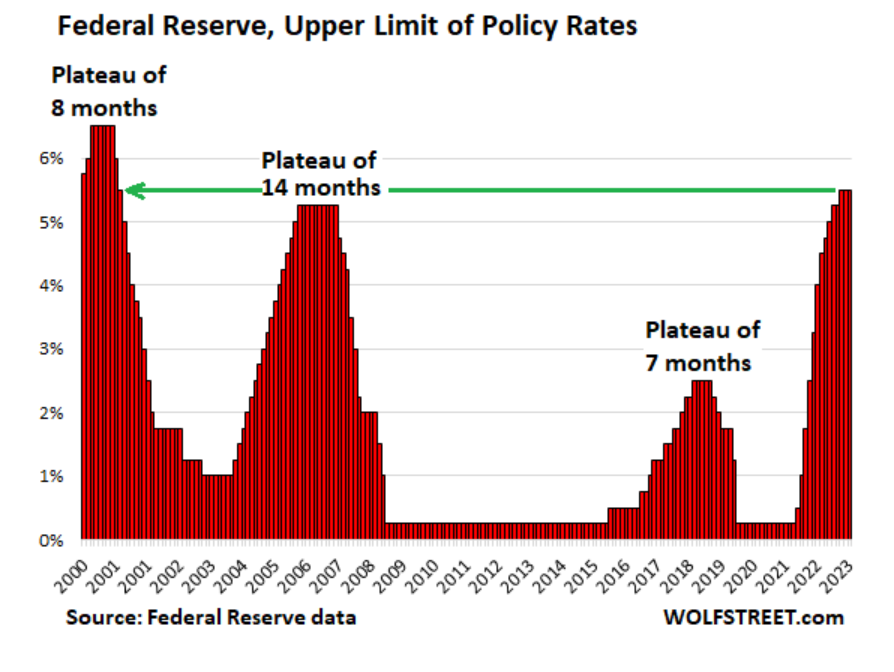

That’s a nice chart by Wolf. So, how much longer?

Please consider Another “Hawkish Hold” with Tightening Bias: Fed Keeps Rates at 5.50% Top of Range, Rate Hike Still on the Table. QT Continues

Higher for how much longer?

The end of the rate hikes is typically followed by plateaus before rate cuts begin. The end of the rate hikes may not be here yet, and the Fed has already said a gazillion times for months that the plateau is going to be “higher for longer.”

Today’s statement repeated the language of the prior statements, which leaves the door open for more rate hikes:

“In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

When will the rate cuts start? The Fed will release its next SEP and “dot plot” at the December meeting. In the SEP released in December 2022, the Fed shocked the world because it removed the projections of a rate cut in 2023. In the SEP released in September, the Fed moved the rate cuts further out into the second half of 2024, which was another shocker. So the next SEP in December will be interesting.

On Hold for Longer

The last meeting was hawkish. This was just more of the same.

Powell did say “The Fed is not thinking about rate cuts at all.” That was the most hawkish thing from the press conference. Otherwise, it was just a rehash of things that should have been totally expected.

Reporters kept trying to get the Fed to commit to more hikes or more cuts with a barrage of similar questions, but Powell ducked them with variations along the lines of significant tightening has taken place and we will wait and see.

Hold Bias, Not a Tightening Bias

I watched the entire press conference and do not see a tightening bias.

I see a stated hold bias.

Unstated Bias

Stock Market Interpretation

After floundering around feebly, the stock market seems to have gotten the message “no more hikes”

ISM Manufacturing Plunges to 46.7 Percent. New Orders, Backlogs in Contraction

For discussion of today’s ISM report please see ISM Manufacturing Plunges to 46.7 Percent. New Orders, Backlogs in Contraction

Notably, the ISM reported “eighty-nine percent of panelists’ companies reported ‘same’ or ‘lower’ prices in October.”

As Powell stressed, this will be data dependent. However, today’s ISM report provides a possible clue that things are not as good a perceived.

We have a jobs report on Friday and there will another one before the next meeting.

I think hikes are done.

[ad_2]

Source link