Fear The Talking Fed! Morgan Stanley Forecasts 315 Basis Point Cut In Fed Funds Target Rate In 2024 (Mortgage Rates Could Fall To 5.50% In 2024) – Confounded Interest – Anthony B. Sanders

The Talking Heads at The Federal Reserve keep yammering about persistant inflation (which Yellen kept saying was transitory) and whether or not Fed rate hikes will be necessary to get infation to 2%.

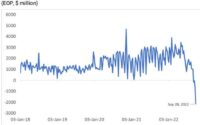

Instead of muddling lectures (like by Atlanta Fed President Rafael Bostic) on Fed tightening to fight inflation, let’s address the elephant in the room (no, not Chris Christie or Hillary Clinton), but Morgan Stanley’s soft landing forecast of a Fed Funds rate cut from 5.50% today to 2.375% in 2024. This is a whopping 215 basis point cut!

Currently, the spread between the 30-year conforming mortgage rate and The Fed Funds Target rate is 1.981% of 198.1 basis points. While the better spread is the mortgage rate compared to the 10-year Treasury yield, I am going to use Morgan Stanley’s Fed Funds target rate forecast for 2024. Assuming the spread is constant, this results in a mortgage rate in 2024 of … drumroll … 5.50%.

In one sense, a 200 basis point decline in the 30-year mortgage rate would be welcome news to home buyers. On the other hand, Morgan Stanley is forecasting a soft landing and a rise in the unemployment rate to 4.3%, hardly good economic news.

So, fear the talking Fed. They are talking about fighting stubborn inflation while ignoring the slowdown forecast for 2024.

[ad_2]

Source link