Hammer Time! New Home Sales Hammered In October As Homebuilders Hit The Wall, Prices Plunge -17.6% YoY – Confounded Interest – Anthony B. Sanders

Hammer time!

With existing home sales collapsing to their lowest SAAR since 2010, new home sales are the only pillar left holding up any hope in the US housing market. However, with housing affordability at its lowest since at least the early 1980s, (and homebuilder sentiment slumping as mortgage rates rose), it’s no surprise that analysts expected new home sales in October to tumble 5.0% MoM (after their unexpected 12.3% surge in September).

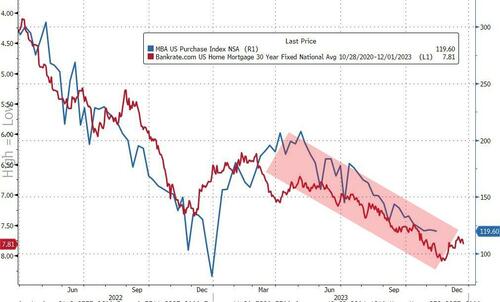

As a reminder, The Mortgage Bankers Association’s index of home-purchase applications tumbled to 120 – the lowest level since 1995 – as mortgage rates hit 8% for the first time in 23 years in October.

Source: Bloomberg

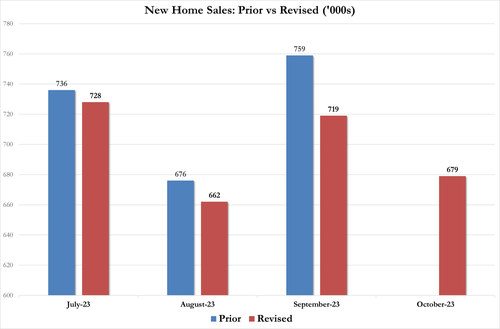

So, it should be no surprise that new home sales were even worse than expected, plunging 5.6% MoM (and making it even worse, the 12.3% MoM jump in Sept was revised down to +8.6%)…

Source: Bloomberg

The trend of downward revisions continues…

The New Home Sales SAAR of 679k is flat from April (that was below all economists’ forecasts)…

Source: Bloomberg

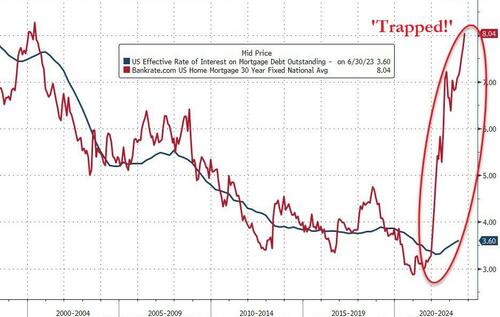

It appears the homebuilders finally hit their wall eating the gap between these two lines was just not sustainable…

Source: Bloomberg

And as we noted previously, homebuilders can’t be filling this gap either – between the current 30Y mortgage rate and the effective rates that borrowers are currently paying on their home loans – (i.e. subsidizing new home sales) forever…

Source: Bloomberg

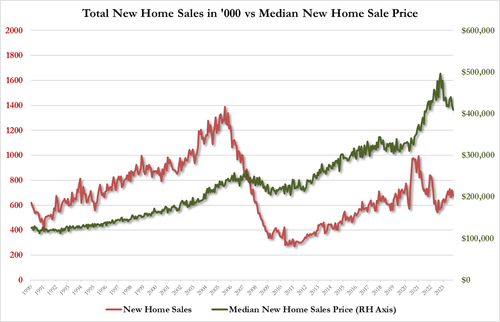

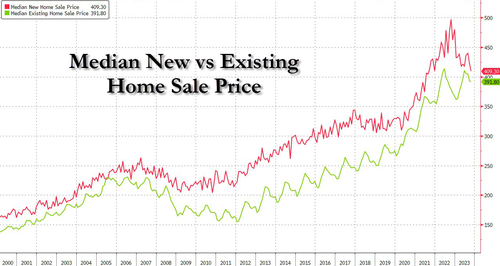

The median new home price fell 17.6% y/y to $409,300; average selling price at $487,000

That is the lowest median price since Aug 2021, catching back down to existing home prices…

Source: Bloomberg

Is Powell winning his war on affordability? Or crushing the middle class’s main source of wealth? Or is it Hammer Time??

[ad_2]

Source link