Massive Downward Revisions For Conference Board Confidence Leave ‘Present Situation’ At April 2021 Lows

Thanks to a massive downward revision in October, the November Conference Board Consumer Confidence index ‘improved’.

-

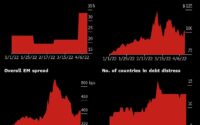

October headline revised down from 102.6 to 99.1 (the weakest since Jul 2022), and November headline printed 102.0 (up notably from the downwardly revised data).

-

October Present Situation revised down from 143.1 to 138.6, and November present situation printed 138.2 (down from the downward revision to the lowest since April 2021)

-

October Expectations revised down from 75.6 to 72.7, and November Expectations printed 77.8 (notably higher than the downward revision).

Source: Bloomberg

The 3.5pts downward revision for the headline print is the largest since Feb 2022…

Source: Bloomberg

Despite this month’s improvement, the Expectations Index remains below 80 for a third consecutive month – a level that historically signals a recession within the next year.

While consumer fears of an impending recession abated slightly – to the lowest levels seen this year – around two-thirds of consumers surveyed in November still perceive a recession to be “somewhat” or “very likely” to occur over the next 12 months.

This is consistent with the short and shallow recession we anticipate in the first half of 2024, according to Dana Peterson, Chief Economist at The Conference Board.

November’s increase (from dramatically lower revised data in October) in consumer confidence was concentrated primarily among householders aged 55 and up; by contrast, confidence among householders aged 35-54 declined slightly.

General improvements were seen across the spectrum of income groups surveyed in November.

Nonetheless, write-in responses revealed consumers remain preoccupied with rising prices in general, followed by war/conflicts and higher interest rates.

The labor market indicators are trending worse – now at the weakest since April 2021…

Source: Bloomberg

Average 12-month inflation expectations receded back to 5.7% after a one-month uptick to 5.9%, dramatically divergent from UMich inflation expectations’ spike…

Source: Bloomberg

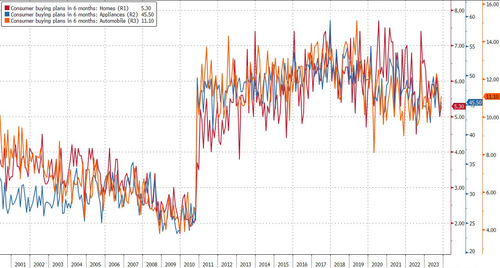

Buying plans for autos, homes, and big-ticket appliances trended downward on a six-month basis – perhaps reflecting the impact of elevated interest rates.

Finally, some food for thought…

How do you revise consumer confidence down? Do you ask them again and they tell you, “You know what, I wasn’t feeling it as much as I thought I was”

— Zebra Cat (@ZebraCat20) November 28, 2023

Is Bidenomics all simply driven by ‘seasonal adjustments’ and historical revisions?

Loading…

[ad_2]

Source link