Huge Discrepancy Between GDP +5.2 Percent and GDI +1.5 Percent Accelerates – MishTalk

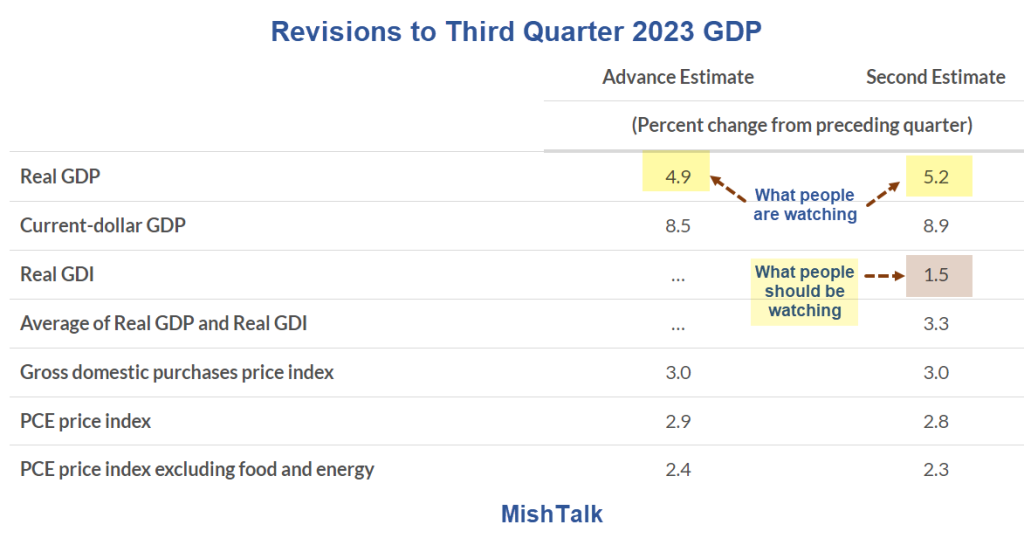

Today the BEA revised its second estimate of third-quarter GDP from 4.9 percent to 5.2 percent. GDI is 1.5 percent but it is a measure of the same thing.

Chart Notes

- GDP and GDI are two measures of the same thing. DDP measures the value of products produced and income measures income from sales.

- The numbers are seasonally adjusted and annualized.

- Real means adjusted for inflation.

- The difference between Real GDP and Real Final Sales is a BEA estimate of CIPI, changes in private inventory. Inventory nets to zero over time so Real Final Sales is the bottom line estimate of GDP.

- The numbers should match and do correlate over time. But the difference between the measures is stunning.

Revisions to Third Quarter 2023 GDP

Instant Gratification

The discrepancy between GDP and GDI is ongoing and massive. That should bear attention. But it doesn’t and won’t.

People like the instant gratification that comes with the initial release of GDP. GDI is only released in later revisions.

All of the discussions today will be on the upward revision to GDP. But even among GDP watchers that’s not even the right focus.

Real Final Sales is the bottom-line estimate of GDP. RFS is a very strong 3.7 percent but far less than the headline 5.2 percent that media will be crowing over.

The Case for Recession

The case for recession has not been dismissed. The negative 3.0 percent decline in GDI followed by very weak increases of 0.5 percent in two consecutive quarters does not rule out recession if one believes as I do, that GDI is the better set of numbers.

At a minimum, as measured by GDI, the economy came very close to recession. Real Final Sales disagrees.

GDP/GDI Blend

The GDP/GDI blend is a stab at the BEA saying they do not know which set of numbers is correct. However, the Philadelphia Fed makes a strong case that GDI numbers are more believable.

The Philadelphia Fed does an alternate blend of GDP and GDI that they label GDPplus. I will do a follow-up post when the GDPplus numbers are released.

Key Take Away

Meanwhile, the key take away from this release is the economy likely is not humming the way media and Biden present.

Why Are Americans in Such a Rotten Mood? Biden Blames the Media

On November 17, I discussed the rotten mood of consumers. Polls show people do not think the economy is humming.

For discussion, please see Why Are Americans in Such a Rotten Mood? Biden Blames the Media

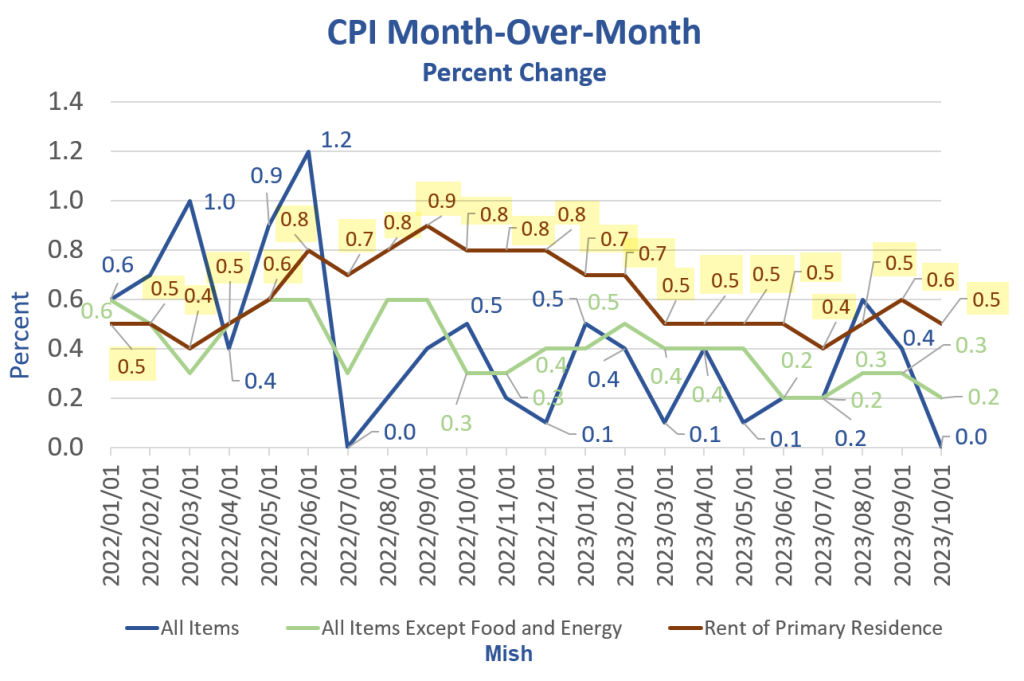

My explanation is certainly not the media, which no doubt will be crowing over these reports. Rather, it’s the price of rent and food.

CPI Rent

Rent of primary residence, the cost that best equates to the rent people pay, jumped 0.5 another percent in October.

For discussion of rent, please see Falling Rent is Extremely Rare, Yet Economists Keep Expecting That

Rent of primary residence has gone up at least 0.4 percent for 27 consecutive months!

People keep telling me rents are falling, I keep saying they aren’t (and the data proves it).

The Average Increase in the Price of Food Every Month for 32 Months is 0.6 Percent

Talk of a tame CPI report this month is entirely an energy mirage and easy year-over-year comparisons. Food is a particular case in point.

Please note The Average Increase in the Price of Food Every Month for 32 Months is 0.6 Percent

Is the economy great? For whom?

Real GDI is More Believable

Recall that “real” means inflation adjusted.

Incomes have been rising, that’s for sure. But how fast are incomes rising relative to inflation?

Could it be 1.5 percent is a much better number than 5.2 percent?

Based on GDI, a very reasonable case can be made that the economy went into recession and/or is still flirting with recession.

Nonetheless, expect a bunch of glowing comments today on how great this economy is.

[ad_2]

Source link