Running On Empty? US Bank Deposit Outflows Continue To Shrink As Regional ‘Stress’ Accelerates (Mortgage Rates UP 151% Under Biden) – Confounded Interest – Anthony B. Sanders

The song “Running on Empty” by Jackson Browne comes to mind when analyzing the state of American banking, especially regional banks.

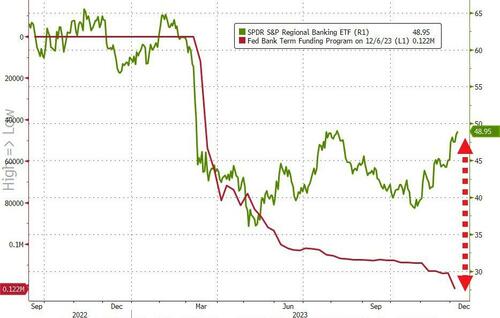

Yesterday we found out that inflows to money-market funds continue to be huge ($290BN in six weeks), and more importantly, regional banks’ usage of The Fed’s BTFP bailout facility surged to a new record high (even as regional banks surged…

Source: Bloomberg

And so, with that shitshow in mind, we await the glorious manipulation of The Fed’s bank deposits data to reinforce that equity confidence.

On a seasonally-adjusted basis, banks saw a $53.7BN deposit outflow…

Source: Bloomberg

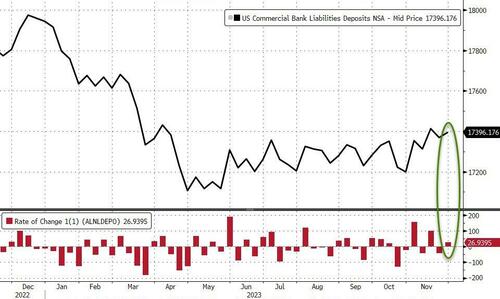

However, on a non-seasonally-adjusted basis, deposits rose by $27BN…

Source: Bloomberg

And even with the outflows (SA), the divergence between soaring money-market funds and bank deposits continues to widen…

Source: Bloomberg

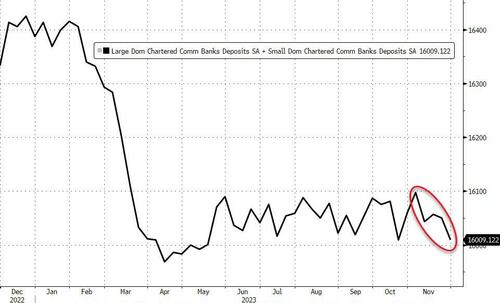

Excluding foreign bank deposits, domestic banks saw the third week of the last four of deposit outflows (-$40.6BN SA) with Large banks -$35BN (SA) and Small banks losing $5.7BN (SA). On an NSA basis, domestic banks saw inflows of $36.5BN last week with Large banks adding $32BN and Small banks adding $4BN…

Source: Bloomberg

That adds up to $88BN (SA) of deposit outflows in the last four weeks (bank to its lowest total since May…

Source: Bloomberg

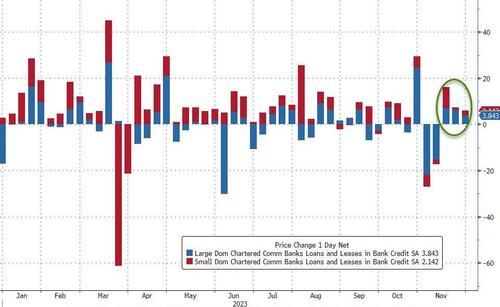

And on the other side of the ledger, despite deposits declining SA, loan volumes increased (SA) for the third week in a row with Small banks adding $2.1BN and Large banks adding $3.8BN…

Source: Bloomberg

Finally, the key warning sign continues to trend ominously lower (Small Banks’ reserve constraint), supported above the critical level by The Fed’s emergency funds (for now)…

Source: Bloomberg

As the red line shows, without The Fed’s help, the crisis is back (and large bank cash needs a home – green line – like picking up a small bank from the FDIC).

Mortgage rates, despite coming down recently, are still up 151% under Biden. And home prices are up 33.2%. So much for affordable housing for those renting.

So, “Running on Empty” applies to middle class and their ability to afford housing.

[ad_2]

Source link