U.S. stocks ended sharply lower after a strong year-end rally lost momentum on Wednesday, putting an end to a string of record finishes for the Dow Jones Industrial Average and a pause on the S&P 500’s push toward an all-time closing high.

How stock indexes traded

-

The Dow Jones Industrial Average

DJIA

ended down by 475.92 points, or 1.3%, at 37,082. -

The S&P 500

SPX

closed lower by 70.02 points, or 1.5%, at 4,698.35. -

The Nasdaq Composite

COMP

finished down by 225.28 points, or 1.5%, at 14,777.94.

On Tuesday, the Dow Jones booked a fifth straight record close out of a total of nine consecutive days of gains, while the S&P 500 closed at its highest level since Jan. 4, 2022. The Nasdaq, like the Dow Jones, also scored a ninth straight session of advances.

What drove markets

The Dow Jones and Nasdaq Composite were on the way toward a 10th straight day of gains on Wednesday, until the rally was interrupted during the New York afternoon by “a bit of a pause” in reaction to overbought market conditions, according to Peter Cardillo, chief market strategist for Spartan Capital Securities in New York.

Investors also seemed hesitant to react to the drop in Treasury yields, Cardillo said via phone, adding that he expects Wednesday’s pause to be followed by a resumption of the rally.

The large-cap benchmark S&P 500 has jumped 22.4% this year, putting it within sight of its all-time closing high of 4,796.56, recorded on Jan. 3, 2022.

With stocks on a tear since the end of October amid what’s been described as an “everything rally,” Eric Sterner, chief investment officer at Apollon Wealth Management, said the market took “a bit of a breather” on Wednesday. Apollon Wealth Management, based in Mount Pleasant, S.C., manages about $7 billion in assets.

“The tailwinds, so to speak, include the Fed’s more dovish pivot that caught the market off guard,” Sterner said via phone.

“And on the other side, some of the headwinds are that the markets have been on an incredible run and have pushed valuations very high, historically speaking,” he said. “We can debate whether there’s going to be a hard or soft landing, but we can all agree that the economy is slowing down and consumer spending is expected to slightly decrease in coming quarters.”

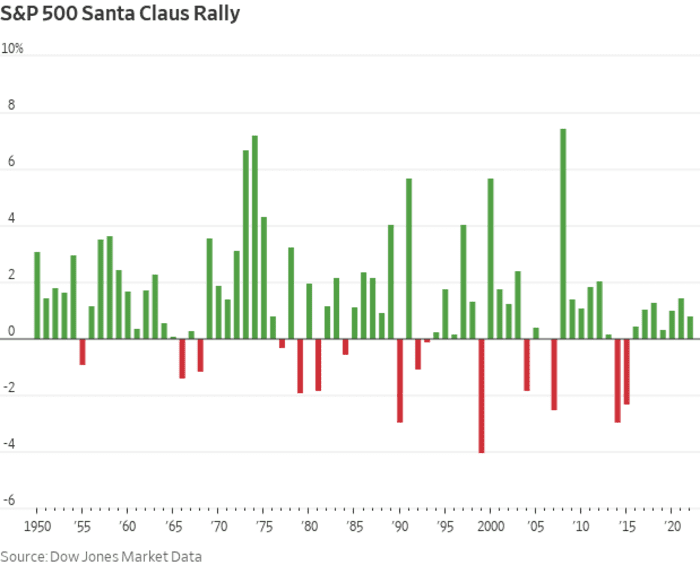

Seasonally speaking, optimism about a festive bounce around this time of year has a tendency to underpin stocks. The “Santa Claus rally” period stretches from the last five trading days of the year through the first two trading days of the new year, according to the Stock Trader’s Almanac.

Since 1950, the S&P 500 has averaged a gain of 1.32% over that period and has closed higher 78.1% of the time, according to Dow Jones Market Data.

DOW JONES MARKET DATA

In U.S. economic data, existing-home sales rose 0.8% in November to 3.82 million, the National Association of Realtors said on Wednesday. Sales of previously owned homes unexpectedly inched up last month, snapping a five-month slump as easing mortgage rates encouraged some prospective home buyers.

Meanwhile, the U.S. consumer-confidence index rose to a five-month high of 110 in December, up from a downwardly revised 101 in the previous month, the Conference Board said Wednesday.

A revision of the third-quarter GDP print is expected Thursday morning, followed by Friday’s personal-consumption expenditures inflation report, which is the Fed’s preferred inflation gauge.

Read: Sticky inflation in a key part of the U.S. economy is the biggest barrier to Fed rate cuts

Companies in focus

-

Shares of FedEx Corp.

FDX,

-12.05%

finished down by 12% after the package-delivery giant trimmed its full-year sales forecast amid continued concerns about subdued shipping demand through the peak holiday season. -

Shares of Tesla Inc.

TSLA,

-3.92%

ended 3.9% lower amid reports that the automaker has decided to cut out merit-based grants from employee-compensation packages. -

Class A shares of Alphabet Inc.

GOOGL,

+1.24%

closed up by 1.2% following a Reuters report that said its Google unit plans to reorganize a large part of its advertising-sales unit. -

Shares of General Mills Inc.

GIS,

-3.57%

ended down by 3.6% after the consumer-foods company missed fiscal second-quarter revenue expectations and lowered its full-year outlook as consumers continue “stronger-than-expected value-seeking behaviors.”

See: The year that wasn’t: 10 Wall Street forecasts for 2023 that didn’t pan out

Jamie Chisholm contributed.