Outlook of gold market’s current state, future potential

(AI Video Summary)

Current state and future potential of the gold market

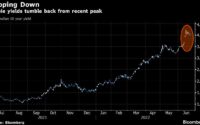

In this video interview for IGTV’s Trading the markets, Eric Strand, founder and portfolio manager at AuAg Funds, discusses the current state and future potential of the gold market with host Angeline Ong. According to Strand, gold prices are holding steady above $2,000 due to hopes of a rate cut. He believes that there is still room for gold prices to rise, with a target of $2,100. Once this level is reached, more investors will likely enter the market, leading to a flow of money into gold and gold mining stocks. Strand also mentions that a weaker US dollar and the Federal Reserve’s change in direction will support the gold market.

Projected strong year for gold and commodities ahead

When asked about the timeframe for reaching $2,400, Strand explains that their previous projection of a 20% increase in gold prices by 2023 may not be far off, as gold is currently up around 12%. He predicts a strong year ahead for gold and commodities, with central banks continuing to buy gold and capital being invested in the commodity sector. For investors seeking protection, Strand suggests investing in gold and commodities, but for those looking for higher returns, he recommends gold mining stocks. European investors can benefit from the leverage that miners have on the gold price, even after considering the foreign exchange effect.

A word on silver

The interview also touches on silver. Strand points out the increasing industrial demand for silver, especially in the renewable energy sector. He explains that in a bull market for precious metals, the ratio between gold and silver tends to decrease. While he sees silver as an interesting investment, he advises investors to be prepared for volatility.

ESG screening and the mining industry

Lastly, the discussion covers the intersection of environmental, social, and governance (ESG) screening and the mining industry. Strand emphasises the importance of mining metals for the green transition and mentions that his ETF, AuAg Funds, selects the 25 best miners for ESG criteria. He believes that companies with strong ESG credentials will attract more institutional investment and perform better in the future.

[ad_2]

Source link