Gold: A Surge Toward $2400 Looks Imminent

the currency of kings, and gold bugs around the world.

The dismal and glorious gold performance chart.

For the past 50 years, the dollar has gone nowhere against the other major government fiats.

Of course, the reverse is true; those other fiats have gone nowhere against the dollar. Contrast that abysmal fiat money action with that of the currency of kings!

Note that mining stocks and commodities are simple tools that can be used to get more ultimate currency gold.

The is an index of the 30 mightiest companies in America. Like the dollar, it has failed to show any sustained gain against gold over the past 50 years.

Here are the buy zones for the . Savvy gold bugs use them to make “big fiat profits” and then wait for a gold price sale so they can convert that fiat into ultimate money gold.

Looking at the current 37,000 zone, the Dow would need to rise to about 45,000 or higher and then drop to 37,000 to turn that into a buy zone.

Right now, ominously, it’s a sell zone, and gamblers can use it to try to make fiat profits by shorting the US stock market and then wisely convert that fiat into gold.

The trading week that ends January 5 is important for the US stock market. The first week of action in January usually indicates what lies ahead for the entire year.

The ultimate money gold chart. An upside breakout and surge toward $2400 appears imminent.

A look at the short-term action and some key buy zones for ultimate money enthusiasts. A nice inverse H&S pattern is in play complete with an upside breakout, pullback to the neckline, and now there’s a fresh surge higher.

Buy zones are different from price projections for current holdings. The two buy zones currently in potential play are $1980 and $1920.

The implied H&S target zone of $2120 is likely the next order of gold price business, so investors eager to get more gold will have to wait for new buy zones to reveal themselves before they get a chance to buy.

A daily focus on the big picture is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape.

What exactly defines a gold buy zone? A significant price sale of around $100/oz or more is one marker.

A strong rise in Asian physical market demand is another. Aggressive short covering and/or buying of long contracts on the COMEX is a third marker. A looming drop in interest rates is the fourth one, and the fifth is weak investor sentiment.

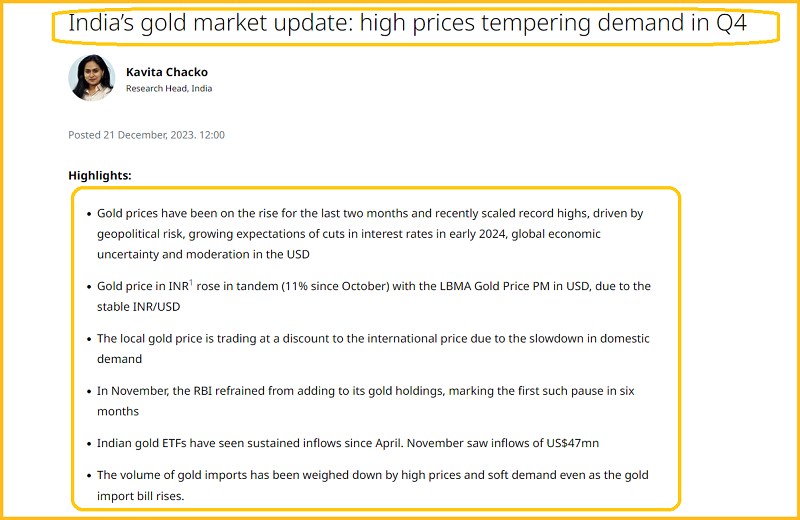

Indian physical demand is softening.

Interest rates are likely headed towards 2.5% (before skyrocketing to 15%-20% while real rates fall!) but there’s already been a big move lower. Here’s the bottom line:

This isn’t a time to buy more gold, but it is a time when gold likely continues to rally. As noted, a price projection isn’t the same thing as a buy zone.

Buy zones are floors. They are price floors, sentiment floors, commercial trader action floors, and physical demand floors.

Investors need to be able to jump up and down on a floor with minimal odds of it being a trap door.

The five big markers that I’ve outlined are what create the ultimate gold buy zone floor. Gold money buyers can jump up and down on it with confidence and glee!

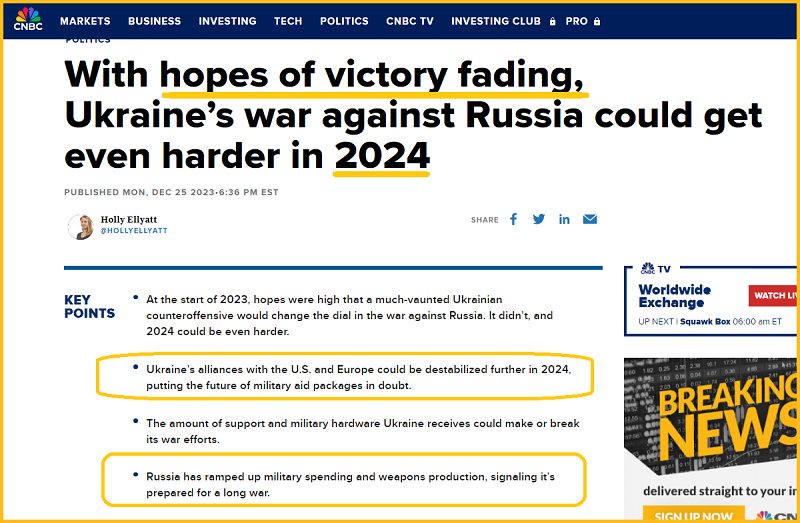

Sadly, but as expected, the American fiat-themed government’s latest violent and debt-funded meddling expedition has failed to do anything except kill, maim, and ruin hundreds of thousands of innocent citizens.

Gold bugs of the world can buy a new order of fiat freedom fries to celebrate the mayhem along with their hideous government, or they can focus on getting more of the ultimate money that can only be gold.

It’s unfortunate that there’s no CDNX ETF (one was attempted years ago but it failed). It’s unfortunate because a multi-decade era of higher junior mine stock prices appears to lie ahead.

Note the “AOS” (arrow of surprise) on this daily chart. A pullback towards $30 is unlikely to happen before GDX approaches $36 but embracing surprise is a key part of wise investing.

A pullback from here or from $36 would only add more right-shouldering to the beautiful multi-shouldered inverse H&S pattern that is currently in play.

Buying mine stocks at the big buy zones for gold can produce enormous fiat profits in a very short time. Then, these profits can be eagerly converted from fiat to gold!

[ad_2]

Source link