The global economy in 2024: Key clues to watch out for | Business and Economy News

The world economy has proved more resilient than most analysts anticipated at the start of 2023. In particular, global inflation has fallen without big surges in unemployment. But policymakers, desperate to engineer a “soft landing“, are not out of the woods yet.

According to the Organisation for Economic Co-operation and Development (OECD), global output, while highly fragmented, will slow in 2024 as high interest rates snuff out persistent inflation and, by extension, economic activity.

The Paris-based organisation does not anticipate growth to edge up until 2025, at which point leading central banks are expected to aggressively slash borrowing costs. Until then, global gross domestic product (GDP) is forecast to rise by 2.7 percent next year, down slightly from 2.9 percent in 2023.

The OECD’s outlook points to a long fiscal hangover from COVID-19, followed by surging energy prices after Russia invaded Ukraine. Moreover, even if monetary policy does begin to unwind next year, global interest rates will remain high by recent historical standards.

Still, economic forecasting is an inexact science. Twelve months ago, predictions of a United States recession were widespread. Elsewhere, market makers were betting that high debt costs would trigger a spate of sovereign defaults across the developing world. Neither have occurred.

Despite recent tensions in Israel-Palestine, the world economy slowly shed growth at a manageable pace in 2023. Looking ahead to next year, three macroeconomic variables – and how they interrelate – will be closely monitored for clues about the direction of global output.

US Federal Funds rate

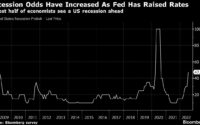

In an effort to lower inflation, the US Federal Reserve raised its benchmark interest rate from near-zero last March to 5.25-5.5 percent today. The experience showed that the American economy, the largest in the world, can withstand high borrowing costs.

At the same time, unemployment has fallen to near multi-decade lows even as inflation has edged down. The upshot is that US output has, somewhat surprisingly, chugged along at an annualised pace of 2 percent.

This has persuaded many analysts to ditch their start-of-year gloom. “The Fed is on course to avert a recession and achieve benign disinflation, which would constitute a soft landing,” Raphael Olszyna-Marzys, an international economist at private bank J Safra Sarasin, told Al Jazeera.

That said, cracks are beginning to show. “Unemployment is slowly creeping up and consumers have fewer pandemic-era savings. This will increase the need for debt, including at the corporate level, and increase financing risks from higher interest rates,” he said.

“And once an economic slowdown gets under way, it risks feeding on itself,” he said, adding that while falling inflation will be an important factor in determining monetary policy, “weakening growth will almost certainly determine when the Fed will pivot.”

Federal funds futures are a straightforward gauge for determining when traders think US interest rates will change. According to CME FedWatch, a tool that tracks the probability of Fed rate changes, there is a 76 percent chance of a rate cut next March.

For Olszyna-Marzys, meanwhile, “the kind of economic weakness, namely a recession, that would precipitate rate reductions is only likely in the second half of 2024”.

He anticipated cuts amounting to 1 percent next year, after June, predominantly to boost domestic growth. But rate cuts will also encourage investment into emerging market countries, which will offer relatively higher rates of return.

“As such, I expect a one percentage point drop in the Fed Funds rate to raise global GDP by 1 percent,” he said.

He pointed out that “keeping rates steady” would have the opposite effect. “An external shock, like an unexpected jump in oil prices, could lift inflation again and force the Fed to keep rates on hold … or even lift them. That would undermine US, and even global growth.”

Brent crude

Shortly after Hamas’s October 7 attack – and subsequent Israeli retaliation – the World Bank used its Commodity’s Market Outlook to warn that Brent crude oil (the international benchmark) prices could spike if producers in the region were drawn into a wider conflict.

In a worst-case scenario, the bank estimated that global oil supply could shrink by six to eight million barrels a day, which would send prices to between $140 and $157 a barrel. Under a smaller disruption, the report added that prices could still hit $102-$121 a barrel.

For now, oil markets appear to have shrugged off the effects of Middle East tensions. Even accounting for recent Houthi rebel attacks on ships in the Red Sea, Brent crude is trading at under $79 a barrel, down from $92.4 in mid-October.

There are several reasons for this. First, the global economy is better positioned to withstand a supply shock than it was during the 1973 oil embargo when prices quadrupled. Today, the Middle East accounts for 30 percent of world supply, down from 37 percent 50 years ago.

Linked to this, US energy supplies have burgeoned in recent decades. At the same time, economic activity has become more fuel efficient while renewable energy is more readily available.

For John Baffes, head of the World Bank’s Commodities Unit and lead author of the Commodity Markets Outlook report, traders appear to have “discounted a possible military escalation [into their price forecasts] for now”.

“Many traders got burned last year, overestimating the scale of disruptions to oil supplies following Russia’s invasion of Ukraine,” said Baffes. “So, they’ll want to see material risks in Israel-Palestine before they start pricing that in.”

He added that “even if Brent did rise by $20 due to Middle East supply issues [as under the Bank’s ‘smaller disruption’ scenario], we still don’t think it would have a material impact on global growth … in the region of 0.1 percent.”

Baffes told Al Jazeera that “the alarmism around high energy prices and global GDP reflects a retrograde view that we’re still living in the 1970s. Supply chains have moved on. It’s time economists do the same.”

Chinese credit growth

Economists are also keeping an eye on China, due to its size and deep linkages with the global economy. Activity there has ripple effects on world trade, international supply chains and commodity prices.

After three years of strict “zero-COVID” controls, China, the world’s second-largest economy, was expected to bounce back when it suddenly reopened last December. But growth has since been fragile and output constrained by a property sector slowdown.

In 2020, Beijing began limiting property developers’ use of debt financing. The real estate sector, which accounts for 23 percent of China’s GDP, has since slumped amid falling house prices and developer defaults.

“Property is weighing on China’s recovery,” said Sheana Yue, China economist at Capital Economics. “Consumers remain suspicious of the sector. After the crackdown on leverage, lots of pre-purchased homes weren’t built when developers went bust.”

Credit rating agency Moody’s lowered its outlook on China’s A1 debt rating from “stable” to “negative” earlier this month, citing “increased risks from … lower medium-term growth and the ongoing downsizing of the property sector”.

China’s property market also has close links to local government finances, which have come under strain in recent years.

After the 2008 global financial crisis, local administrations embraced credit-fuelled infrastructure investment to boost growth. Demand, however, has slowed after decades of rapid urbanisation.

Together with pandemic-linked spending, falling land sale revenues – a key source of income – have sapped budgets pushing some local governments to rely on Beijing to pay their bills.

Indeed, Beijing has been driving the availability of credit in recent months. Broad credit growth – which measures all lending across the domestic financial system – rose by 9.4 percent in November from a year earlier. Government bond sales made up half of that increase.

The reliance on government financing to drive growth suggests “the structure of credit is still not good,” Yue said. “The data shows an economy that is stabilising thanks to the help of state support. While that’s unlikely to change soon, it won’t be good when it does.”

Economists have been watching loan demand as a barometer of China’s economic recovery. Slow credit growth is typically associated with economic contractions, as businesses and consumers become reluctant to borrow, choosing to hoard their savings instead.

“We think the pace of credit expansion will fall from 10 percent this year to 8 percent next,” Yue said. But she cautioned against reading too much into this, “it’s a mistake to think that will have a big impact on GDP. By extension, the impact on global growth will probably be limited.”

In the face of continued headwinds, China’s Politburo, the government’s top decision-making body, is expected to unveil further stimulus measures in the coming months.

While these trends have reinforced expectations of a relatively benign outlook for global growth in 2024, historical evidence shows that soft landings remain elusive. As in 2023, forecasts may well fall wide of the mark again.

[ad_2]

Source link