Gold prices slide as markets question early rate cuts; Inflation data on tap By Investing.com

© Reuters.

Investing.com– Gold prices fell in Asian trade on Monday, extending losses from the prior session as stronger-than-expected U.S. labor data saw markets reconsider expectations for early interest rate cuts.

The yellow metal logged a weak start to 2024, tracking a sharp rebound in the as traders scaled back bets that the Fed could trim rates by as soon as March.

This notion was exacerbated by stronger-than-expected data on Friday showing resilience in the labor market- which gives the Fed more headroom to keep rates higher for longer.

Gold also saw a heavy degree of profit-taking after a fairly strong melt-up through December. The yellow metal ended 2023 with over 10% in gains.

fell 0.5% to $2,035.69 an ounce, while expiring in February fell 0.4% to $2,042.25 an ounce by 00:00 ET (05:00 GMT). Both instruments lost about 0.9% in the first week of 2024.

US inflation in focus after nonfarm payrolls surprise

Markets were now focused squarely on key U.S. (CPI) inflation data for December, which is due this Thursday.

The reading, which comes on the heels of a strong payrolls report, is expected to show a from the prior month.

Any signs of sticky inflation bode poorly for bets on early interest rate cuts by the Fed, given that the labor market and inflation are two major points of consideration for the central bank when adjusting monetary policy.

The Fed had also warned that any signs of sticky inflation and labor market strength are likely to keep it from cutting interest rates early.

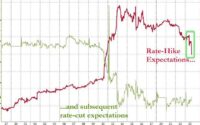

The showed traders pulling back their expectations for a March cut. Traders now expected a roughly 63% chance for a 25 basis point cut in March, down from an over 73% chance being priced-in last week.

Higher-for-longer rates are likely to herald more near-term pressure on gold, which was battered by rising rates through most of 2023. While the Fed is still expected to trim rates eventually this year, analysts at ING said they had pushed back expectations for a cut to May from March.

High interest rates push up the opportunity cost of investing in bullion, which offers no yield.

Copper rises after weak start to 2024, more China cues on tap

Among industrial metals, copper prices rose gingerly on Monday after falling sharply in the first week of 2024.

expiring in March rose 0.3% to $3.8128 an ounce, after losing 2.2% in the past week.

Prices were battered by a strong dollar, as well as weak purchasing managers index data from several major economies, particularly top importer China.

China is set to release more economic indicators this week, with and data due this Friday. Chinese copper imports will be a key point of focus for traders of the red metal.

[ad_2]

Source link