With one going up and the other down, Nvidia is now worth as much as the entire Chinese stock market, represented by the H shares of the Hong Kong stock market.

That’s a point made by Michael Hartnett, Bank of America strategist, who also notes that the $600 billion market cap rise in Nvidia

NVDA,

over just the last two months equals the entire market cap of Tesla

TSLA,

Nvidia has soared 228% over the last 52 weeks, while the Hang Seng

HK:HSI

in Hong Kong has dropped 26%.

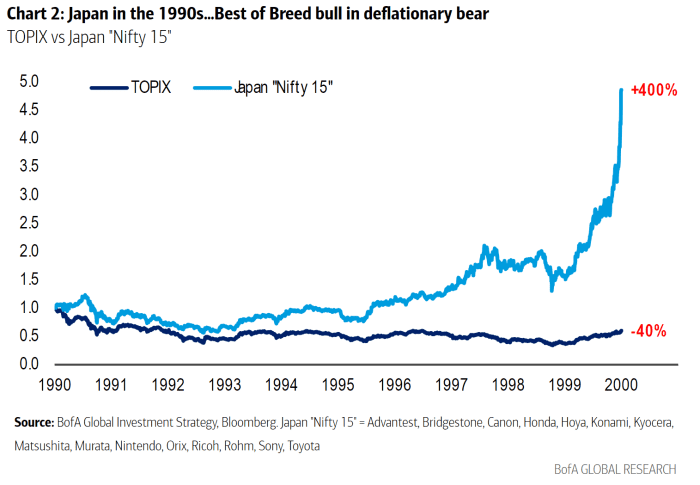

Hartnett was focusing more on China’s woes than Nvidia’s AI-inspired gains. He made a comparison between China’s struggles now and Japan’s in the 1990s.

He said as the Nikkei collapsed from 40,000 to 20,000 in the 1990s, there was a big 400% bull market for 15 stocks. Especially in a deflationary bear market, a small portfolio of what he called “best of breed” stocks, with strong management, balance sheets, and EPS growth, can be very profitable, he said.

As for the U.S. stock market, he said positioning is flipping from a tailwind to headwind, though he said the old market adage is, “tops are a process, lows are a moment.” He said there’s no stopping what he calls a bubble until the 10-year yields, adjusted for inflation, are above 2.5%. The 10-year TIPS rate is 1.91%.

But he did say a number of Bank of America’s rules are closing in on sell signals, such as the cash levels reported in its fund manager survey, or inflows to risky assets.

The S&P 500 index

SPX

closed at a record high for the ninth time this year on Thursday and has gained 22% over the last year.