BHP flags $5.7 billion impairment on Samarco dam failure, nickel operations By Reuters

[ad_1]

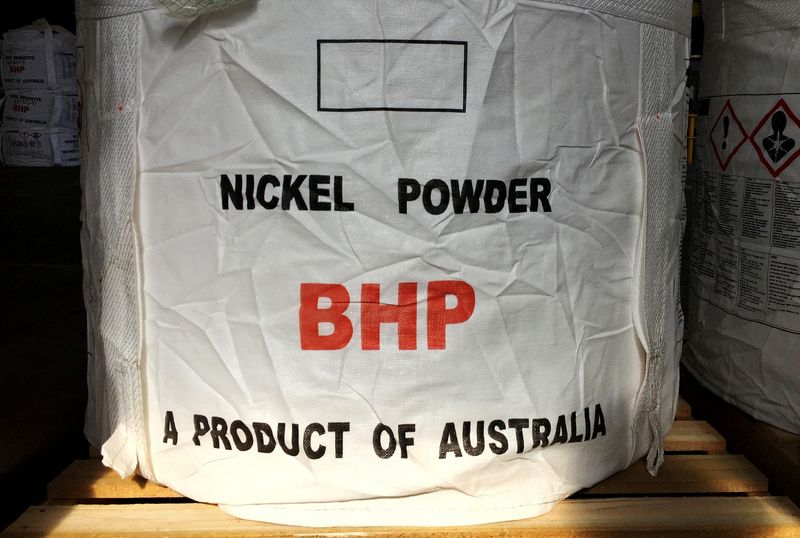

© Reuters. FILE PHOTO: A ton of nickel powder made by BHP Group sits in a warehouse at its Nickel West division, south of Perth, Australia August 2, 2019. Picture taken August 2, 2019. REUTERS/Melanie Burton/File Photo

MELBOURNE (Reuters) -BHP Group will record another $3.2 billion impairment in relation to its Brazilian Samarco dam failure, and a $2.5 billion non-cash impairment charge for its Western Australia Nickel business, the world’s biggest listed miner said on Thursday.

Last month a federal judge in Brazil ruled that BHP and Vale and their joint venture, Samarco, must pay up to 47.6 billion reais ($9.67 billion) in damages for the 2015 dam collapse, in a decision still subject to appeal.

The collapse in the southeastern city of Mariana caused a giant mudslide that killed 19 people and severely polluted the Rio Doce river, compromising the waterway to its outlet in the Atlantic Ocean.

BHP Brasil’s provision for the Samarco dam failure will be $6.5 billion as at Dec. 31, 2023, BHP said.

The miner last month flagged a potential writedown at its Western Australian nickel operations as a jump in nickel supply from Indonesia has led to a swathe of writedowns and restructures across the sector. It has an arrangement to supply nickel to Tesla (NASDAQ:) from the operations.

“Due to the deterioration in the short-term and medium-term outlook for nickel, BHP has lowered its nickel price assumptions,” the miner said. “These unfavourable operating conditions are expected to endure for a considerable time,” BHP said in a statement.

BHP said it would record a $2.5 billion non-cash impairment, including closure and rehabilitation provisions of approximately $900 million, which would reduce the carrying value of its Nickel West assets to minus $300 million.

The operations are now under review with the potential to be placed on care and maintenance.

BHP’s Kambalda concentrator will be placed into care and maintenance in June after its supplier, mining company Wyloo, decided to suspend its Cassini and Northern Operations mines, which feed the plant, from late May.

It is also assessing development plans for its West Musgrave nickel project which is 21% complete.

BHP is set to report its first-half results on Tuesday, Feb. 20.

[ad_2]

Source link

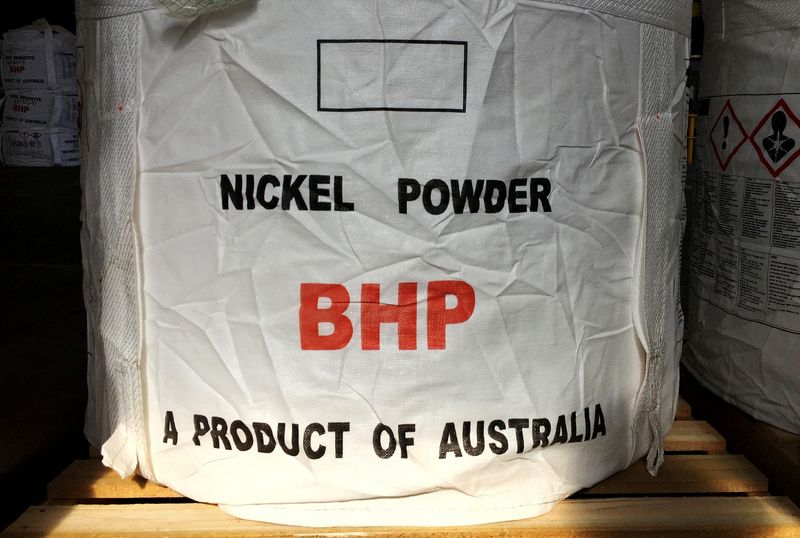

© Reuters. FILE PHOTO: A ton of nickel powder made by BHP Group sits in a warehouse at its Nickel West division, south of Perth, Australia August 2, 2019. Picture taken August 2, 2019. REUTERS/Melanie Burton/File Photo

MELBOURNE (Reuters) -BHP Group will record another $3.2 billion impairment in relation to its Brazilian Samarco dam failure, and a $2.5 billion non-cash impairment charge for its Western Australia Nickel business, the world’s biggest listed miner said on Thursday.

Last month a federal judge in Brazil ruled that BHP and Vale and their joint venture, Samarco, must pay up to 47.6 billion reais ($9.67 billion) in damages for the 2015 dam collapse, in a decision still subject to appeal.

The collapse in the southeastern city of Mariana caused a giant mudslide that killed 19 people and severely polluted the Rio Doce river, compromising the waterway to its outlet in the Atlantic Ocean.

BHP Brasil’s provision for the Samarco dam failure will be $6.5 billion as at Dec. 31, 2023, BHP said.

The miner last month flagged a potential writedown at its Western Australian nickel operations as a jump in nickel supply from Indonesia has led to a swathe of writedowns and restructures across the sector. It has an arrangement to supply nickel to Tesla (NASDAQ:) from the operations.

“Due to the deterioration in the short-term and medium-term outlook for nickel, BHP has lowered its nickel price assumptions,” the miner said. “These unfavourable operating conditions are expected to endure for a considerable time,” BHP said in a statement.

BHP said it would record a $2.5 billion non-cash impairment, including closure and rehabilitation provisions of approximately $900 million, which would reduce the carrying value of its Nickel West assets to minus $300 million.

The operations are now under review with the potential to be placed on care and maintenance.

BHP’s Kambalda concentrator will be placed into care and maintenance in June after its supplier, mining company Wyloo, decided to suspend its Cassini and Northern Operations mines, which feed the plant, from late May.

It is also assessing development plans for its West Musgrave nickel project which is 21% complete.

BHP is set to report its first-half results on Tuesday, Feb. 20.