Banks With Heavy Commercial Property Exposure See Bonds Get Hit

March 5, 2024

Bond investors have punished banks with heavy exposure to commercial real estate, potentially adding even more pressure to the lenders’ profits as Wall Street scrambles to assess how widely pain in property debt will spread through the financial system.

Banks with high levels of commercial real estate exposure tend to have bonds that trade at relatively wider spreads, according to an analysis by Barclays Plc credit strategists led by Dominique Toublan. In some cases, spreads on those bonds have been widening, even as investors have broadly piled into financial industry bonds in pursuit of higher-yielding securities.

[ad_2]

Source link

Related Posts

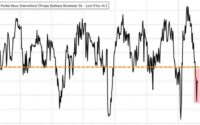

Chicago PMI Suffers Longest ‘Contraction’ Streak Since Lehman

Signal From Liquidity Is Becoming Loud And Clear