Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

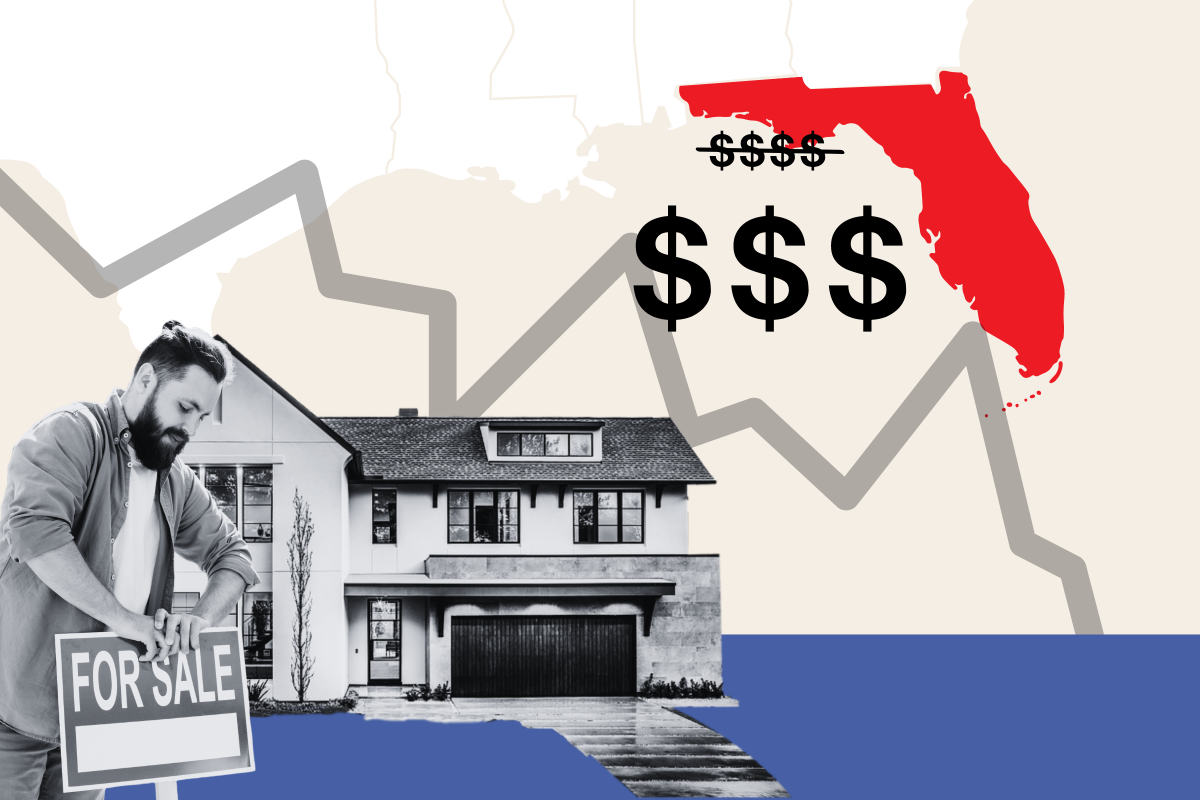

The number of “motivated sellers” in Florida has grown in the past two weeks, as more homeowners are trying to offload their properties quickly amidst a worsening of the state’s insurance crisis.

As of Wednesday morning, 204,833 properties, including single-family and multi-family homes, apartments, condos, townhomes, and lots, were listed for sale on Zillow. Of these, 5,244 were listed by self-described motivated sellers—homeowners and agents willing to accept a lower offer than the price listed on their ads.

When Newsweek reported on the issue on February 28, there were 4,928 listings in Florida of properties whose sellers described themselves as motivated sellers out of a total of 202,000.

Read more: Best Mortgage Lenders

The Sunshine State’s number of motivated sellers on Zillow remained much higher than in other states like California and Texas. As of Wednesday morning, California had 1,032 motivated sellers for a total of 74,792 properties listed, while Texas counted 1,829 out of a total of 1818,888.

In California, the number of motivated sellers trying to offload their properties is now lower than a couple of weeks ago, when they were 1,069 out of a total of 73,000 listings, while in Texas, it has grown. On February 28, Texas counted 1,775 motivated sellers out of a total of 172,000.

Both Florida and Texas have grown their active housing inventory in the last year, with both states building more new homes than the rest of the country.

Read more: How to Buy a House With Bad Credit

Matthew Walsh, Moody’s Analytics housing economist, previously told Newsweek that Texas and Florida are the two states that, in absolute terms, started construction on the most units in 2023. In per capita terms, he said, Idaho, North Carolina and Florida led the U.S. in new home construction over last year.

According to data shared on ResiClub, Florida’s active home-for-sale inventory increased by 45.8 percent year-over-year in February, while Texas’s increased by 22.8 percent. At a nationwide level, inventory rose by 15.0 percent in the same period. However, active inventory was still down by 40 percent compared to the pre-pandemic level (February 2019).

According to these estimates, Florida had the biggest shift in active housing inventory for sale compared to any other state.

Newsweek reached out to Florida REALTORS for comment via email on Wednesday.

The high number of motivated sellers in Florida might be explained, in part, by the skyrocketing home insurance premiums in the state. In the past three years, the cost of home insurance has grown by 102 percent, according to the Insurance Information Institute (Triple-I), as the risk posed by extreme weather events is rising. Several private insurers have left the state or have stopped offering new policies.

But some homeowners might also be willing to “cash in” after years of home appreciation, Lawrence Yun, chief economist and senior vice president of research at the National Association of Realtors (NAR), previously told Newsweek.

“Florida had the highest home price appreciation over the past three years, and some people may be cashing out,” he said.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

[ad_2]

Source link