An Inflation Rate Of 20%

The US Federal Reserve building is seen past caution tape (Photo by Stefani Reynolds / AFP)

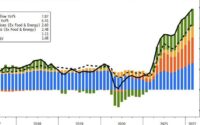

All the inflation reports have a fatal flaw: A reliance on a moving, 12-month time period. The use of the latest, trailing twelve months is easy to get – It’s on the front page of the BLS’s monthly CPI report. But that doesn’t mean it’s the right number to focus on.

The latest twelve months ignores the total inflation period’s preceding months – the cumulative inflation period results that are fully with us today. That means examining the entire Covid period from January 2020, now entering its fifth year.

Why start then?

Because that is just prior to the Federal Reserve and the U.S. Government flooding the financial system with trillions of new dollars to counter the Covid recession. Such a significant money supply increase is always a key driver of inflation. Intensifying the effect of those easy money actions was the Fed’s return to near-0% short-term interest rates.

Here’s the money supply (M2) picture. Note the Fed’s promise to reverse the 40% money supply increase has only been a plateau.

- January 2020 – $15.4 T

- January 2021 – $19.3 T

- January 2022 – $21.6 T (up 40%)

- January 2023 – $21.2 T

- January 2024 – $20.8 T

And here’s the Federal Funds rate picture. Note the long delay to start and to reverse the Fed’s low-rate, easy money strategy.

Inflation at 10% when Fed acted, 15% when Fed Funds at 2% only

The need to track cumulative inflation

The dramatic inflation rise caused by the money actions (and inactions) did great damage the U.S. dollar’s purchasing power. The cumulative 20% inflation rate means it now takes, on average, $120 to make a comparable January 2020 purchase. (Mathematically, that means $1.00 is now worth only $0.83 in January 2020’s terms.)

The bottom line: An unhappy environment continues

Very important: That 20% four-year change is drastic. It may seem a happy occurence for stock investors whose companies are raising prices (revenues and earnings) to compensate. But, as always happens in inflationary periods, the millions of people whose income, savings and assets do not rise enough, if at all, there is distress and despair. They are the ones who must cut back on spending or run into financial troubles. (Already, late loan payments are on the rise, including for mortgages.)

What that means is key: The Federal Reserve’s self-congratulation on getting the 12-month inflation number down is false praise. They have created lasting damage for those that can least afford it.

[ad_2]

Source link