Gold Retreats as Robust US Jobs Data Dampen Fed Rate Cut Expectations

April 8, 2024

Gold pared gains after setting a fresh record above $2,350 an ounce, as investors shifted focus to a key US inflation reading later this week.

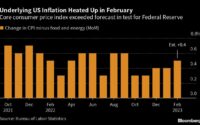

Higher Treasury yields weighed on bullion during US trading hours as the precious metal pays no interest. Earlier, gold rose as much as 1% as traders assessed where policymakers now stand on the timing of their pivot to lower borrowing costs, ahead of Wednesday’s March inflation data. The Federal Reserve expects to cut this year, but needs to see more evidence that inflation is easing first. Higher rates are typically negative for gold.

[ad_2]

Source link